We all want to get the most from our money, and getting paid in US dollars has always been considered the best way. After all, the USD is one of the strongest currencies in the world and its value holds up against most other currencies. But is it actually best for you to get paid in USD?

Getting paid in USD versus other currencies - I see how exchange rates affect your spending power. Although you should consider diversifying your income streams in case there’s an economic downturn, we are English-speaking people. Whether it's best to get paid in USD or not, what's your opinion?

Still a Widely-Accepted Currency

On one hand, getting paid in US dollars can be convenient because it is a widely-accepted currency. This means that you can more easily use your earnings to cover expenses while traveling or living abroad.

For people who live in politically and economically volatile countries, US dollar cash is still good to keep as an emergency fund. This is because the US Dollar remains one of the most widely accepted currencies in the world, meaning that it can be used to purchase goods or services across borders without worrying about exchange rates.

Politically volatile also means something else; Since cash transactions are anonymous and difficult to trace, it provides a layer of security for people who may fear their financial information being tracked by authorities or other malicious actors. Ultimately, keeping some USD on hand provides peace of mind for those living in countries with unstable social conditions.

How to Decide What's Best for You

If the cost of living is high and the currency value is low in your home country, then you'll want to consider getting paid in US dollars so you can have more spending power.

In other words, it's the exchange rate between your home currency and the US dollar. If the exchange rate is favorable, then it may be beneficial to get paid in US dollars so you can get more money for your goods and services.

It also depends on how comfortable you are dealing with currency fluctuation. If you're not comfortable with the idea of your income changing based on the value of the US dollar, then you may want to stick to being paid in your home currency.

Considerations When Making Your Decision

When making the decision of whether or not to be paid in US dollars, what kind of things would you consider?

Currency Exchange

The immediate subject I guess is the current exchange rate between the US dollar and your home currency.

If the US dollar is stronger than your home currency, you may want to consider being paid in US dollars so that you can get more for your money. However, if the US dollar is weaker than your home currency, you may want to be paid in your home currency so that you don't lose out on any money.

The Spending Purpose

What do you usually use the money for? If you plan on spending it all in the United States or digital products sold in USD, then being paid in US dollars may be the best option for you. If you plan on sending some or all of the money back home, you may want to be paid in your home currency so that you don't have to pay any extra fees when converting it back.

Tax Implications

It depends on the tax system in your country, but the tax you pay on your foreign income does not change whether you receive it in your home currency or in USD. However, if your home currency value fluctuates a lot, it will also impact the tax you pay according to the exchange rates. You might want to speak to your accountant to find out if there's a way to avoid paying too much.

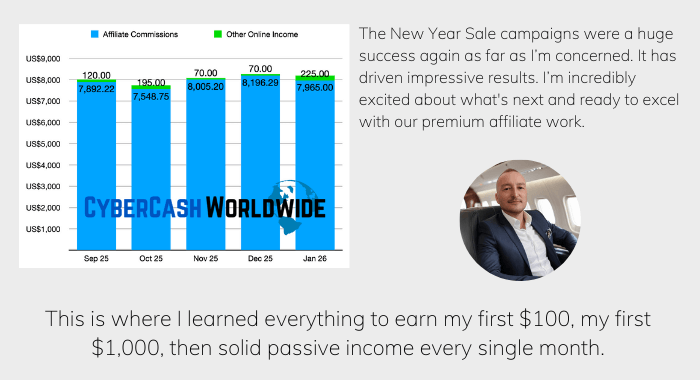

Getting Paid in Affiliate Marketing

When you work as an affiliate marketer, you'll usually receive commissions in US Dollars. This means that no matter where you are in the world, your earnings will always be based on US Dollars. Plus, if you're earning from multiple countries or currencies, it's much easier to manage when everything is converted into a single currency like US Dollars.

By setting up an affiliate program with reliable payment gateways such as PayPal or Stripe, you'll usually have your home currency plus USD, which makes the currency mainstream.

Globalization and the Weakening US Dollar

Globalization has led to the weakening of the US dollar. In recent years, the dollar has lost value against other currencies, such as the Euro and the Japanese Yen.

This is due to a number of factors, including the large trade deficit that the United States has with other countries. Globalization has also resulted in more countries using their own currencies, rather than the dollar, for international trade. As a result, there is less demand for dollars, and its value decreases.

The weakening of the US dollar has had a number of impacts on American businesses and consumers. For example, it has made imported goods more expensive, which raises inflation rates. It also makes it more difficult for American businesses to compete in global markets. The weaker dollar has also led to an increase in foreign investment in the United States, as investors seek to take advantage of lower prices.

The Collapse of Petrodollar

The petrodollar is the global system of currency used to trade oil. It is based on the US dollar, and oil-producing countries sell their oil in dollars. The petrodollar system has been in place since the early 1970s, and it has been a key part of the US economy. However, there are signs that the petrodollar system is collapsing.

Several factors have contributed to the collapse of the petrodollar system;

- The US dollar has been losing value in recent years. This has made it less attractive for other countries to use it as a currency for trade.

- China and Russia have been working together to develop an alternative to the petrodollar system. This has put additional pressure on the system.

- There are increasing numbers of countries that are refusing to use dollars for their oil trades. This includes Iran, Venezuela, and Iraq.

The collapse of the petrodollar would have serious implications for the US economy. It would likely lead to inflation, as well as higher interest rates. It could also cause a recession or even a depression.

The collapse of the petrodollar would be a major blow to the United States, and it could have far-reaching consequences for the global economy.

Is This The End of US Dollars?

The US Dollar has been the world’s reserve currency since World War II, and its status as the global benchmark for pricing commodities and settling international debt is not likely to change anytime soon. However, with other countries embracing digital currencies like Bitcoin or Diem, there are questions about whether this could be the end of US Dollars as we know it.

While central banks around the world have expressed concerns over these digital currencies, they do represent a new way of doing things that could eventually challenge traditional methods of commerce and payments. Ultimately, only time will tell if these emerging technologies will supplant the US Dollar or if it will remain atop its throne for years to come.

Still The Best Currency

We speak English. America is a great country. America is by far the largest English-speaking country. Americans are responsible for too many things we use in our daily lives - Apple, Microsoft, Google, Wikipedia, Hollywood and the music industry, to name a few.

The US economy is strong and we still believe that USD is the most trusted and stable currency in the world. For us, it is the best currency to get paid in.