Have you ever dreamed of retiring early? Maybe it's been a lifelong fantasy or maybe you are being faced with the possibility of retiring before reaching traditional retirement age. Now, 30 years old is not even halfway through your life yet, so if you're wondering if it's a good idea to retire so early, you must either be devastatingly unhappy with your work situation or have so much money to waste over the rest of your life.

There are things to consider and understand, indeed, when it comes to taking the plunge and potentially retiring before your 60s. But at 30? Let's discuss this.

What Makes You Think You Want To Retire Now?

Retiring early can provide a sense of security and freedom to pursue new interests. It may be motivated by the desire to maximize the quality of life, or simply due to a belief that there is more out in the world to experience than what is attainable within the confines of traditional retirement age expectations.

Some people seek earlier retirement for financial reasons, as they have saved enough money throughout their lifetime and are confident that it will sustain them through their golden years.

Others might dream of having more time for hobbies and travel, or just being able to take life at a slower pace without worrying about working all day every day.

Ultimately, retiring early can create an opportunity for living on one's own terms earlier than expected - something that many find appealing and rewarding.

Discretionary Income

Usually - for retirees of a good age - retirement doesn't mean that your income stops. In fact, for many people, retirement is actually when their discretionary income (household income less all the necessary bills) increases. Well before they enter their golden years, they no longer have to worry about paying for things like childcare or commuting costs. Instead, they can use that money to travel, take up new hobbies, or simply save for a rainy day.

However, retirement also comes with some financial challenges. One of the biggest is healthcare costs. When you're no longer working, your health insurance premiums will likely go up. And if you don't have a job-based health plan, you may find it difficult to get coverage at all. Another challenge is figuring out how to pay for long-term care, whether it's in-home care or assisted living.

The Advantages of Retiring Early

There's no doubt retiring early has its benefits. Let's list them all up.

1. You'll have more time to enjoy your hobbies and pursuits.

Retiring from work can be a liberating experience, allowing you to pursue the hobbies and pursuits that have been neglected during your working life. Without the stresses of juggling a job with family and leisure time, you'll have more freedom to spend time doing activities that make you happy.

Reading books, taking up painting or gardening, exploring travel destinations around the world or volunteering for a cause close to your heart - when you retire you will finally have more free time available to focus on what truly matters most in life.

2. You can travel and see the world while you're still young and active.

You often hear the phrase "it's never too late to..."

But in reality, your physical ability limits you from doing what you want to do as you get older.

Traveling around the world is an amazing experience, and if you think you want to do it "before you die", then it's something that should be experienced while you are young. As you age, you'll find traveling physically challenging and uncomfortable. It'll become more difficult to keep up with the fast-paced schedules required to adequately explore different countries.

On top of that, things like jet lag can take a greater toll on older travelers than younger ones. Therefore, if your goal is to see as much of the world as possible before retirement, then it is best accomplished when you’re young and full of energy.

3. You can live a healthier lifestyle by avoiding the stress of work-related deadlines and obligations.

Without having to worry about the pressure that comes with working, you can take more time for yourself to focus on your own mental health and physical well-being.

This could include exercising regularly, eating nutritious meals, taking time out for relaxation activities such as yoga or meditation, getting enough sleep each night, or even just spending quality time with friends and family. Not only will this help reduce stress levels in general but it can also improve overall health in the long run.

4. You'll have more time to volunteer or pursue philanthropic interests.

Instead of working, you can use that extra time and energy to pursue your Interests in philanthropy. Whether it's volunteering in environmental projects, helping out at a local animal shelter, or even organizing a fundraiser for a good cause - there are countless ways to make the world a better place when you no longer need to worry about working full-time.

When you can dedicate more time and resources towards making positive changes in your community or around the globe, everyone benefits from your efforts. Take advantage of the opportunity if you don't have to work - use this precious gift of free time wisely!

The Disadvantage of Retiring Early

There are certainly some devastating drawbacks to consider before deciding to retire so early.

1. You may lose your raison d'etre.

Your career is an essential part of your life and it can give you a sense of purpose. Without it, you may feel lost and without direction. It can be hard to motivate yourself to find new opportunities or challenge yourself outside of your current job if you don't have something that drives you.

Your career should be something that excites you, gives you a sense of accomplishment and allows for growth in both professional and personal capacities. Having a strong career plan will help ensure that when times get tough, you still have something to focus on and strive for which will keep the passion alive.

2. You'll lose a connection with your current friends.

When you no longer have a working life, you might think you can spend more time with family and friends, but the reality is quite opposite. It'll be difficult to stay connected with your friends who are still actively engaged in their careers. You may find that the topics of conversation are drastically different from what you used to discuss and as a result, conversations may become awkward or uncomfortable.

You may find yourself feeling isolated and bored without the structure and social interaction that comes with work. (Although you may find people in simular situations and start making friends with them.)

3. Easy life can rot your brain.

Easy life can hinder intellectual growth and development. When you don't have to put in the hard work and effort that comes with tackling challenging tasks, then your ability to think critically, problem-solve and develop new ideas is compromised.

Over time, this lack of stimulation can lead to a decrease in creativity, motivation and mental agility. Finding ways to remain mentally fit can become challenging. Retiring early can be a big adjustment emotionally and socially.

How To Know If You're Ready To Retire

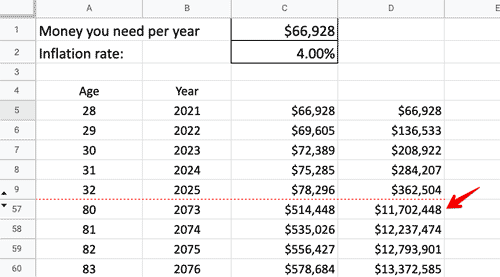

According to the Bureau of Labor Statistics, the average annual expenditures in 2021 were $66,928.

Based on this information, if you were the age of 30 in 2023, and will live until the age of 80 (2027), you will need a total of $11.7 million.

But this is based on the steady inflation rate of 4% every year. The inflation rates in the USA are much higher right now, and we never know what will happen in the future. So this is a complete guestimate.

If you want to calculate it based on different numbers, you can download a spreadsheet from here (Excel, 62Kb)

Is 30 Too Early To Retire? Yes. Pretty Unfeasible

So as you can see from the numbers, retiring at the age of 30 seems likely to put you in financial trouble sooner or later, unless you are a multi-millionaire already and ready to live frugally for the rest of your life. Agree?

And considering the disadvantages - imagine lazing away for years and years - you’re not gonna be able to find a decent job after you reach middle age.

So the conclusion - 30 is far too early to retire.

30, in all honesty, you have the best decade ahead of you. 15+ years, to be a little more precise, before your physical and mental capabilities start to decline.

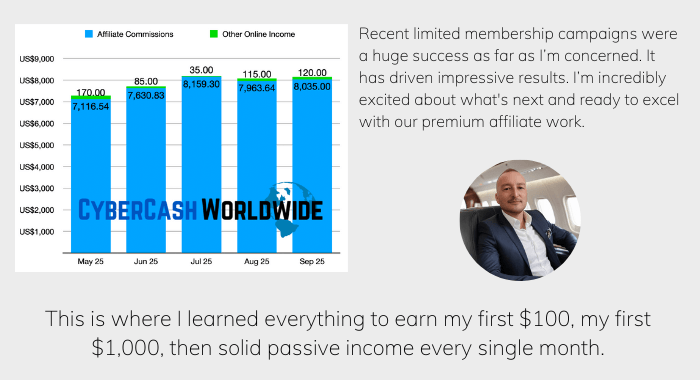

If you don’t want to work for anyone else, the only other way is to run your own business. Use whatever skills you’ve built so far through college or work, and start selling services online.

Whatever trauma you may have experienced as a result of your work, you should never give up hope. Finding out what you can sell and learning to turn it profitable in years to come is better than dreaming of doing nothing.

Please help me if you are young and rich enough to retire I am a single mother of 2 sons I am struggling to make ends meet in fact, if I don’t pay my rent by next Tuesday I don’t know where to go and my son is hungry, I need your help! If you have some money to donate, you can have some money to send to people who struggle please? Please send me whatever you can to

I wait for your positive response as I contacted every possible place in town and nobody can help me.

Thanks for your comment Mary, but I suggest that you stop leaving comments on random websites – you’re wasting your time. Nobody donated money to someone anonymous. Instead, I suggest that you go to a local charity group and meet someone face to face. Good luck!