You may have always been told to save money for financial stability, but did you know saving is not the wisest path to wealth? While a chunk of money in your bank account can help you maintain a solid foundation, you know it doesn't generate significant wealth on its own.

So to really grow your wealth, you do need to take some calculated risks. Invest your money and if necessary, borrow some funds to start up your own business. And you should take action as soon as you can because it takes a lot of trial and error to find opportunities for significant financial growth and personal fulfillment.

If you have a brilliant idea or a burning desire to be successful, stop saving money. Let it circulate to get bigger returns over and over again.

Why Saving Money Won't Get You Wealthy

Saving money alone may not make you wealthy because the money you save typically sits idle, not growing significantly over time. While saving is important for short-term needs and emergencies, it's not an effective strategy for long-term wealth building.

The idea of saving money also encourages a scarcity mindset rather than an abundance one. Saving every penny and living frugally can lead to a limited mindset where opportunities are missed due to reluctance to take risks.

Did You Know? (Borrowing Money Statistics - 1)

- Global Debt: Global debt reached a record $281 trillion in 2020 (Institute of International Finance).

- Credit Card Use: About 47% of U.S. adults carry credit card debt (Federal Reserve).

- Mortgages: 62% of Americans have a mortgage as their largest debt (Experian).

- Student Loans: Over 43 million Americans have student loan debt (EducationData.org).

- Payday Loans: Approximately 12 million Americans use payday loans annually (Consumer Financial Protection Bureau).

To illustrate, let's say you save $100 every month and keep it in a savings account that earns a low interest rate. After a year, you might earn a small amount of interest, let's say $10. So your total savings would be $1,210 ($100 x 12 months + $10 interest). While it's good to have saved money, it's not a substantial increase in wealth.

When you invest money in yourself and your own business instead, you are allocating resources towards creating something that has the potential to generate income and wealth in the future. Additionally, entrepreneurship allows you to take control of your financial destiny, as the success of your business is directly tied to your efforts and decisions.

Investing Money To Start Your Own Business

So what kind of things you should invest your money in? When starting your own business without employing anyone, here are some areas where you might consider investing your money:

1. Product Development

If you have a product idea, invest in developing it to a market-ready stage. This could involve creating prototypes, refining the design, or conducting testing.

For example, if you're starting a handmade jewelry business, you might invest in materials and tools to create your products.

Cost:

The cost can vary widely depending on the complexity of the product. It could range from a few hundred dollars for simpler products to several thousand dollars or more for complex and customized offerings.

2. Service Development

Service development is about turning your service idea into a well-defined and market-ready offering, tailored to meet the needs of your target customers.

For example, if you're starting a tutoring business, you would identify the subjects you'll teach, define your teaching approach, determine session duration and frequency, and set pricing and packages.

Cost:

The cost can vary widely depending on the complexity of the product. It could range from a few hundred dollars for simpler products to several thousand dollars or more for complex and customized offerings.

Did You Know? (Investment Statistics - 1)

- Stock Market Participation: 55% of Americans own stocks (Gallup).

- Retirement Savings: The average retirement savings for Americans is $65,000 (Transamerica).

- Real Estate Investment: 31% of U.S. adults see real estate as the best long-term investment (Gallup).

- Cryptocurrency Adoption: 13% of Americans have bought or traded cryptocurrency (Pew Research Center).

- Millennial Investors: 67% of millennials are comfortable with investing in stocks (Ally Financial).

3. Equipment and Tools

Depending on your business type, you may need to invest in specific equipment or tools. For instance, if you're starting a gardening service, you might need to purchase gardening tools, lawnmowers, or a vehicle to transport your equipment.

Cost:

I don't need to tell you the cost of the equipment you're looking to use. It's up to you to find it out by googling and comparing prices.

4. Website and Online Presence

Having an online presence is crucial, as you know. Invest in creating a professional website that showcases your product. You can also allocate funds for domain registration, web hosting, and e-commerce platforms.

For example, if you're a freelance graphic designer, investing in a website to display your portfolio and attract clients would be essential.

Cost:

Creating a basic website can cost anywhere from $500 to $2,000, depending on the complexity and features you require. Additional costs may include domain registration ($10 to $20 per year) and web hosting ($50 to $200 per year).

5. Marketing and Advertising

Marketing/advertising could include printing business cards, and flyers, or investing in online advertising.

For instance, if you're a personal fitness trainer, investing in printed flyers to distribute locally or running targeted Facebook ads to reach potential clients could be effective.

Cost:

Marketing and advertising costs vary based on the strategies you choose.

Local advertising, like newspaper ads, may cost $0.05 to $0.20 per flyer and $50 to a few hundred dollars for newspaper ads.

Online advertising, such as PPC ads on platforms like Google/Meta ads, can range from a few cents to several dollars per click, or a few dollars to several hundred dollars per campaign.

Collaborating with influencers may cost a few hundred to several thousand dollars, while content marketing can range from a few hundred to a few thousand dollars. Costs depend on factors like duration, audience size, and industry competitiveness.

Did You Know? (Saving Money Statistics)

- Savings Rate: The U.S. personal saving rate peaked at 33.7% in 2020 (Bureau of Economic Analysis).

- Emergency Funds: Only 41% of Americans could cover a $1,000 emergency with savings (Bankrate).

- Average Savings: The average American has $3,500 in savings (Federal Reserve).

- Retirement Readiness: 22% of Americans have less than $5,000 saved for retirement (Northwestern Mutual).

- Health Savings Accounts: There were 30 million health savings accounts (HSAs) in the U.S. by 2020 (Devenir).

- Savings Goals: 25% of Americans have no specific savings goal (Federal Reserve).

6. Business Registration and Permits

Set aside funds to cover the costs of registering your business, acquiring any necessary permits, and fulfilling legal requirements. This ensures that you're operating your business in compliance with local regulations.

Cost:

The costs depend on your location and the type of business you're starting. It can range from $50 to a few hundred dollars.

7. Professional Services

Consider investing in professional services like accounting/bookkeeping to ensure proper financial management. You might also consult with a lawyer for advice on legal aspects specific to your business.

Cost:

Accounting or bookkeeping services can range from a few hundred dollars to a few thousand dollars per year, depending on your qualification, the complexity of each customer's business and the level of support required. Legal services may involve costs for consultations, which can range from a few hundred dollars to a few thousand dollars.

8. Training and Education

Allocate some money to invest in your own knowledge and skills development. This could involve attending relevant workshops, courses, or purchasing educational materials. For example, if you're starting a freelance writing business, investing in online writing courses to improve your skills could be beneficial.

Cost:

Training costs can vary widely depending on the courses you choose. It could range from free online resources to several hundred or even thousands of dollars for more comprehensive programs.

9. Business Tools and Software

Depending on your business needs, consider investing in software that can streamline your operations. This might include project management software, accounting software, or graphic design tools. If you're a freelance photographer, investing in photo editing software or cloud storage solutions for your client files could be valuable.

Cost:

Many photo editing apps are free. Premium apps offer affordable monthly subscription plans, ranging from $10 to $30 per month. Cloud storage solutions like Google Drive, Dropbox, or OneDrive often provide free or low-cost plans with limited storage, while paid plans typically range from $5 to $20 per month, offering more storage capacity.

These tools allow you to edit and enhance your photos professionally and securely store and share client files without significant financial investment. Prices may vary based on the provider you choose and the features you require.

Did You Know? (Borrowing Money Statistics - 2)

- Auto Loans: Around 85% of new cars are purchased with loans (Experian).

- Personal Loans: The average personal loan debt in the U.S. is $16,458 (Experian).

- Small Business Loans: In 2021, the average small business loan amount was $663,000 (Federal Reserve).

- Borrowing for Emergencies: 40% of Americans would struggle to cover a $400 emergency expense without borrowing (Federal Reserve).

- Credit Score Influence: A 100-point difference in credit score can save or cost a borrower over $40,000 in interest on a mortgage (MyFICO).

Borrow Money To Invest In Your Business

Borrowing money to invest in your business can be a viable option. Here are some factors to consider when deciding whether to borrow money for your business:

- Think about how much extra money your business can make from the investment. Will it help you expand your business? Make sure the benefits are worth the cost of borrowing.

- Have a plan for your business and how the borrowed money will be used. Show how it will help your business grow and make more money. This will help you see if the investment is likely to be successful.

- Make sure you can pay back the borrowed money, including the amount you borrowed and the interest, without causing financial problems for your business. Look at how much money your business will make and how much it will cost to pay back the loan.

- Compare different lenders and their offers to find the best deal. Look at the interest rates, fees, and conditions they have.

- Consider any risks involved, like changes in interest rates or unexpected expenses. Be prepared with backup plans to handle these risks and make sure you have enough money to deal with any problems.

- Think about how borrowing money will affect your personal finances. Consider your personal financial situation, like your credit score and ability to handle more debt.

When is the Best Time to Borrow and Invest Money?

The best time to borrow and invest money is as soon as the right time arrives. Here's a simple explanation:

- Stable Business: It's usually best to borrow when you're determined to make your business stable and to have a steady income in the future. This gives you a better chance of being able to repay the loan without financial stress.

- Growth Opportunities: Look for opportunities to expand or improve your business. If you see a chance to invest in something that will help your business grow and make more money, it might be a good time to consider borrowing.

- Low-Interest Rates: Keep an eye on interest rates. If they are low, it may be a favorable time to borrow because you can potentially save money on interest payments.

- Strong Market Conditions: Assess the overall market conditions and trends in your industry. If the market is doing well and there is demand for your products, it's a good time to take advantage of growth opportunities.

- Cash Flow: Evaluate your monthly cash flow. Make sure you have enough money coming in constantly to cover your monthly loan payments as well as your expenses. Borrowing money should not strain your cash flow or put your business at risk.

- Risk Management: Consider the risks involved. Think about what could go wrong and have a plan to handle any setbacks. Unexpected challenges do exist, so just keep that in mind.

How to Safely Borrow Money

First and foremost, make sure you are not taking on too much debt that you cannot handle. This means being realistic about your ability to repay the borrowed amount. Also, make sure to read all the terms and conditions carefully before signing any agreements. Be aware of any fees associated with the loan, as well as any potential risks.

Recommended options:

- Banks and Credit Unions: Traditional financial institutions often offer competitive interest rates and a range of financing options. If you have a good credit history, a well-developed business plan, and collateral, this can be a reliable choice for obtaining business loans.

- Small Business Administration (SBA) Loans: SBA loans can be beneficial for small businesses as they typically have lower interest rates and longer repayment terms. However, they require more paperwork and have stricter eligibility criteria.

- Microlenders: Microlenders are particularly useful for small businesses that may not qualify for traditional bank loans. They often have more flexible requirements and a mission to support underserved entrepreneurs.

- Crowdfunding: Crowdfunding platforms can be effective for raising funds while also validating your business idea. They give you an opportunity to find customers and generate early interest in your product.

Options with considerations:

- Online Lenders: Online lenders offer convenience and faster funding compared to traditional banks. However, they may have higher interest rates and less favorable terms. So review the terms and conditions before committing to an online loan.

- Business Credit Cards: Business credit cards can provide quick access to funds and help manage cash flow. However, they often have higher interest rates than traditional loans, so it's crucial to pay off balances on time to avoid accruing excessive interest.

- Trade Credit: While trade credit can offer short-term cash flow relief, you need to manage your payment obligations carefully. Late payments or misuse of trade credit can harm your relationship with suppliers.

Stay vigilant about monitoring your finances after borrowing money. Keep track of payment due dates and monitor your credit score regularly to ensure everything is going according to plan.

Did You Know? (Investment Statistics - 2)

- Women Investors: Only 26% of women are invested in the stock market (S&P Global).

- Robo-advisors Usage: Robo-advisors manage approximately $460 billion in assets globally (Statista).

- Impact Investing: Impact investments reached $715 billion in assets under management in 2020 (Global Impact Investing Network).

- ETF Popularity: ETFs account for about 30% of all U.S. trading volumes (Statista).

Or Start a Business With Little Investment

There are several online business options you can start on your own without needing to invest a lot of money upfront. Here are a few ideas explained in simple terms:

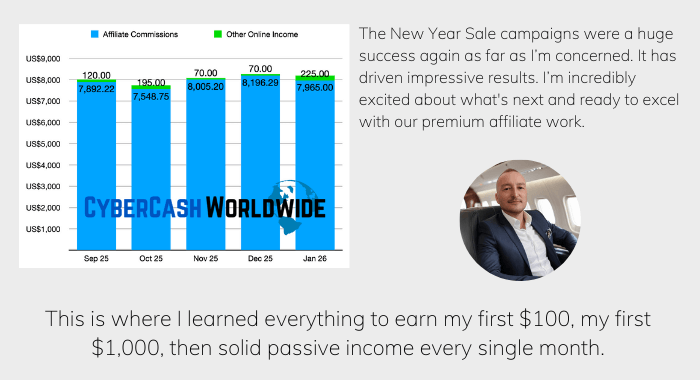

Affiliate Marketing:

Affiliate marketing requires little investment as you know, as you promote other people’s products for commission. You join affiliate programs that sell merchandises related to your niche. You promote their products through your blog site, YouTube, TikTok, etc, and when someone makes a purchase through your referral link, you make money.

Investment Required:

Affiliate marketing has relatively low upfront costs since you don't need to create your own products. However, you may need to invest in a website, which can range from $10 to $30 per year for a domain name and around $5 to $30 per month for web hosting.

Example: Let's say you decide to become an affiliate marketer in the fitness niche. You purchase a domain name for $15 per year and choose a web hosting plan for $10 per month. You spend some time creating content and optimizing your website for search engines. Your total investment for the first month would be approximately $25.

Online Consulting/Coaching:

If you have expertise in a particular field and you are good at teaching, why not teach online? You can offer a service as a consultant or train others in any area of your expertise. Marketing, fitness, personal development, financial planning, etc. You can conduct sessions through;

- Vdeo calls

- Pre-recorded courses

- E-books.

Investment Required:

The investment needed for online consulting can vary depending on your expertise. Some potential costs may include building a professional website, investing in video conferencing tools, or creating informational materials.

Example: Suppose you want to offer online consulting services for small businesses in the field of marketing. You spend $500 on building a visually appealing and user-friendly website. You invest in video conferencing software, which costs $30 per month. Additionally, you create an e-book as a resource for your clients, spending $200 on professional design and editing. Your total investment for the first month would be approximately $730.

Content Creation:

If you enjoy writing, creating videos, or producing podcasts, you can monetize your content. Build a website, YouTube channel, or podcast where you can share valuable information, entertain, and educate your users. Once you have a following, you can earn money through advertising, sponsorships, or by selling merchandise or premium content.

Investment Required:

Content creation can be started with minimal investment. You may need to invest in quality equipment like a camera, microphone, or video editing software, which can range from $100 to $500 or more, depending on your needs.

Example: Let's say you want to start a YouTube channel where you share cooking tutorials. You invest $300 in a good camera, $100 in a microphone, and $200 in video editing software. You also set up a simple website for $50 to prove your credibility. Your total investment for the first month would be approximately $650.

Online Freelancing:

If you have skills like graphic design, writing, programming, or social media management, you can offer your services as a freelancer. Services like Upwork, Fiverr, or Freelancer.com connect freelancers with clients who need specific tasks completed. You can start small by taking on individual projects and gradually expanding your client base.

Investment Required:

Online freelancing generally requires a minimal upfront investment. You may need to invest in professional software related to your freelance service, such as graphic design software, project management tools.

Example: Suppose you want to offer freelance graphic design services. You invest $50 per month in a graphic design software subscription. You also spend $100 on creating a portfolio website to showcase your work. Your total investment for the first month would be approximately $150.

Dropshipping:

With drop shipping, you can sell products online without needing to keep inventory or handle shipping. You partner with a supplier who stores and ships the products directly to your customers. Your job is to set up an online store, market the products, and handle customer inquiries. You earn a profit by selling products at a higher price than what you pay the supplier.

Investment Required:

The investment for dropshipping typically includes creating a professional-looking online store, which can cost around $30 to $300 per month, depending on the platform you choose. Additionally, you may allocate some budget for marketing and advertising, such as influencer collaborations, which can range from $100 to $500 or more per month.

Example: Let's say you decide to start a dropshipping business selling home decor items. You choose to use Shopify as your e-commerce platform, which costs around $29 per month. You spend $200 on setting up a visually appealing website design and product descriptions. For marketing, you allocate $300 per month for Facebook ads and collaborations with Instagram influencers. So your initial investment for the first month would be approximately $529.

Why Borrowing and Investing Money is Smarter Than Saving: Final Words

Invest wisely in your online business. Instead of solely saving money, you allocate funds strategically to enhance your chances of success. Of course, minimizing unnecessary expenses is important, but you really start to make good profits when you're making smart investments.

Wise investments and prudent financial management, they're not as difficult as you think. Continuously monitor the impact of your investments and ensure they align with your business objectives. Take calculated risks and make the most of your resources. You'll soon find the way to expedite your business's growth and increase its long-term profitability.

In summary, investing wisely in your online business sets the stage for success. It accelerates growth, enhances your online presence, and positions you for sustainable profitability. Take advantage of any opportunity to propel your business forward.

Why Borrowing and Investing?

That’s what this post is all about. In short, the more capital you have, the greater chance of growing your business/money, providing you invest it wisely, than simply saving. Thanks for your comment.