Global economic growth is declining - they say. The cost of living is rising and the future may certainly seem bleak to you right now. Your state pension age may increase and you may also be expected to increase your private pension contributions.

However, put it this way. Nothing is certain in this life. The best way to prepare for unforeseen circumstances in the future is to have some extra income sources, do you agree? So let’s look at some ways to make money for retirement that you can start now. You don’t have to start any of the options immediately, but you can at least look into them and see which ones are most viable to you. Doing something is better than doing nothing at all.

Part I: Investments

Investing in assets that have intrinsic value is a good idea. It means to own a tangible asset such as gold, or a house. For example, if you invest in a company’s share and the company goes out of business, the value of the stock will go down to zero and your share certificate becomes a worthless piece of paper. It’s good to own precious metals or real estate because the value of a tangible asset may fluctuate over time, you will not be left with nothing even if worse comes to the worst.

1. Real Estate

Billionaire Andrew Carnegie said, “90% of millionaires become so through owning real estate.” One of the biggest reasons people who have some extra cash consider real estate investment is that property values generally appreciate over time.

Another reason is that home improvement is every home owner’s interest. If you are into DIY projects and own a small, manageable-sized second home, renting it out and making improvements before selling it is totally achievable.

Real Estate Pros and Cons

Pros

- The value appreciates - House prices are ever-increasing. If your surveyor’s report says there’s no apparent future risk with the property, the return of your investment now is most likely to be promising when you sell it years later.

- Rental income will increase your equity - The monthly rental income you receive from your tenant will pay down your mortgage.

- Passive income opportunity - Needless to say, any excess income (your rental income less mortgage, expenses, withhold tax) will be your passive supplemental income.

- Hedge against inflation - Real estate investment correlates with the inflation rates. As the cost of living rises, your rental income will also go up, and so will the value of your property.

- Tax-efficient - This again, depends on the country you reside, but property income tax computation is usually different from the one for your employment/self-employment income. All your refurbishment expenses should be deductible from your income. Check your local regulations.

Cons

- You may need a lot of capital - The initial deposit requirement hugely depends on the standard in the country or the state you live in. If you were to buy a $400,000 property, 2% of it would be $8,000, and 20% of it would be $80,000. Check the rate from your local realtors’ sites.

- Mortgage rate can be higher - Depending on your country and your mortgage lender, a “buy to let” mortgage may offer higher payout (interest) rates.

- Renting out can be problematic - Having someone to live in your property can always be stressful, and we rarely find perfect tenants. Dealing with their complaints over the appliances, damages made by them and the cost of repair, and late payment or no payment can always be possibilities.

2. “Fractional” Real Estate

Buying and owning a house for an investment purpose can be a huge responsibility and the high purchase cost can be mind-boggling. A fractional real estate investing is where you share the ownership of a property with other investors, so this may be a handier option for you.

You buy a portion of a property, and it’s usually a larger building such as an apartment block or a commercial building. The nitty-gritty of the maintenance such as repairs, finding tenants, the lease, etc. are all handled by the management company. You can get out of it (sell your portion) any time you want. There are some disadvantages as well as advantages, however,

Fractional Real Estate Pros and Cons

Pros

- Low investment cost - Unlike buying a house, it doesn’t require a large sum of the initial investment. We are not talking about thousands of dollars. You can be involved with fractional real estate for as low as a few hundred dollars or less.

- Less decision-making responsibility - The property is maintained by the management company and the costs are shared by all the shareholders. Unlike owning your own house, you’ll never have to be the sole decision-maker.

- Easy to sell - You will only own a share of the property, which means when it comes to selling, the property will still be shared by the rest of the owners. You won’t have to deal with finding buyers, showing the property around, etc.

Cons

- You may have less control - You don’t have to be the decision-maker, the flipside of it is that there are always chances of disagreements with the other fractional real estate owners over maintenance issues. Psychologically, the bigger the share you buy and the longer you hold it, the more you will want to be involved in the decision-making discussions. You may find it stressful.

- High management costs - The property maintenance is all handled by the management company, which means it can be costly.

3. Gold Investment

There is no right time to invest money in gold (or any other precious metal). Over the past many years, we once suggested that the time was questionable, and then we suggested it was the right time. Now the price of gold is on the steep rise. After all, it has always been recommended as part of a diversified investment portfolio as commodity prices fluctuate.

Gold Investment Pros and Cons

Pros

- Hedge against inflation - Gold is not subject to external influences such as inflation, often considered a good hedging strategy.

- Little learning to do - You need to gain a lot of knowledge before buying company shares. But buying gold requires only the basic knowledge. It’s easy and straightforward.

- Tangible - Gold has intrinsic value. You can always exchange it for cash.

Cons

- No passive income - Unlike stock or premium bond investments, you are not receiving dividends or interests while you hold the ownership of gold.

- The price is higher than ever - You may want to note that gold's price has been at its highest for the past few years, although no one can tell whether it may come down or go up even more in the near future.

- The storing can be costly - Unless you have a safe in your house, you’ll be paying storage and insurance fees to keep your gold in a safe deposit.

4. Cryptocurrencies

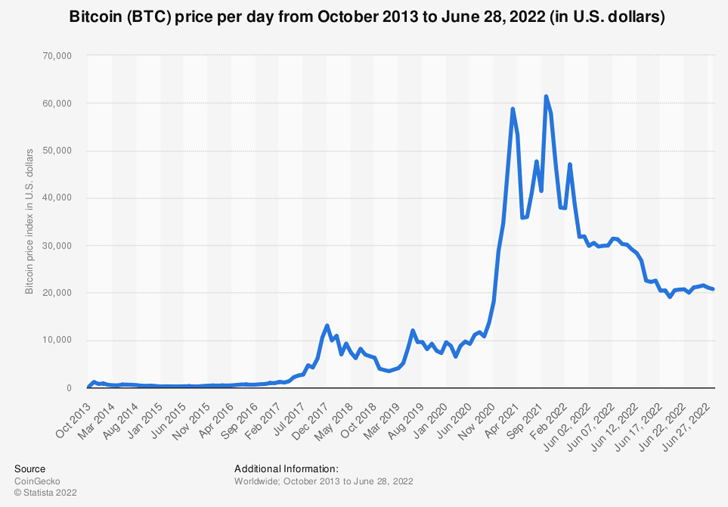

The cryptocurrency market is ridiculously volatile, as you probably know already. But we cannot deny the fact that the prices of Bitcoin and Ethereum have hugely grown over time.

Aaron Brown, market researcher and writer for Bloomberg.com explained the scale of the cryptocurrency assets this way; The total market value of Microsoft Corp and Apple Inc is $2.5 billion, whereas the total value of all cryptocurrencies exceeds $3 trillion, i.e. 20% more than the value of the two giant corporations combined.

Prices of Ethereum and Bitcoin both shot up during 2021, then dropped dramatically. However, the current price of Ethereum is twice that of the pre-pandemic, whereas Bitcoin is three times. So there’ a great risk but there’s also a great potential.

Cryptocurrency Investment Pros and Cons

Pros

- Transparency - All the transactions are recorded on a decentralised ledger using blockchain technology. Each transaction is permanently visible to the public, so fraud is prevented.

- Security and anonymity - The blockchain won’t record your name or any personal detail. You’re only known as a number code, so your privacy is protected.

- No income tax - We are all taxed based on the transactions we make with fiat currency but there’s no taxation in the crypto world. The cryptocurrency market is not regulated by the government, which means your transactions are not subject to income tax.

- High return potential - Based on Bitcoin’s value increase, there’s a huge potential to make good profits.

Cons

- No payment protections - Not being regulated by the central government also means that your payments are not protected in any way. No security verifications, no refunds if you sent to the wrong account.

- Risk of losing your account - Decentralised means that your accounts (wallets) or transactions are your sole responsibility. If you forget your password, you’ll lose everything and there’s no way to retrieve it.

Part II: Side-Hustle

With an investment, there may be a long time before you see the return. In the meantime, you can use your spare time to earn extra income while still working a regular job. And when you take early retirement, it’ll be up to you to turn your side hustle into a full-time equivalent job or continue to work as a part-time and enjoy freedom.

5. Affiliate Marketing

If you think it may be too late to start anything to make money online because the technology evolves too fast that you cannot keep up, yes it’s partly true. While you are planning your retirement life, teenagers are gaining the best ways to monetize their technical skills at twice the speed of yours, if not more.

But this never means that the decades of your life experience will be worthless to share with others. There are things that nobody else can take away from you. It can be your life-long hobby, career, or qualification that you have. You can monetize it using the way that you think the most suitable for you.

Affiliate marketing is not about selling products, but it’s about recommending related products to help problems. People search online, day-in, day-out, to find out solutions to their problems. Their “problems” can be serious and complicated such as illnesses, relationships, careers, etc. But they can also be some simple questions, such as “Which supermarket flour is best to make a pizza?”, “What’s it like to live in Tashkent?” You can help them by sharing your experience (cooking or travel, respectively) while you recommend relevant products.

Affiliate Marketing Pros and Cons

Pros

- Low or no initial investment - All you have to do is join an affiliate program. You can start without spending any money, although you may wish to spend small fees on a good training course to learn the techniques.

- Passive income opportunities - Some affiliate sales such as recurring membership fees will allow you to earn passive income in years to come, even if you quit affiliate marketing.

- Fewer responsibilities - Because you are merely promoting other people’s products and you are not the seller, you won’t have to deal with customer service or after-sales, such as complaints, and refunds.

Cons

- Competition may become tougher - Affiliate marketing is accessible by anyone, which means it’s becoming increasingly competitive year on year.

- It takes time - Due to its competitive nature, it takes time to build your platform to an authority level. It may take at least several months before you can make your first affiliate commission. While most investment options only require monitoring, affiliate marketing requires a lot of building-up work.

If you don’t want to wait, you can always spend money on advertising to promote your affiliate products. But also takes a few extra techniques such as copywriting, and image optimization to draw attention. Whichever method you take, it will be achievable so long as you persistently keep learning and enjoy the trying & testing process of it. Affiliate marketing still stands as one of the most lucrative ways to make money for retirement.

What Do You Advocate?

6. E-Commerce Business

The e-commerce industry is also highly competitive. But there’s no reason why you should give it up the idea just because it’s competitive. It may well be just more difficult to find non-competitive ways to make money in this day and age. If you think about this way, for centuries, people have built shops and physically sold goods to make money. Online stores have become the mainstream in the past decade or two, that’s all it is.

According to a survey carried out in circa 2019, 90% of e-commerce businesses failed after 120 days, i.e. 4 months. (Source: via Small Business Trends, the original source can no longer be found.)

The top 3 reasons are to do with marketing (poor skills or methods and lack of search engine visibility), followed by cashflow problems and pricing issues.

The study results tell you 3 things;

- Learning marketing skills is the crucial key.

- Don’t underestimate management accounts. (Monitor your spending and profit per unit.)

- Be persistent (don’t give up within 4 months!)

As your goal is to keep earning a good level of income for retirement, which is a long-term strategy, there is a very good chance that you can become a successful e-commerce business owner.

E-Commerce Pros and Cons

Pros

- Limitless possibilities - You can sell anything you want, whether you are a creator and sell your own products (e.g. art, accessories), run a retail business, or drop-shipping.

- Low barrier to entry - You can start an Amazon FBA business, which will only cost $0.99 per item sold, then when you start making good sales, either stick to the Amazon or move on to expand your business by venturing with other wholesalers or niche brands.

- Supplemental income opportunities - You can create extra income sources by displaying third-party advertisements and affiliate products on your store site,

Cons

- Inventory and packaging costs - Although drop-shipping has become the mainstream method for individuals to run an online store, if you choose to do packaging and shipping yourself, you’ll need to consider the storage and cash flow (i.e. payment to suppliers.)

- Technical issues - When you deal with customer payments, the stability of your web server is crucial. you need to make sure that your e-commerce site is secure and well-protected from cyberattacks. You’ll risk losing sales in the event that your site crashes or there is a problem with the payment gateway.

Read more:

- Yakkyofy Review: The End-to-End Dropshipping Software Solution That Helps You Avoid The Pitfalls

- Debutify Theme Review – Create The Best Dropshipping Site

7. Online Teaching (Sell Your Course)

If you have teaching experience, you probably know what it’s like to work for an online college already. To be hired, you’ll need to prove your qualifications and career history. There’ll be a curriculum to follow, time management, appraisal process, etc.

But if you work for yourself - selling your own teaching class - there’ll be no such restrictions. Here are some pros and cons.

Online Teaching Pros and Cons

Pros

- No qualification is required - You’re working for yourself, so it doesn’t matter if you’ve had formal education or experience, though the proof will provide credibility.

- Teach in any way you want - You can create your own course curriculum, update each lesson as and when, and it’s all up to you to sell pre-recorded lessons, live webinars, or even to sell audio-only/text-only lessons.

- Flexible - Once your course is set up, you’ll have time for yourself, which you can use to focus on the marketing side of it.

- Take advantage of affiliate programs - Online courses are extremely popular among affiliate marketers to sell. So you can join affiliate programs such as ClickBank and get them to sell your course for a commission.

Cons

- Setting up can be tricky - Although you don’t need a developer to create a course program for you, you will need a tool and some trial and error before you make it sellable.

- Marketing your course is not easy - Although you can rely on affiliates to sell your courses, you’ll still have to put in a little effort to make your online course known, by promoting it on social media, for example.

Having said all that, setting up an online course (student-only access site) is not as difficult as you think. Of course, you may need the basic skills such as recording videos, creating textbooks, and your website hosted.

If you are interested, check out a WordPress plugin called Thrive Apprentice which will bundle a professional course site with a friendly interface pretty easily. Templates are provided for you so you can make your course site easily, such as the homepage, course overview and modules, audio, video, and text files.

You'll be in control of your entire site and customise it in any way you want, for example;

- Make part of your course members-only, so you can offer some free lessons to new students. Give them access to those who paid to learn some more.

- Organize and re-order your course structure just by drag & drop.

- The quiz platform will allow you to offer quizzes, competitions, and questionnaires to interact with students.

- The conditional display feature - show different screens to the visitors who meet specific conditions.

7 Ways To Make Money For Retirement: Final Words

When it comes to investments, diversification of the portfolio is important. You hedge one investment against another, so if one doesn’t work and you lose your money, at least one of the others can win to cover your loss. However, this doesn’t mean you should randomly try them all. I suggest that you master one area and dig deeper before you give the next one a try.

For example, if you decide to invest in gold, you can also look at other precious metals such as silver and platinum, or other commodities which I didn’t mention today.

If you decide to start affiliate marketing, you can first start promoting one product or one brand, but in case something goes wrong with that particular brand, you can also start looking at other affiliate programs to search for other products.

I hope you will find the best project to make money for retirement. If you have any questions or doubts, don’t hesitate to leave a comment below. Good luck with the second half of your life journey!

Thank you for such a wonderful job compiling the ways to make money for retirement. It adds a touch of motivation to my job search activities. I have been trying all sorts of ways for years but it’s been so difficult. I agree with all of your points and hopefully, I can retire soon. Please visit my site also. I think you will find this useful for your business.

Thanks for your comment Rachel, you’re not making sense and your link is broken. It all seem pretty hopeless but the only way is up, right?