If you're one of the millions of Americans with student loan debt, you know how difficult it can be to pay it back. With interest rates rising and wages stagnant, it can feel like you're stuck in a never-ending cycle of debt. Your part-time job may be helping you while also getting experience in the workforce. But you want something extra that fits your schedule and is in line with your career goals.

I have asked my AI boss for some other ways to earn extra money to help pay off your student loan quickly. From freelancing to side hustles, here are 20 ways to make extra money to help get rid of your student loan debt…eventually.

1. Do Freelance Work

Many websites and platforms offer freelance work, such as Fiverr, Upwork, and Freelancer. You can sign up for these platforms and start offering your services to clients. There are a wide variety of services you can offer, such as writing, graphic design, web development, and more.

If you have a specific skill or talent that you’re good at, there’s a good chance you can find freelance work that relates to it. And even if you don’t have any specific skills, there are still many ways to get started with freelancing. For example, you can offer general administrative or customer service support to businesses.

Doing freelance work can be a great way to gain some experience in your chosen field and build up your portfolio.

2. Sell Unwanted Items Online

No brainer. But my AI boss suggests so, so here it goes. If you have any unwanted items lying around your house, sell them through websites and apps such as Decluttr, Letgo, and Poshmark. This is a great way to get rid of clutter and earn some extra money at the same time. Plus, it’s a lot easier than having a garage sale.

Personally, I’m not sure if it’s easier though, because you still have to sell each item upon sale. Whereas with a garage sale, you just hand it over.

It’s easier in the sense that you don’t have to negotiate verbally. Because you find a lot of time wasters at garage sales - even when you're selling something valuable for a bargain price of $3, people will still try to negotiate it.

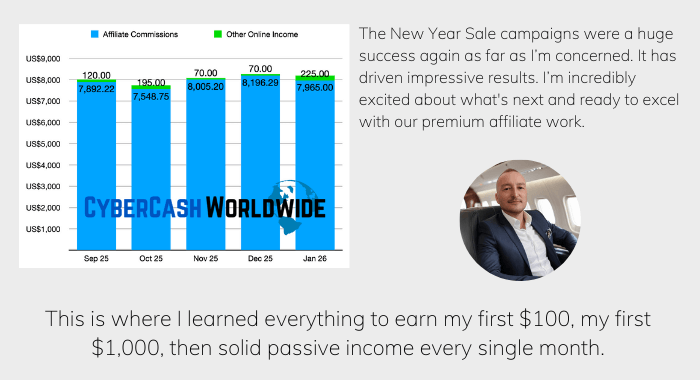

3. Affiliate Marketing Through Blog

If you are still at college, you may be used to writing essays and writing fast. Share your knowledge through blogging and insights on a topic you're passionate about while also earning some extra income. What information can you provide that will be valuable to them? Once you have a clear understanding of this, creating content will be much easier.

You can earn affiliate commissions by recommending brand products. But not only that. You can also sell the advertising space of your blog site at the same time.

No need to say that sharing your content on social media will make it more effective. With a crazy fabulous effort, you can build up loyal followers who will appreciate your content - and help you pay off those student loans.

4. YouTubing

YouTubing allows you to make some advertising income. By sharing your skills and knowledge with other students on YouTube, you can start to build up a following and generate some revenue.

The video marketing industry is insanely competitive but if you keep at it and produce quality content, you'll be successful in paying back your student loan.

5. Offer Your Services as a Tutor

Once you’ve gained a good number of your YouTube channel subscribers, it will become easier to invite them to your paid online course program. This can be a great way to use the knowledge you've acquired through your studies to help others while also earning some extra cash.

You can also offer a one-on-one coaching service. Not only should you be knowledgeable in the subject you’re teaching, but you should also;

- Be staying up-to-date on new developments in your field.

- Able to explain complex concepts in simple terms.

- Organized and have good time management skills.

- Be patient and understand that not everyone learns at the same pace. You'll need to adjust your teaching methods accordingly.

This will help you stay on top of your own workload while also meeting the needs of your students.

If you have a good qualifications, another option is to contact local schools or tutoring centers and inquire about becoming a part-time or full-time employee. This can provide some stability and regular income.

6. Do Odd Jobs For People In Your Community

There are always people in your community who could use an extra hand – whether it’s doing some landscaping, painting their house, or making pickled onions for them and stuff. Offer to do odd jobs for people in your community and earn some quick cash. Not only will you be making money, but you’ll also be helping out your neighbors.

7. Buy and Sell Cryptocurrency

Cryptocurrency trading is one of the ways to make money from the volatile digital asset class. It can be extremely profitable, but it also comes with a high degree of risk. The benefits include;

- The ability to make money from price movements: Cryptocurrency prices are highly volatile, which means there are plenty of opportunities to make money from price movements. If you buy low and sell high, you can turn a profit even in a bear market.

- 24/7 trading: The cryptocurrency markets never close, which means you can trade 24/7. This is perfect for those who want to take advantage of every opportunity or who live in different time zones.

- Low barriers to entry: You don’t need a lot of capital to start trading cryptocurrency.

Whereas the risks include;

- The volatility of the markets. Cryptocurrency prices can fluctuate wildly, and this can lead to losses for traders who are not careful.

- The possibility of hacks or theft. exchanges have been hacked in the past, and this could lead to loss of funds for traders.

- The market may not develop as hoped, and traders could end up losing money if they do not exit their positions in time.

Choose a reputable exchange. Make sure to read reviews and compare fees before choosing an exchange. When start buying and selling cryptocurrency on the exchange. Pay attention to market trends and prices to make profitable trades.

Start with a small investment. You don't need to invest a lot of money to get started in cryptocurrency trading. Just start with a small amount and see how it goes. Don't expect to get rich quickly from trading cryptocurrency; realistically, it takes time and patience to make significant profits.

Remember to always do your research before making any trades, and never invest more than you can afford to lose. With these tips in mind, you should be well on your way to making money from cryptocurrency trading.

8. Invest in Real Estate

My AI boss says real estate is a great investment, and if you're able to find the right property, you can earn a significant return on your investment.

One of the biggest benefits of investing in real estate is that it's a relatively low-risk investment. Unlike stocks or other investments that can fluctuate wildly in value, real estate tends to be much more stable. This means that you're less likely to lose money on your investment, and it also means that you're more likely to see a steady return over time.

Another benefit of investing in real estate is that it can provide you with passive income. If you buy a property and rent it out, you'll receive regular payments from your tenants that can help you pay down your student loan debt.

Of course, there are some risks involved with any type of investment, and real estate is no different. The key is to do your research and only invest in properties that have the potential to appreciate in value over time. With careful planning and a bit of luck, investing in real estate can be a great way to earn extra money to pay off your student loan quickly.

...That's why my boss says.

If this has ever been possible in the modern society, it would have been decades and decades ago. But AI wouldn’t have existed decades ago, so my boss is living in a fairyland where mortgages don’t exist.

Yes, you can make a great profit from your rental income if you don’t have a mortgage to pay. Had you managed to pay cash for the property, you wouldn’t have carried a student loan.

9. Be a Dog Walker

Becoming a pet sitter or a dog walker is a great option if you love animals and don’t mind taking care of them while their owners are away. You can set your own hours and rates, and there is always a demand for this service.

To get started, you can sign up with a company like Rover or Wag!, or you can start your own pet-sitting business by advertising your services online or through word-of-mouth. Once you build up a clientele, you’ll be able to start charging more for your services and earning some good money to help pay off those student loans.

10. Participate in Surveys

Oh please stop, boss. One minute you suggest real estate where you can potentially make half a million dollars, and the next minute you suggest that you make 50 cents a day with a useless survey-for-cash.

You might as well get a volunteer job at a prison. At least you’ll get to learn how hard real life can be, and get a free meal. (Except that getting any volunteer job isn’t exactly easy either, let alone one in prison.)

11. Rent Out a Room in Your House on Airbnb

As you can see, the suggestion is absolutely rubbish again because Airbnb has been around since 2008. if you own a house of your own and you want to make extra money to help reduce your debt, renting out a part of your house must have crossed your mind. There must be a reason you haven’t.

But as a cyborg, I have to follow my AI boss’s suggestion. Renting out extra space in your house can be a great way to earn some extra money to help pay off your student loan quickly.

To get started, simply create a listing on Airbnb and include photos and a description of your space. Be sure to set a competitive price that will attract guests. Once your listing is live, guests will start booking their stay with you.

To ensure a positive experience for your guests, be sure to communicate well and provide any amenities or services that you promised in your listing. If you provide a great experience for your guests, they are likely to leave positive reviews which can attract even more guests in the future. (Which you already know, doh.)

12. Be an Uber or Lyft Driver

“With the rise of ride-sharing apps, this has become a popular way to earn extra money, especially if you live in a city where there’s high demand for transportation services.”

Another random, and rubbish suggestion. Why cab driver, not pizza delivery driver? If you liked driving enough to become a cab driver, you’d have researched it already. If you are under 23, Uber requires you to have at least 3 years of driving experience, anyway. And you’d have to have a decent car. There’ll be a test as well.

13. Rent Out Your Car

If you have a car that you're not using all the time, you can offer it for rent through a number of different online platforms. This can be a great way to earn some extra money to help pay back your student loan quickly.

Make sure that your car is in good condition and that it's insured. You'll also need to set up a schedule for when people can use your car.

Once you've got everything set up, you can start promoting your car rental service online. You can use social media, word-of-mouth marketing, or even online ads to reach potential customers.

If you're looking for a way to earn some extra money using your car, renting it out can be a solution.

That’s what my AI boss suggests, but what if the borrower gets a speeding ticket and disappears? I personally wouldn’t lend my car to anyone, really.

Conclusion

Some of the ways to earn extra money to pay back your student loan that my AI boss suggests sound dubious; real estate requires you a lot of initial investment, surveys-for-cash are useless, and crypto-trading can be a sheer gamble if you don’t know what you’re doing. And for the 1,000th time, why dog walking? But I hope you’ve found something useful from the list above, and whatever you do, I hope you’ll find a decent one that suits your personality the most. Good luck!