Forget everything traditional financial advisors tell you about settling down and buying property. The nomadic lifestyle demands a completely different financial strategy - one that works with constant movement, multiple currencies, and the beautiful chaos of location independence. Most financial advice assumes you'll have a permanent address, steady local employment, and predictable expenses, but your reality looks nothing like that outdated model.

Breaking free from conventional financial wisdom opens doors to opportunities that sedentary folks will never see. Your money needs to work as hard as you do, flowing across borders as seamlessly as you move between time zones. The old rules don't apply when your office changes every few months and your cost of living fluctuates based on which continent you're calling home this quarter. Smart nomads build wealth not despite their mobility, but because of it.

Creating Multiple Revenue Streams That Travel

Building financial security as a nomad requires diversifying your income sources across different time zones, currencies, and skill sets. Relying on a single client or revenue stream puts your entire lifestyle at risk when contracts end or markets shift. The most successful nomads typically juggle three to five different income sources, each serving as a backup when others inevitably fluctuate.

Freelancing forms the backbone of most nomadic income strategies, but smart nomads go beyond basic hourly work to create scalable revenue. Subscription-based services, digital products, and retainer agreements transform your earning potential from trading time for money into building systems that generate income while you sleep. Consider combining immediate-payment freelance work with longer-term projects that compound over time.

The key lies in building revenue streams that require minimal physical presence or specific geographic locations to maintain. Your income should follow you anywhere with reliable internet, adapting to different time zones and market demands. This flexibility becomes your competitive advantage over location-bound competitors.

Client Arbitrage Strategy

Schedule your high-paying Western clients during their business hours while living in lower-cost regions where your purchasing power stretches further. A $100/hour rate goes much further in Bangkok than it does in San Francisco, effectively doubling or tripling your standard of living without changing your income.

Steps to maximize geographic arbitrage:

- Set up your daily schedule to accommodate multiple time zones

- Take advantage of overlap periods where you serve clients across different continents

- Research cost of living differences before choosing your base locations

- Negotiate rates based on Western market standards, not local wages

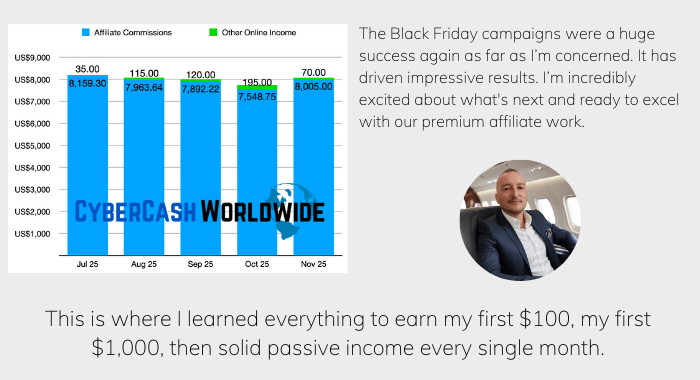

Digital Product Development

Create once, sell forever by developing online courses, ebooks, templates, or software that generate passive income regardless of your physical location. Focus on solving specific problems you've encountered in your travels - other nomads face similar challenges and will pay for your solutions.

Build your digital empire systematically:

- Start with one product and perfect the sales process

- Reinvest profits into better production quality and marketing reach

- Create products that solve real problems you've personally faced

- Price products based on the value they deliver, not production costs

Retainer Revenue Systems

Lock in predictable monthly income by offering ongoing services to established clients rather than constantly hunting for new projects. Retainer agreements provide the financial stability nomads need while giving clients consistent access to your expertise.

Structure retainers for success:

- Define clear deliverables and communication schedules that work across time zones

- Set boundaries around scope to prevent scope creep

- Include price escalation clauses for multi-year agreements

- Require payment in advance to improve cash flow

Banking Without Borders

Traditional banking systems weren't designed for people who live everywhere and nowhere simultaneously. Standard banks often freeze accounts when they detect international activity, charge excessive foreign transaction fees, and limit your access to funds when you need them most. Smart nomads build banking relationships that work globally while minimizing fees and maximizing access.

Opening accounts in multiple countries requires careful planning and legal compliance, but provides insurance against banking restrictions and currency fluctuations. Different banks excel in different regions - what works perfectly in Southeast Asia might be useless in South America. Your banking strategy should include both local accounts for daily expenses and international accounts for major transactions and savings.

The banking landscape for nomads has improved dramatically with the rise of digital banks designed specifically for international lifestyles. These neo-banks often offer better exchange rates and lower fees than traditional institutions while providing features that make global money management much simpler.

Multi-Currency Management

Maintain accounts in three to four major currencies to avoid constant conversion fees and take advantage of favorable exchange rates. Keep your primary savings in stable currencies like USD, EUR, or CHF while maintaining spending accounts in the local currencies of regions where you spend significant time.

Currency strategy basics:

- Monitor exchange rates and transfer money when rates favor your position

- Use forward contracts to lock in favorable rates for large transactions

- Keep emergency funds in multiple currencies to avoid conversion during crises

- Set up automatic transfers to rebalance currency exposure monthly

Digital Banking Solutions

Neo-banks like Revolut, Wise, and N26 were built specifically for international lifestyles, offering real exchange rates and minimal fees for global transactions. These platforms often provide better exchange rates than traditional banks while offering features like automatic spending categorization and instant international transfers.

Maximize digital banking benefits:

- Use digital banks for daily transactions while keeping larger amounts in established institutions

- Take advantage of cards that work globally without foreign transaction fees

- Set up automatic savings rules that work across multiple currencies

- Use spending analytics to track costs across different countries and currencies

Local Banking Relationships

Open local accounts in countries where you spend several months per year to access better exchange rates, avoid foreign transaction fees, and build financial history for future visa applications. Many countries offer special accounts for foreigners or temporary residents with reduced documentation requirements.

Local banking strategy:

- Research banking requirements before arriving in new countries

- Look for accounts designed for expats or digital nomads

- Maintain minimum balances to avoid monthly fees

- Use local accounts as backup access to funds if primary cards get blocked

Tax Optimization Strategies

Tax planning for nomads involves way more complexity than most people realize, but the potential savings make the effort worthwhile. Your tax obligations depend on your citizenship, residency status, the countries where you earn income, and the specific tax treaties between nations. Most nomads significantly overpay taxes because they don't understand their options or assume they must pay the highest possible rate.

The key lies in understanding tax residency versus citizenship - you don't automatically owe taxes to every country you visit. Many nomads qualify for foreign earned income exclusions, tax treaties, or territorial tax systems that dramatically reduce their obligations. However, tax mistakes can be expensive and complicated to fix, so professional advice becomes an investment rather than an expense.

Strategic tax planning legally reduces your burden while keeping you compliant across multiple jurisdictions. Start by understanding your home country's tax obligations for citizens abroad, then explore opportunities to minimize your tax burden through legal residency planning and business structure optimization.

Foreign Earned Income Exclusion

US citizens can exclude over $100,000 of foreign earned income from federal taxes by meeting either the physical presence test or bona fide residence test. The physical presence test requires being outside the US for 330 days out of any 12-month period - easier for nomads than the residence test.

Maximize your FEIE benefits:

- Track travel dates meticulously using apps or spreadsheets

- Plan travel to meet the 330-day requirement well before tax season

- Keep detailed records of your location and activities for IRS documentation

- Consider the bona fide residence test if you establish clear tax residency elsewhere

Territorial Tax Advantages

Countries like Singapore, Hong Kong, and Malaysia use territorial tax systems that only tax income earned within their borders. If you establish tax residency in these locations while earning income from clients in other countries, you might pay little to no income tax on your nomadic earnings.

Territorial tax planning:

- Research residency requirements carefully - they vary significantly by country

- Maintain proper documentation to support your tax position

- Keep detailed records of where income is earned versus where you're resident

- Consider professional tax advice for complex multi-jurisdiction situations

Corporate Structure Benefits

Incorporating in business-friendly jurisdictions can provide legitimate tax advantages and legal protection for your nomadic business activities. Countries like Estonia offer digital residency programs that let you incorporate and manage a European company entirely online.

Business structure considerations:

- Research tax implications in both your incorporation jurisdiction and residence country

- Consider ongoing compliance requirements and costs

- Evaluate liability protection benefits for your specific business activities

- Consult with tax professionals familiar with nomad business structures

What Do You Advocate?

Investment Strategies for the Mobile Lifestyle

Traditional investment advice assumes you'll stay in one country with consistent access to local financial markets and advisors. Nomads need investment strategies that work across borders, don't require physical presence to manage, and remain liquid enough to fund travel and emergencies. Your investment timeline differs from settled people - you need both short-term flexibility and long-term growth without the stability of permanent residence.

Global diversification takes on new meaning when your living expenses span multiple currencies and economic systems. Currency risk becomes a major factor in investment planning, as does access to funds when you're constantly moving. The best nomad investment strategies combine growth potential with practical accessibility while accounting for the unique risks of international living.

Your investment approach should reflect the reality that you might need to access funds quickly for visa requirements, emergency travel, or unexpected expenses. This means maintaining higher liquidity than traditional investors while still building long-term wealth through diversified global investments.

Geographic Index Fund Strategy

Invest in broad market index funds from multiple regions rather than focusing solely on your home country's markets. This approach provides natural currency hedging while reducing dependency on any single economy's performance. Use low-cost ETFs that track developed and emerging market indices to capture global economic growth.

Global diversification tactics:

- Allocate investments across US, European, Asian, and emerging markets

- Rebalance quarterly to maintain target allocation percentages

- Use currency-hedged funds to reduce foreign exchange risk

- Focus on low-cost index funds to minimize fees that compound over time

Real Estate Investment Options

REITs let you invest in real estate without the complications of property ownership across multiple countries. International REIT funds provide exposure to global real estate markets while maintaining the liquidity you need for nomadic life. These investments often provide higher dividends than traditional stocks while offering some inflation protection.

REIT investment approach:

- Choose REITs from stable economies with strong property laws

- Diversify across residential, commercial, and industrial property types

- Focus on REITs with transparent financial reporting and good governance

- Consider both domestic and international REIT exposure for diversification

Cryptocurrency Portfolio Building

Digital currencies align naturally with nomadic lifestyles since they exist independently of any single country's financial system. Allocate 10-20% of your portfolio to established cryptocurrencies like Bitcoin and Ethereum while avoiding speculative altcoins. Use cryptocurrency for international transfers when traditional banking becomes problematic or expensive.

Crypto strategy fundamentals:

- Store digital assets securely using hardware wallets that travel well

- Focus on established cryptocurrencies with long track records

- Use crypto for international transfers to avoid high bank fees

- Treat cryptocurrency as a high-risk, high-reward portfolio component

Emergency Fund Architecture

Nomad emergency funds require different planning than traditional savings because you face unique risks and limited access to support systems. Your emergency fund needs to cover not just unexpected expenses but also emergency travel, visa complications, medical evacuation, and temporary accommodation costs. The fund must remain accessible from anywhere in the world while protected from currency fluctuations and banking restrictions.

Building an emergency fund that works globally requires spreading funds across multiple accounts, currencies, and access methods. Consider scenarios like political instability requiring immediate evacuation, medical emergencies in countries without insurance coverage, or banking system failures that freeze your primary accounts. Your emergency fund becomes your safety net when traditional support systems aren't available.

The size of your nomad emergency fund should reflect the additional risks and costs of international living. While traditional advice suggests 3-6 months of expenses, nomads often need 6-12 months due to visa restrictions, limited employment options, and higher costs for emergency services abroad.

Geographic Fund Distribution

Keep emergency funds in at least three different countries across two continents to ensure access regardless of political or economic disruptions. Store roughly 40% in your home country, 40% in stable international locations, and 20% in the regions where you spend most of your time.

Distribution strategy:

- Use high-yield savings accounts in stable banking jurisdictions

- Maintain accounts in both major financial centers and your frequent destinations

- Keep some funds in physical cash reserves in major currencies

- Set up automatic transfers based on your travel schedule

Multiple Access Methods

Maintain access to emergency funds through various channels including international ATM cards, online banking platforms, wire transfer capabilities, and backup debit cards from different banks. Test all access methods regularly to ensure they work before you need them.

Access method checklist:

- Keep backup cards from different banks in separate locations

- Set up multiple online banking platforms with different security credentials

- Establish wire transfer relationships with international money transfer services

- Maintain small amounts of physical cash in major currencies

Medical Emergency Preparation

Medical emergencies abroad can cost tens of thousands of dollars and require immediate payment before treatment begins. Purchase comprehensive travel health insurance that covers medical evacuation to your home country or a facility with higher medical standards.

Medical emergency planning:

- Research medical costs in countries you plan to visit

- Keep detailed insurance records in multiple formats and locations

- Establish relationships with medical assistance companies

- Maintain a separate medical emergency fund beyond general emergency savings

Thrive, Not Just Survive: A Nomad's Financial Guide

Financial independence as a nomad requires abandoning conventional wisdom and building systems designed for constant movement. Your money must work harder, smarter, and more flexibly than traditional investors because your lifestyle demands it. The strategies outlined here transform the apparent disadvantages of nomadic life into significant financial advantages for those willing to put in the planning work.

Success comes from treating your finances as a global operation rather than a domestic concern. Every decision should consider multiple currencies, time zones, tax jurisdictions, and regulatory environments. The complexity initially seems overwhelming, but nomads who master these systems often achieve financial freedom faster than their settled counterparts while living richer, more varied lives.

Start implementing these strategies gradually rather than attempting everything simultaneously. Begin with basic banking and tax optimization, then expand into more sophisticated investment and emergency planning as your nomadic systems stabilize. Your future self will thank you for building financial systems robust enough to support whatever adventure calls next.