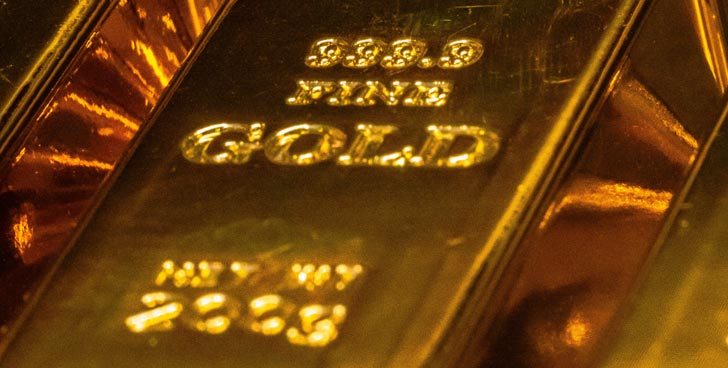

Gold has always been one of the most popular investment options for first-time investors. If you are planning a secure retirement life, investing in a gold IRA company is certainly a wise decision. But what makes it different from other methods of investing? Would it be appropriate for you, and would it be manageable?

First and foremost, you may want to determine what kind of investor you are and what you intend to achieve before you can begin investing. There are a few questions that you need to address before you can start giving your cash to someone else. How much risk are you willing to put yourself in in order to attain your goal of success? Is it a source of frustration for you because you're always concerned with your assets since you consider yourself a trader?

Someone like you could enjoy putting money aside and then utterly forgetting about it for an extended period of time. Which scenario makes you more fearful: the potential that you would lose all of your money or the prospect of acquiring huge wealth? It is possible that you may be able to sleep better at night knowing that you are exposed to dangers.

Do you consider yourself to be younger or older than you actually are? Which of the following is your major goal: accumulating wealth for the future, or generating cash immediately?

These are all important questions to ask, and the answers will assist you in determining which assets should be prioritized. You are reading this article therefore you know that precious metals are already included in your investment portfolio under any and all conditions. Their inclusion would be justified primarily on the grounds that, while they do not provide cash flow, they are a great vehicle for transmitting wealth to the next stage of your life.

What Kind of an Investor Are You?

When it comes to risk, the one thing you must be completely honest with yourself is how much you are comfortable with. This is due to the fact that your level of participation and involvement in a particular will decide how much you are willing to take a risk. You may then pick whether to invest in something completely safe, like precious metals, or something incredibly unpredictable, such as cryptocurrencies.

What you say will have a big influence on the amount of dollars that you are willing to put up as a deposit. In any situation, the person who remains in the saddle for the duration of the bull ride will outperform the one who trades on a regular basis. This is owing to the fact that the person who will be accompanying you will not be looking at short-term peaks and troughs, as you would be doing.

The opposite is true for traders, who can sell their entire investment on the basis of a hunch, and they will never be able to acquire it at the same price again. Prices can climb for a short period of time after the peak looks to be a brief blip on the chart, and then prices can rise again as time passes. In the event that you take your gains too fast, you may miss out on a large quantity of money. Read more on this page.

Advantages of Gold IRA

Security

The security that comes with having a precious metal IRA (Individual Retirement Account) is perhaps the biggest benefit of it. When you choose this plan, you subconsciously develop a feeling of control over the unknown and you can sleep better knowing your wealth is preserved.

Diversification

Some investors will get a combination of bonds and stocks and feel like that is enough portfolio diversification. We hate to break it to you though that these assets are very much interrelated.

But with gold, you get an asset that is highly uncorrelated with other assets and it certainly doesn’t decline with either bonds or stocks.

Also Read: Crypto Quantum Leap Review – The Best Cryptocurrency Course?

Acts as Disaster Insurance

Investments can crash at any point. If you can insure your health, home, car, and so on against unforeseen events, then you also need to insure your finances against unforeseen threats. Nobody can predict what will happen in a few months to come.

But, you can protect yourself from it regardless. When there are geopolitical dangers like war and economic issues like inflation and depression, your gold IRA can provide that soft landing you need.

The ability of this asset to retain value despite economic and/or political upheaval will make sure your finances are protected despite the crises.

Reduces Investor’s Tax Burden

Precious metals held in IRAs are usually very tax-efficient, in that they aren’t taxable so far they aren’t sold. Taxes are also not imposed on the gains an investor gets from the investment while the profits remain in the IRA. This is still the case even if the asset has been liquidated.

Supercharge Your AWeber Account

Take Your Email Marketing To The Next Level With These Powerful Tools

The safest option

When it comes to asset safety, gold is without a doubt the safest option currently available in the market. A bar of gold in your hands does not equate to the generating of cash flow in any way. It's actually just a massive slab of metal, to be honest. The United States remains unchanged while the rest of the world changes. As a static investment, the bar is one of the most efficient vehicles of moving money from one point in time into another.

It is expected that those who understand how to play the game would reap substantial financial rewards. Moreover, you should be informed that the game is rather straightforward to understand and navigate through. To invest in precious metal, you just acquire the amount of precious metal that you can afford and then wait until the precious metal is ready to be sold. Simply said, that's all there is to it. Despite the fact that gold and silver have been overcharged, inflated, as well as deflated throughout history, they are still in existence today as a result of these operations.

When it comes to investing, precious metals are the most secure at the moment, and most people have between 50-70 percent of their money invested in precious metals when they retire. Although a big number of individuals acquire shares in mining companies, the practice has become slightly more dangerous in recent years, owing to the existence of various environmental regulations.

Also Read: Top Tips to Promote Precious Metal IRA as an Affiliate

A mine may also be compelled to close as a result of labor conflicts, permission difficulties, and strikes. In a similar vein, worries about licenses, administrative ineptitude, and a lack of resources are all issues that require attention. The presence of core metal is an excellent strategy in this case.

It is necessary to make mistakes in order to progress to the level of an experienced investor. A great deal of the time, you'll be able to learn from past experiences of other people. You will not, on the other hand, receive life-changing knowledge until you have been burned by the financial markets. Excellent technical analysts will be able to predict major reductions and rises in both the short and long term. A good idea is to check out inquirer gold IRA companies to learn more about investing!

In the event that you follow a trend, you may find yourself losing some of your investment capital. Greed may lead you to believe that you may recoup your losses on the market at a lower price if you allow it to rule your thoughts. This, however, is not always the case. To put it gently, when the free market collides with destiny, the results are likely to be disastrous for you and your family.

Don’t invest in a gold IRA company. I was persuaded by some shady affiliate and spent more than 10000 dollars. I lost it all because the broker disappeared. The phone number was one day suddenly no longer in use and the site was gone. The affiliate disappeared from Facebook. I have no proof of payment. If someone you don’t know recommends you, say no for your sake.