You’ve probably heard the term “get-rich-quick scheme” before, and you are probably aware that many of them are actually illegal. So many ordinary folks know that they shouldn’t be involved in any shady businesses, yet somehow fall for them and end up losing fortunes. In this post today, let's take a look at some of the questionable schemes and discuss how we should avoid them.

Did You Know?

- The majority of participants in get-rich-quick schemes make less money than they invest.

- Less than 1% of participants in multi-level marketing (MLM) schemes profit, according to a study by the FTC.

- Victims of pyramid schemes lose approximately $700 million annually in the United States alone.

- Online get-rich-quick scams have surged by over 50% in the past two years.

- 60% of the money made in pyramid schemes is earned by less than 1% of participants.

Peter: "They said I'd make money in my sleep. Didn't know it meant dreaming about it."

Paul: "At least your dreams are profitable."

What Is a Get-Rich-Quick Scheme?

A Get Rich Quick scheme is a plan or system promising to make someone rich quickly, typically through illegal or unethical means. Get-rich-quick schemes often appeal to people who are facing financial difficulties or who are simply looking for a way to make some quick and easy money. Unfortunately, these schemes are usually illegal or highly risky, and can often lead to financial ruin.

Promoters of get-rich-quick schemes often use false claims and deception to lure in unsuspecting investors. Once the scheme collapses, those who have invested their money or time often find themselves worse off than they were before.

Examples of Get-Rich-Quick Schemes

Some popular get-rich-quick schemes include pyramid schemes, Ponzi schemes, and chain letters. The majority of the schemes share a few common characteristics. They typically,

- Promise easy money with little or no effort required.

- Typically require an upfront investment, which can be in the form of money, time, or both.

- Involve some level of risk, which can lead to financial losses if the scheme doesn't pan out.

CyberCash Wonderland

"You sold my wooden duck?! What were you thinking? That was our family history!"

"No it's not, dad. You bought it for $2 in the flea market..."

"That's not the point, son! How much did you sell it for?"

"$100. There was this investment opportunity, big returns..."

"Don't you dare talk to me about 'opportunities'! You just threw away my treasure for some get-rich-quick pyramid scheme! Fly to Egypt and apologize to the Sphinx for your lack of respect for tradition!"

Ponzi Schemes

Ponzi schemes are one of the most common types of get-rich-quick schemes. Investors are promised high returns with little or no risk. The promoter collects money from new investors and uses it to pay off earlier investors, giving the appearance of profitability. However, the scheme eventually collapses when the promoter is unable to attract new investments or meet payout obligations.

Pyramid Schemes

"My get-rich-quick scheme involves selling get-rich-quick schemes."

"So, a pyramid scheme?"

Pyramid schemes are another type of get-rich-quick scheme that share many similarities with Ponzi schemes. Both types of schemes promise high returns with little or no risk and both to require an upfront investment. However, in a pyramid scheme, participants recruit new members who make investments in the scheme. These new members then earn commissions on their own investments and on the investments made by other members that they recruit.

Like Ponzi schemes, pyramid schemes eventually collapse when recruitment slows down and there are not enough new members to make up for withdrawals by earlier investors.

Did You Know?

- The average loss per victim of investment scams, including get-rich-quick schemes, is roughly $5,000.

- Over 80% of people who join MLM schemes drop out within the first year.

- Cryptocurrency-related get-rich-quick schemes have defrauded investors out of billions globally.

- The FTC receives over 10,000 complaints related to pyramid schemes annually.

- In a survey, 20% of Americans admitted to participating in what turned out to be a get-rich-quick scheme.

"Heard about the new get-rich-quick scheme? It's called 'Work Hard and Save Your Money.'

"Sounds like a scam. Who would fall for that?"

The History of Get-Rich-Quick Schemes

From the earliest days of human civilization, there have been those who have sought to gain an unfair advantage over others in the quest for wealth.

The first recorded get-rich-quick scheme was devised by an Egyptian pharaoh who promised his subjects that they could double their money if they invested in his pyramid project. Needless to say, the pharaoh's pockets were lined with the proceeds while his investors lost everything.

Over the centuries, there have been many other examples of get-rich-quick schemes, ranging from Ponzi schemes to investment scams. And while some people have indeed managed to strike it rich through such schemes, far more have lost everything they've put into them.

So why do people keep falling for get-rich-quick schemes?

Why Do People Fall For Get Rich Quick Schemes?

Unfortunately, human nature is such that we are all too often drawn to the promise of easy money with little or no effort on our part. It's only when we realize that there's no such thing as a free lunch that we learn our lesson, often at a great financial cost.

The reasons people fall for such schemes are because;

- Laziness - They tend to be looking for a way to make money without having to work hard. They see the ads and think that they can just hand over their money and watch it grow.

- Out of Desperation - They often desperate to make money. They may have lost their job or be in a difficult financial situation. They see the promise of easy money and think that it will help them get out of their current situation.

- Being Unrealistic - They underestimate how difficult it is to actually make money. They see the ads and think that all they need to do is put in a little effort and they will start seeing results.

Did You Know?

- Online get-rich-quick schemes affect not only adults but also 15% of teenagers who attempt to use them to make money.

- Approximately 5% of U.S. adults have lost money in a get-rich-quick scheme.

- The average age of victims in investment scam schemes, including get-rich-quick scams, is between 45 and 54 years.

- Reports indicate a 70% increase in social media-based get-rich-quick schemes during the pandemic.

- Only about 10% of reported losses from get-rich-quick schemes are recovered.

How to Avoid Get-Rich-Quick Schemes

There are a few things to keep in mind to avoid get-rich-quick schemes. Firstly, be wary of anyone promising quick or easy money. If it sounds too good to be true, it probably is.

Secondly, don’t invest any money you can’t afford to lose. Get-rich-quick schemes are often high risk and you could end up losing everything you invest.

And finally, do your research before investing in anything. Make sure you understand the risks involved and always know who you’re dealing with.

What to Do If You've Been Scammed by a Get-Rich-Quick Scheme

If you've been scammed by a get-rich-quick scheme, there are a few things you can do to try and get your money back.

Contact The Scheme Owner

First, contact the company that ran the scheme and explain what happened. The administrator of the company is unlikely to listen to you, they’ll probably come up with the “small print” (terms and conditions / no-refund policy). But the proof of your correspondence may come in useful when you take further action at a later date.

Contact Your Credit Card Company

Your next step is to contact your bank or credit card company and explain the situation. They may be able to help you get your money back by disputing your transaction if you can prove that you were scammed.

Report To The Authority

Lastly, you can file a complaint via the "Report Fraud" site, run by Federal Trade Commission (FTC). The FTC takes complaints about scams and works to shut them down. If enough people file complaints about a particular scam, the FTC may investigate and take legal action against the company involved.

Did You Know?

- The success rate of making a stable income through MLM schemes is lower than 1%.

- Get-rich-quick schemes have been reported in over 100 countries, showing their global impact.

- Approximately 25% of get-rich-quick scheme participants are enticed through social media platforms.

- Women are twice as likely to be recruited into MLM schemes, a common type of get-rich-quick scheme.

- The psychological impact of losing money in get-rich-quick schemes leads to depression and stress in over 30% of victims.

CyberCash Wonderland

"Oh Brandon, are you serious?! That 'crypto-currency' thing sounds like a pyramid scheme in a shiny suit!

Remember that time-share you almost bought in Florida? This is worse! We could have used that money for those gorgeous red pumps I saw, or that perfect tote bag for work! Honey, put that 'investment' down and invest in me, please!"

How To Make Money Online Legitimately

There are a number of ways to make money online legitimately instead. Here are some options to consider:

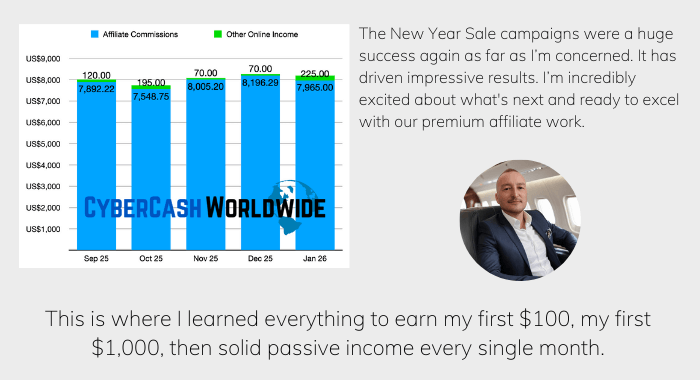

- Start a blog or website and monetize it through advertising, affiliate marketing, or selling products and services.

- Join an online marketplace that connects freelancers with clients who need their services.

- Create and sell an online course or eBook on a topic you're knowledgeable about.

- Offer to consult or coach services online.

- Sell handmade goods or crafts online through a platform like Etsy.

- Participate in paid online surveys.

- Sign up for paid focus group studies.

Start Earning Small Then Scale Up

The majority of successful millionaires start small and gradually increase their income level. So you too need to have a plan, set your goals and stick to your plan.

One way to start earning small and then scaling up is to find a niche market. This could be a group of people who share a common interest or need that you can address with your products or services.

Once you've found your niche, focus on creating value for them. This could be in the form of providing useful information, offering great customer service, or creating an innovative product or service that meets their needs.

When you've established yourself in your niche, you can start to scale up your operations. This could involve;

- Expanding your audience base,

- Increasing your marketing efforts, or

- Adding new products or services.

The key is to keep growing your business so that you can eventually achieve your goal of becoming rich quick.

Do Not Gamble

A get-rich-quick scheme is a fraudulent investment opportunity that promises to pay out large sums of money in a short period of time. These schemes are often too good to be true, and people who fall for them usually end up losing all of their money. If you're thinking about investing in any opportunity that seems too good to be true, make sure to do your research first and beware of get-rich-quick schemes.

Remember, where there's a chance to earn a lot in a short period, there's also a chance to lose it all. Don't gamble unless you know it's a gamble.

I was promised that I make at least 20000 dollars in the first week but after 10 days I didn’t make anything. Something was going on. I messaged them more than 5 times but and did not receive anything from them. a few weeks later I tried to log in then it said there was no such account existed. I emailed them again but nothing. When I think back I should of known it was a scam but anything but I paid more than 100 dollars they should have returned my money before banning me from joining again.

Hi Markie, which scheme are you referring to? Share with us, and it’ll help others stay away from it. Have you tried to get your money back, e.g. disputing against your credit card company?

Yeah, I’ve been there before, don’t trust anything that tells you to get rich in a short period of time. If you want to make affiliate marketing income for years to come, try this course. I have seen success for over 6 months now.

Thanks for your comment, I had to remove your link because the site seems to be loaded with malware. But I wish you all the best.

I wanted to share my experience with a get rich quick scheme. run by someone who pretended to be Warren Buffet. I joined and was promised that I would make all this money, I soon realized it wasn’t Warren B but it turned out to be a scam and I lost $1000. The only reason I’m telling you this is to save you from making the same mistake.

Sorry to hear that, what was the name of the scheme? How did you first hear about it? Share with us if you don’t mind, so that our readers would know…unless it’s all disappeared already.