Creating a budget, saving money, investing, using credit wisely... Managing personal finance does not require a strict, rigid approach. But just be mindful of your habits, and you have the freedom to decide what works best for you and make adjustments as needed.

Budgeting can help you identify potential savings opportunities while still allowing you to enjoy life's pleasures in moderation. Being open-minded about your finances will help ensure that you remain healthy over time.

Did You Know?

- Emergency Savings: Only 40% of Americans can cover a $1,000 emergency expense with savings (Bankrate).

- Retirement Savings: 22% of Americans have less than $5,000 saved for retirement (Northwestern Mutual).

- Budgeting: 65% of Americans do not maintain a budget (Debt.com).

- Credit Card Debt: The average American has $6,194 in credit card debt (Experian).

- Student Loans: The average student loan debt is $32,731 per person (Federal Reserve).

The Basics of Personal Finance

The 3 areas of personal finance: earning, saving and investing - seem ridiculously simple, but just look at each area differently and you'll be able to manage your finance better.

Earning: Boost Your Income

Sticking to your day job is cool, but it might not skyrocket your earnings. Here's where a bit of creativity comes into play:

- Consider a Side Hustle: Look for something you enjoy that can also bring in some extra cash. It could be anything from freelance writing to selling handmade crafts online.

- Learn New Skills: In today's world, learning never stops. Pick up skills that could make you more valuable at work or open doors to new opportunities.

- Networking: Sometimes, it's about who you know. Chat with folks in and outside your field to uncover new opportunities.

Expanding your income sources can be exciting and rewarding. Plus, it's nice to have a bit more cash for your needs and wants.

Did You Know?

- Homeownership: 65.8% of Americans own their homes (U.S. Census Bureau).

- Investment: Only 55% of Americans own stocks (Gallup).

- Financial Literacy: Only 33% of adults worldwide understand basic financial concepts (S&P Global FinLit Survey).

- Retirement Confidence: Only 36% of non-retired adults think their retirement savings are on track (Federal Reserve).

- Net Worth: The median net worth of American families is $121,700 (Federal Reserve).

Saving: Keep Saving Some but Don't Be Afraid To Spend

It's smart to save, but you also want to keep the economy moving. Here's how you can strike a balance:

- Budget Wisely: Know where your money's going. A good budget isn't a cage; it's more like a roadmap to help you find what works best for you.

- Save, But Spend Too: Sure, build that emergency fund, but also feel free to inject some of your money back into the economy. Buying from local shops or supporting small businesses online is a great way to do this.

- Financial Cushion: Aim to save enough so that you're comfortable, but remember that money is also there to be enjoyed. Plan for fun experiences or purchases that add value to your life.

Finding the right saving-spending ratio is like mixing the perfect drink. It needs the right ingredients, tailored to your taste.

Investment: Take Calculated Risks

No risk, no reward, right? Here's how to step into the investment world:

- Start Small: You don't need a fortune to begin. Investing even small amounts can grow over time.

- Diversify: Don't put all your eggs in one basket. Spread your investments across different assets to reduce risk.

- Educate Yourself: Understand what you're investing in. Whether it's stocks, bonds, or real estate, knowledge is power.

- Patience is Key: Investments need time to mature. It's like planting a tree; you won't see the full growth overnight, but give it time, and you might be surprised.

Investing is about moving forward, even if it's just baby steps. Every bit of progress counts towards building your wealth and securing a comfy future.

If You Are Short of Money

When you are short of money and don't know where to turn, take a step back and think about how you ended up in the situation. It will help you understand why your finances may not be where they ought to be.

It could have been something as simple as overspending on non-essential items or an unexpected expense that drained your resources. Maybe you didn't plan ahead for bills that come at certain times each year like taxes or insurance payments. Perhaps too much of your income goes towards servicing debt such as student loans or credit cards with high-interest rates.

Understanding what caused the shortage and taking steps to address those issues is key so that the same problem doesn't recur when future financial challenges arise.

Did You Know?

- Paycheck to Paycheck: 59% of Americans live paycheck to paycheck (Charles Schwab).

- Financial Stress: 73% of Americans rank their finances as the number one stress in life (American Psychological Association).

- Savings Rate: The personal saving rate in the USA is 7.6% (Bureau of Economic Analysis).

- Economic Impact Payments: 89% of recipients of the first Economic Impact Payment used it for consumption (U.S. Census Bureau).

- Digital Payments: 78% of consumers use digital payment methods (Worldpay Global Payments Report).

Stay Away From Loan Lenders

Try your best not to borrow money. Financial problems can quickly spiral out of control, especially if the borrowed money comes with a high-interest rate.

Never ever take loans from loan companies as they are generally unreliable and will often offer unreasonable interest rates that can leave you in more debt than when you started. If you must borrow money, then speak to your bank or other reliable financial institution as they may be able to provide lower interest rates and better terms for repayment.

Household Bookkeeping

Bookkeeping isn’t as difficult as you think. People who get confused usually make things too complicated and get themselves in a muddle of numbers. All you need is ins and outs. You don’t even need the exact date of spend, as long as you keep every single spend monthly.

Personal Finance Apps

Free online software like Mint, Goodbudget, etc. all allow you to easily keep track of income and expenses. They allow users to create detailed budgets, set up automated reminders for bill payments, categorize transactions, and generate reports on the fly. But there's a huge disadvantage too.

The advantages will be;

- By utilizing these tools, you can stay organized while creating a comprehensive picture of their financial health.

- Those apps have user-friendly interfaces that make it easy to quickly enter information into spreadsheets that can be accessed from anywhere with an internet connection.

- With an advanced analytics view, you can gain a better understanding of where their money is going and adjust accordingly for greater fiscal responsibility over time.

But the disadvantage is;

- You don't need any of that!

You should only use a personal finance app if you are naturally organized. If you were naturally organized, you've probably been using an app already, and you wouldn't be reading this.

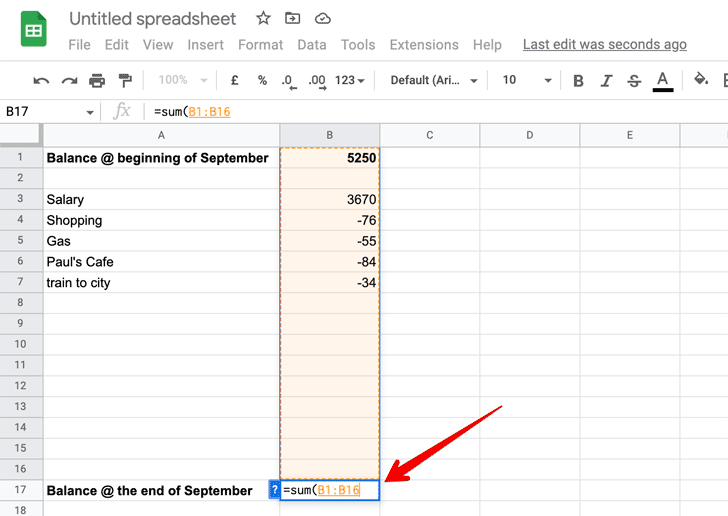

If you’ve never kept your household income/expenditure, the golden rule is to start with a very, stupidly simple “two-column” spreadsheet using Google Sheets.

Did You Know?

- Financial Goals: 21% of Americans say paying down debt is their top financial priority (Bankrate).

- Insurance: 55% of American adults have life insurance (Insurance Information Institute).

- Wealth Inequality: The top 1% of Americans own 40% of the country's wealth (Federal Reserve).

- Retirement Age: The average retirement age in the U.S. is 62 (U.S. Census Bureau).

- Mortgage Debt: The average mortgage debt in the U.S. is $208,185 (Experian).

The Simplest Spreadsheet

You don't think you've spent too much this month, but you're suddenly short of money. Where has it all gone?

It may be your credit card that's killing you. Then you can start logging everyday spending on a spreadsheet. Log on to your Google Sheets at the end of each day and type in the amount you spent.

By doing this, you'll know exactly what your money situation is, and the total balance at the bottom of the spreadsheet may prevent you from unnecessary shopping.

- The top of column (B) should have how much you have at the end of each month.

- List up the total spending each day;

- Column (A) - put a rough description. You don't even need the name of a shop. Just type in what it is.

- Column (B) - put the amount you spent with "minus". Ignore decimal points (round it off.) If you spent $50, put "-50".

- At the end of the month, take the total of it. (=sum(B1: B50"))

How You Can Save Money

Everyone knows what saving money means. But sometimes, it's good to go back to the basics like a school child and build your habit systematically.

Saving money means two things;

- Keeping some of your income in your bank account and

- Spend less.

In terms of keeping money in your bank, you may want to consider setting up a savings account so that you can automatically transfer a fixed amount of money into it each month. This can help you build up your savings over time without having to think about it.

Spending less doesn't just mean less frequently but looking for cheaper alternatives and taking advantage of discounts, loyalty cards, and special offers for signing up for their newsletters. If you know what you want to buy ahead of time, you can also look for coupons online or in newspapers.

You may already be doing this; shop online rather than in-store, or use price comparison websites when making a major purchase. Have a look around at different stores before committing to any one product; there may be something out there with the same features but at a much lower cost.

You can also simply be mindful of your spending. Make sure that you are only buying things that you really need and that you are not wasting money on unnecessary purchases. This can be difficult at first, but if you stick with it, you will find that it gets easier over time.

Investing

Investing is simply putting your money into something with the expectation of earning a return on your investment.

Buy Stocks

Shares of ownership in a company. When you buy stocks, you become a part-owner of that company and are entitled to a portion of its profits.

Bonds

Through bonds, which are loans that you make to a company or government. In exchange for lending your money, they agree to pay you interest over time.

Gold Investments

Gold has been revered and prized for centuries, and its value typically remains stable during periods of economic uncertainty. You can buy physical gold coins, bars, or jewelry, or you could choose an ETF to gain exposure to the price of gold without actually physically owning it.

Gold offers investors the opportunity to preserve their purchasing power with long-term stability, unlike many other investments that are subject to market volatility.

Real Estates

Buying real estate is a major investment and one of the most important decisions you will ever make. It can be an exciting process that comes with many benefits such as potential tax deductions, building equity in your home, enjoying the pride of ownership and more. Engaging professional help from trusted realtors or financial advisors is highly recommended for anyone considering purchasing a property.

No matter what type of investing you do, there is always some risk involved. But if you're smart about it and invest in a diversified mix of assets, you can minimize your risk and maximize your chances for success.

Retirement Planning

Retirement planning is the process of figuring out how much money you will need to have saved up in order to live comfortably after you retire.

The best way to start planning for retirement is to sit down with a financial advisor and come up with a plan that fits your unique circumstances. However, even if you don't have a financial advisor, there are still a few things you can do to get started.

Take a look at your current salary and figure out how much you will need to have saved in order to replace it. This number is called your "replacement ratio." Once you know your replacement ratio, you can start working on saving enough money to reach that goal.

Different ways to save for retirement include 401(k)s, IRAs, and pension plans. Talk to your employer about what options are available to you and make sure you are taking advantage of any matching programs they offer. If your company does not offer any retirement savings plans, there are still options available to you through other organizations.

Building Wealth

The above are personal finance tips and tricks to help you manage your personal finances, but what about building wealth? If you can find ways to bring in additional income through side hustles or promotions, you will be well on your way to financial success.

Starting your own business using your spare time is a great way to get creative and make money while still having some free time. It allows you to focus on the areas that are of most interest to you, so you can pursue projects that excite and engage you.

You’ll need a plan, an idea for what kind of product or service you want to create and develop, and then it’s just a matter of putting in the effort required to see it through. Allocating just a few hours each week can help turn an ambitious idea into reality, with the potential for significant rewards down the track if all goes according to plan.

Personal Finance: Final Words

Personal finance is not an as difficult subject to tackle as you think. Many people think managing finance is a daunting task because they’re making it daunting. It’s income less expenditure - simples.

If you really believe that it’s a task that you cannot even begin, I suggest that you keep your record daily using a basic smartphone app or a spreadsheet and you can make your financial future much brighter. Soon you will get used to it, and when you do, you can start using a little more complicated app to explore budgeting, forecasting, etc.

Educating yourself on personal finance will help ensure that you are making smart decisions about money management for years to come.

How I "Finally" Make Over $7,000 Monthly Income

"The most valuable thing I've ever done!"