With the cost of almost everything on the rise, it is becoming increasingly challenging to make ends meet. To offset these rising costs, we must all find ways to decrease our expenses and increase our incomes. This may involve sacrificing certain luxuries or cutting back on unnecessary spending in favor of more frugal habits. We can also look for additional sources of income such as side jobs or freelance work that can help supplement our current wages.

Make smart financial decisions and stay mindful of our budgets to maintain a comfortable lifestyle despite fluctuating prices - easier said than done. How can we survive this?

The Cost of Living Crisis

The cost of living is determined by a complex array of factors, including inflation, supply and demand, government policies, and economic growth. As we all know, Covid followed by the war between Russia and Ukraine can indirectly impact the cost of living in some ways.

The conflict leads to disruptions in the global supply chain, it could result in higher prices for certain goods and services. Additionally, if the conflict escalates and leads to broader geopolitical instability, it could impact financial markets and cause fluctuations in exchange rates and commodity prices.

That being said, of course, other factors could contribute to a cost of living crisis, including natural disasters, political instability, and economic policies. It's unlikely that any single event or conflict would be the sole cause of a cost of living crisis in Western countries.

How to Survive the Cost of Living Crunch

The cost of living eats into your budget. Prices for basic necessities like food and housing are rising, while incomes remain stagnant. It's a recipe for financial disaster, and it's only getting worse.

But there is some good news: you can survive the cost of living crunch. By following a few simple tips, you can make ends meet without going into debt. Here's how:

Make a Budget and Stick To It

- Determine your income: Calculate your total monthly income, including salaries, wages, and any other sources of income.

- Find out your fixed expenses: These are expenses that do not vary from month to month, such as rent or mortgage payments, car payments, insurance premiums, and loan payments.

- Find out your variable expenses: These are expenses that can vary from month to month, such as utilities, groceries, entertainment, and transportation.

- Prioritize your expenses: Determine which expenses are essential and which are non-essential. Essential expenses include things like housing, food, and utilities, while non-essential expenses might include things like eating out, cable TV, or gym memberships.

- Allocate your income: Based on your prioritized list of expenses, allocate your income to cover your essential expenses first, and then allocate any remaining funds to cover your non-essential expenses.

- Track your spending: Keep track of your spending to ensure that you are staying within your budget. There are numerous budgeting apps to use - choose the most basic one that helps help you track your expenses. Don’t choose an app with too many features to avoid being overwhelmed.

- Adjust your budget: If you find that you are consistently overspending in certain areas, consider adjusting your budget to allocate more funds to those areas or finding ways to cut back on expenses in other areas.

Creating a budget is only just the first step. Making the necessary adjustments to your spending habits is difficult. It may take some time and effort, but sticking to a budget can help you survive the cost of living crisis and achieve your financial goals over time.

Cut Back on Unnecessary Expenses

Cutting back on unnecessary expenses is an important step in managing your finances during the cost of living crisis. Here are a few things you can do to reduce your expenses:

- Track your spending: Keep track of your spending for a month or two to see where your money is going. This will help you identify areas where you can cut back.

- Cut back on eating out: Eating out can be a significant expense. Try cooking meals at home more often, packing lunches for work or school, and reducing the frequency of dining out.

- Shop smarter: Look for deals and discounts when shopping for groceries, clothing, and other items. Start buying generic/non-brand or store-brand products instead of well-known brand items.

- Reduce utility bills: Take steps to reduce your utility bills by turning off lights and electronics when not in use, reducing water usage, and adjusting the thermostat to save on heating and cooling costs.

- Cancel subscriptions and memberships: Evaluate your subscriptions and memberships to see if you can cancel any that you no longer use or need.

- Use public transportation or carpool: Consider using public transportation or carpooling to reduce your transportation costs.

- Limit entertainment expenses: Look for free or low-cost entertainment options, such as visiting local parks, libraries, and museums, or hosting game nights or movie nights at home.

Use Credit Wisely

While "credit" is handy for making purchases and managing cash flow, any credit you use will need to be paid off at some point. Here are some tips for using credit wisely:

- Understand your credit: Learn about credit scores, interest rates, and the terms and conditions of your credit accounts. This will help you make informed decisions about how to use credit.

- Pay on time: Make all of your credit payments on time to avoid late fees and damage to your credit score.

- Avoid credit cards if you can: Try to keep the amount of credit low. Just use a small portion of your available credit even if you’re allowed to use thousands of dollars. Because high credit utilization will affect your credit score negatively.

- Shop for low-interest rates: If you need to carry a balance on your credit account, look for low-interest rate credit options. This can help you minimize interest charges and pay off your debt more quickly.

Remember to use any "credit" responsibly and within your means.

Stop Relying On Royalty (Point) Cards

Retailers are devaluing the points on their loyalty program cards, it may be a good idea to use up your points before the devaluation takes effect. This can help you get the most value out of your points and avoid losing them.

So you should expect less from your reward cards from now.

For example, a shop may have rewarded you with 10 points for every $1 you spent and each point represented $0.01. This means that the shop effectively gave you 10% cashback. Now imagine the shop changes the terms and makes the numbers sound confusing, saying it will reward you with 25 points for every $1 you spend (you'll get more points) but every 100 points will represent $0.10.

This would mean that you would now have to spend $4 to receive $0.10 cashback, i.e. the cashback rate will be reduced to 2.5%.

So you may want to reconsider whether the loyalty program is still worth participating in if the devaluation significantly reduces the value of the points. If the program no longer provides significant benefits or savings, it may be better to discontinue your participation in the program and find other ways to save money on your purchases.

Invest In Decent Items

Investing in quality items that will last can be a smart financial decision in the long run. While cheaper options may be more affordable in the short term, they may end up costing you more in the long run due to their lower quality and shorter lifespan.

Here are some benefits of investing in quality items:

- Better quality: High-quality items are often made with better materials and construction, which can lead to better performance and a longer lifespan.

- Fewer replacements: Investing in quality items means you'll need to replace them less frequently, which can save you money in the long run.

- Lower maintenance costs: Quality items may require less maintenance and repairs, which can save you time and money.

- Better resale value: Quality items may retain their value better than lower-quality items, which can make them easier to resell and recoup some of your investment.

Of course, decent items cost you more upfront. But consider the long-term savings and benefits when making purchasing decisions. Additionally, you can look for deals, discounts, or second-hand options for quality items to help reduce the upfront cost.

Prioritize your essential expenses and make good decisions about where to allocate your funds!

Learn DIY To Cut Down Costs

Learning how to do-it-yourself around the house can be a great way to save money on home repairs and maintenance. Here’s what you can do to get started:

- Start small: Begin with simple projects, such as changing light bulbs, painting walls, or fixing leaky faucets. These tasks are usually easy to complete, and they can give you the confidence to tackle more complicated projects.

- Watch tutorials: There are plenty of online resources that can teach you how to complete a variety of home improvement projects. Websites like YouTube and DIY Network offer step-by-step video tutorials for DIY projects.

- Borrow or rent tools: If you don't have the necessary tools for a DIY project, consider borrowing or renting them from a friend or a local hardware store. This can save you money compared to purchasing tools outright.

- Consult with professionals: For more complex projects, consider consulting with a professional before beginning the work. They can offer guidance on how to complete the project safely and efficiently.

- Prioritize safety: Always prioritize safety when completing DIY projects. Wear appropriate safety gear, follow instructions carefully, and don't attempt projects that are beyond your skill level.

A DIY can be time-consuming and require a certain level of skill, but weigh the costs and benefits of doing it yourself versus hiring a professional - that will be another way to survive this cost of living crisis.

Earn Extra Income

No one's income is ever going to be high enough to keep up with the rising cost of living indefinitely. But it only makes sense if you try a little hard using your spare time and start making extra money to ease the financial burden, doesn’t it?

Make some additional funds to cover expenses or save for the future. Even a small amount of extra income can make a big difference in your financial situation.

The key is to find a way that fits your schedule and skills. Freelancing, selling products online, taking on a part-time job, or participating in the gig economy... You just need to be realistic about the amount you can generate and budget accordingly. Also consider the impact that extra work may have on your mental and physical health, as well as your relationships.

Content Creation

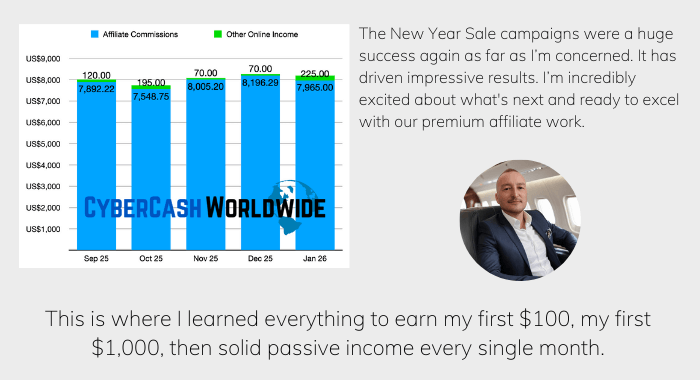

You can make money by creating content on a website. The ways to monetize a website are;

- Advertising: You can display ads on your website through ad networks such as Google Ads or Mediavine. You earn money based on the number of clicks or impressions the ads receive.

- Affiliate marketing: You can include affiliate links in your content and earn a commission for any sales that result from clicks on those links.

- Sponsored content: You can partner with brands and create sponsored content in exchange for payment. This could include product reviews, sponsored posts, or social media mentions.

- Membership or subscription fees: If you create high-value content that people are willing to pay for, you can offer it behind a paywall and charge a membership or subscription fee.

- E-commerce: If you have products to sell, you can set up an e-commerce store on your website and sell them directly to your audience.

To make money from a website, it's important to create high-quality content that resonates with your audience, build a loyal following, and promote your website through social media and other channels. It takes time and effort, but with persistence, you can build a successful website that generates income.

Start YouTube Marketing

YouTube marketing can be a very lucrative way to make money online. With over 2 billion monthly active users, YouTube is the second-largest search engine in the world, making it an excellent platform for businesses and individuals to reach a large audience.

There are several ways to make money through YouTube marketing, including:

- Advertising revenue: YouTube allows you to monetize your videos through advertising. You can earn a share of the advertising revenue based on the number of views and clicks your videos receive.

- Sponsorships and endorsements: You can partner with brands and promote their products or services in your videos in exchange for payment.

- Affiliate marketing: You can include affiliate links in your videos and earn a commission for any sales that result from clicks on those links.

- Merchandising: You can sell merchandise related to your channel, such as t-shirts or mugs, and earn a profit.

As you may already be aware, YouTubing takes time and effort. So you are expected to consistently create content that makes viewers want to subscribe, build a loyal audience, and promote your videos through social media and other channels. It's not a get-rich-quick scheme, but with dedication and hard work, it can be a very profitable way to make money online.

Government Assistance Programs

There are several government assistance programs that can help offset the cost of living crunch. Here are a few of the most popular programs:

- The Low-Income Home Energy Assistance Program (LIHEAP) provides financial assistance to low-income households to help pay for energy costs.

- The Supplemental Nutrition Assistance Program (SNAP) provides food assistance to low-income individuals and families.

- The National School Lunch Program (NSLP) provides free or reduced-priced lunches to eligible children in school.

- The Temporary Assistance for Needy Families (TANF) program provides cash assistance to low-income families with children.

- The Housing Choice Voucher program provides subsidies to low-income households to help with rent payments.

How to Prepare for the Hyperinflation

As the cost of living continues to rise, many people are wondering how to prepare for the possibility of hyperinflation. While there is no quick solution, there are some steps that everyone can take to help protect themselves from the effects of inflation.

Invest in Assets That Will Hold Their Value

Precious metals like gold and silver typically do well during periods of inflation, as do real estate and other hard assets.

Investing in Euro Currency

Now that there's a greater chance of US Dollars collapsing than ever, having some Euro is a wise financial decision for those who want to diversify their portfolio and benefit from the stability of the European economy.

As one of the world's most widely-traded currencies, investing in Euros can provide investors with access to opportunities across Europe, as well as potential capital gains when exchange rates are favorable. When choosing how much to invest, it is important to take into account factors such as risk and volatility when making an informed decision.

Keep Some Cash on Hand

Having a stash of cash may (or may not) be helpful in case banks are overwhelmed by customers. At least you can buy some basics for a while. Although hyperinflation means that your bank bills may be worth nothing. Imagine a loaf of bread costs $100 - that's what happens with severe hyperinflation.

Cut Expenses Where You Can

If your income isn't keeping up with inflation, you'll need to find ways to reduce your spending. Look for ways to save money on groceries, transportation, housing, and other necessary expenses.

Have a Plan B

In case of severe hyperinflation, it may be necessary to leave the country or make other major life changes. Have a backup plan in place so that you know what you'll do if things get really bad.

Rising Prices and Falling Incomes: Let's Survive This Cost of Living Crisis - Final Words

The cost of living crunch is a serious problem that affects many individuals and families across the country. Fortunately, with some creative budgeting strategies and an open mind towards alternative methods of saving money, you can survive this economic reality without sacrificing your quality of life. With a bit of extra effort, it may even be possible to find ways to improve your finances when prices are rising and incomes are falling.

No matter how difficult the situation might seem right now, there’s no reason why you can’t make small changes that will help you get through these tough times while still maintaining financial security in the long run.