Which gold investment advice should I take? Is now a good time to buy? Hold on, should we ever buy gold as an investment? I’m talking about you & me. I have a small amount of spare cash in my bank account, should I continue to save towards the new kitchen, or should I buy gold?

I was considering this seriously late last year and couldn’t make up my mind. Now it’s March, what should I do?

When I was young – like when I was a barman – we were always told that gold was one of the safest and the most secure ways to invest your money in. In times of economic instability, the precious metal was continually in great demand, plus the resource would be exhausted one day – there’d be no more gold left on the Earth. You’d have a truck full of gold bars by then, sell it all and become a billionaire. Great plan!

When I was young – like when I was a barman – we were always told that gold was one of the safest and the most secure ways to invest your money in. In times of economic instability, the precious metal was continually in great demand, plus the resource would be exhausted one day – there’d be no more gold left on the Earth. You’d have a truck full of gold bars by then, sell it all and become a billionaire. Great plan!

Yeah talking about economic instability in those days…it’s actually pretty unstable now too. When is the economy ever stable?

Now for the past several years we’ve been told “gold no more”. It doesn’t mean there’s no more gold left, people are still digging. Gold can be dug. The economy has been at an all-time low and the value of gold has gone downhill.

Is that all true? Economy is always bad though. Children’s behaviour today is always worse than it used to be. “Today’s music” has always had no taste, and “today’s economy” has always been bad. Your parents would tell you and your grandparents would tell you even more.

Gold Investment Was Good But No Longer Brilliant – Why?

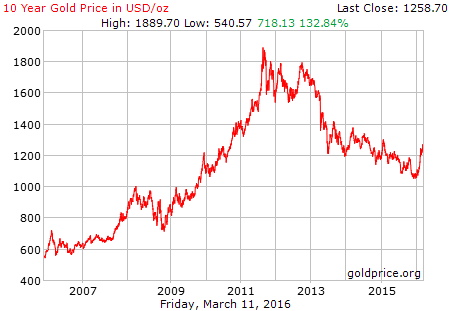

If you look at the 10-years chart, the gold prices were steadily going up until 2011, then there was a sudden drop. In 2013 there was a further, even harsher drop, and the prices have been going downhill since.

Why? Mainly because;

- “Commodities” i.e. gold, and US Dollars work in negative correlation – means when USD is stronger, the gold gets weaker. And USD has been strong since 2011.

- Recent Greek crisis and the Euro bailout package – other big European countries lend more money, means their share prices will go up. So investors will spend more money on shares. Means spend less money in gold.

- China being the biggest consumer of gold, now buys less.

So there were two opposite speculations; the gold prices may come down even more in the future, would be worth less & less. Or the prices have now hit the bottom, the only way is up therefore we should buy NOW.

Gold Prices Are Going Back Up

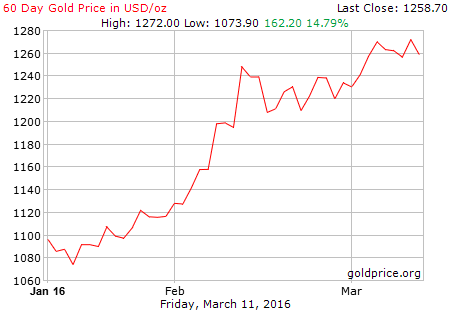

…that was back in late 2015, and now the gold prices have been going back up since the start of this year.

Because the oil price is low, making the whole market value volatile. So China’s facing its economy crisis in the last few months, making Chinese Yuan devalued. Investors don’t want to spend on stocks & shares now, they’d rather buy gold again instead. Meaning the gold prices are dramatically rising again.

People buy gold to hedge against inflation – gold tends to do well when other things don’t. My investment in shares (my previous post back in November 2015 – Complete Beginners Guide to Stock and Shares) is not doing great. For the first time I’m making a loss and, I guess all the millionaire shareholders are suffering big time with the current stock market slump. My minor share investment is nothing comparing to that!

But at least I receive some dividends from my shareholdings. You don’t receive an income from owning gold bullion. I’d hesitate to call it an “investment” if there was no guarantee of benefit. There’s no benefit from just owning gold, there’ll be a benefit only when you’ve sold it and made a profit.

So I’ll just do a quick summary here;

Gold Investment Advice Pro’s and Con’s

Pro’s:

- Holding gold bullion is good as insurance against inflation and events such as global stock market crash.

- Some gold brokers sell gold in small unit, you could buy a small coin, say 1/4 ounce for $300 or so. It’s not inaccessible. Easy to buy online.

Con’s:

- Gold pays no income like dividends. There’ll be storage costs like a bank safety deposit box (unless you keep it under your bed!)

- Look how volatile the gold prices are – from the 10 year’s chart above; you can see it was $600 per/oz in 2007, $1,800 in 2001 and now down to $1,100 – $1,200.

Are Gold Prices Going Up?

According to the World Gold Council, in 2015 central banks added 252.1 tonnes of gold to their reserves in the first half of the year, then 336.2 tonnes in the second half, in order to diversify their reserve holdings.

cnbc.com says new shares of the iShares Gold Trust fund (IAU) have been suspended temporarily from being issued, because the demand for gold has been so strong.

So are gold prices going up? The experts seem to think so. But they can only speculate it based on the current and historical market conditions. They all seem to continue to buy more gold this year and it looks like the prices will likely go to up in the near future. It’s just the market analysts’ predictions. Some disagree of course.

Conclusion

It looks really like just a good enough idea to buy gold in order to hedge against share investment. Gold price today is, say $1,250. Let’s be super-optimistic and it will go up to $1,400 later on this year… I would buy at least 5 ounce though;

It looks really like just a good enough idea to buy gold in order to hedge against share investment. Gold price today is, say $1,250. Let’s be super-optimistic and it will go up to $1,400 later on this year… I would buy at least 5 ounce though;

- Spend 5 x $1,250 = $6,250.

- Price will go up: 5 x $1,400 = $7,000.

- 7,000 – 6,250 = $750 profit.

Is the risk worth taking? I personally don’t think it is. What do you think?

I would buy both gold and silver and I bury it in the ground so I have something when the governments go to digital money which they control totally. It will take time so in the meantime I am buying shares in public gold and silver companies that are not mining now, but have a lot in the ground and enough money to last for 2 years without diluting the shares.

Hi Roger, thanks for your comment. Wow, burying gold and silver in the ground, I’ve never thought of that. And also to buy shares in public gold and silver companies, what a good idea. In the UK the new tax year has just started and there’s a good opportunity to invest more shares in ISA (Individual Savings Account, the profit on shares of which will be tax free) so I should definitely look into it.

Thanks again for stopping by and taking time to leave a comment.

This is a great looking site and it has been bookmarked! I really enjoyed your examples of what an investment in gold would look like. Only $750 for the amount you have to put up seems to be a bit much of a risk.

This is why I personally choose to diversify and collect gold AND silver. I know it’s worth FAR less, but I also enjoy the history behind all the coinage. Perhaps you would like to check out my site about silver as an investment over at howtobuysilvercoinsonline .com. Maybe we can help each other out?! Let me know! Either way, excellent site you have here Ray! Thanks for your time!

Hi Paul,

I just looked at your site – howtobuysilvercoinsonline.com. I love it! Fascinating. It seems well-worth collecting silver coins especially as you say in your site, that they’re produced for a limited time. Also your Silver vs Gold page explains in detail; howtobuysilvercoinsonline.com/buying-silver-vs-gold

I’d rather love to buy these coins for my collection as a hobby and never want to let go! And with that benefit, I could call it a great investment (=not just in order to make a profit).

Thanks Paul, your site is something I look forward to refer back to!

Ray

I always use Gold as a hedging against inflation. Not for a cash flow.

This is the safest bet.

Your argument is understandable. I still think Gold is an investment. Currency value is always against gold. It will never be against something else.

I foresee that Dollar will be weaker in the next couple of year against Gold as Chinese Yuan will enter the market as one of the World Currency. By this argument alone, I will hold Gold rather than currency (or its derivative such as stocks).

Hi, thanks for your comment & advice, that I just needed directly from an expert. It’s good to know that currency value is always against gold but never against anything else. Thanks for your prediction as to Dollar being weaker in the next few years. If there was a potential for the gold price to be say, doubled in the next 10-15 years, then I’d like to spend a good money on gold today. I guess we never know, or quite unlikely?