Gold - the most sought-after commodity in the world, a safe haven for investors and the bedrock of many economies. The global gold market is highly competitive and has been shaped by many factors over the past few decades.

One of the most influential forces in this market today is BRICS, an international economic bloc formed in 2009 by Brazil, Russia, India, China and South Africa. How BRICS is influencing the dynamics of the global gold market means a lot to us investors in the West.

We will also examine how some of its members are leading the way to create more equitable access to gold investments.

The BRICS Countries

The BRICS countries are Brazil, Russia, India, China, and South Africa. They are all major emerging markets with large populations and rapidly growing economies. The BRICS countries work together to promote economic growth and development and, one of the ways they have done this is by creating the BRICS Bank, which is an institution that provides loans to member countries.

The BRICS countries are also important players in the global gold market. Each country has significant reserves of gold, and they are all major producers of metal. The BRICS nations are also increasingly turning to gold as a way to diversify their reserves away from the U.S. dollar.

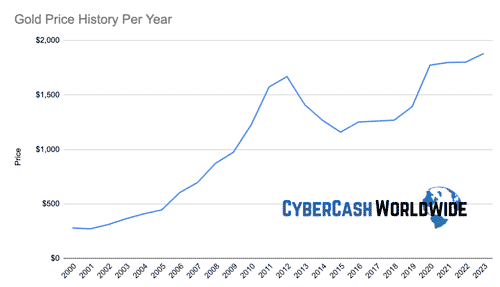

The increasing importance of the BRICS countries in the gold market is having a major impact on prices. The demand for gold from these nations is helping to drive up prices, while their large reserves are providing significant selling pressure when needed. This dynamic is likely to continue in the future, making the BRICS nations a key factor in determining the direction of gold prices.

The Rise of BRICS

BRICS nations are now some of the largest producers and consumers of gold in the world and their growing economic clout has been a major driving force behind gold’s price rally in recent years.

Investors have flocked to gold as a safe haven asset in times of economic uncertainty and many see the BRICS nations as a key driver of global growth going forward.

The BRICS nations are also major players in the global central banking system and their policies have a significant impact on gold demand. Through their policies, they can significantly impact gold demand by either creating an environment which encourages investment in gold or one that is not conducive to buying it.

For example, if these countries tighten monetary policy then investors may be encouraged to put more of their savings into gold as a safe haven asset. Alternatively, expansionary fiscal policies could increase liquidity and reduce the attractiveness of buying gold as an investment option. The BRICS countries have therefore been influential in shaping global trends in gold demand over recent years.

Overall, the rise of BRICS is having a profound effect on the global gold market and investors need to be aware of this trend when making investment decisions.

The Role of Gold in BRICS

Gold plays an important role in the BRICS economies because first of all, the countries account for around 20% of the global production of gold. China is the largest producer, followed by Russia, Brazil, and South Africa. India is the fifth-largest producer.

The BRICS nations are also major consumers of gold, with China and India being the top two markets. Together, they account for around 50% of global demand. Gold is seen as a safe haven asset and is used to hedge against inflation and other economic risks.

The growing importance of the BRICS economies has led to increased interest in gold among investors. The metal is seen as a way to diversify one's portfolio and protect against downside risk.

For example, when stocks slumped in early 2018 on fears of a trade war between the United States and China, gold prices rose sharply as investors sought safe-haven assets.

The gold prices soared in 2020 when Covid hit the world, but according to Financial Times, when the war broke out in the Spring of 2022, Russian consumer demand for gold also soared and it pushed the prices up even more.

The Global Gold Market

The global gold market is an ever-changing and dynamic place. Gold prices have been on the rise in recent months due to a number of factors, such as rising geopolitical tensions, concerns about slowing economic growth, and currency devaluation.

In addition, gold investors have also been attracted to its safe-haven qualities during times of uncertainty. As a result of these factors, the demand for gold has increased significantly around the world. This has led to higher prices and greater trading volumes in gold exchange-traded funds (ETFs) than ever before.

Additionally, some countries are now buying more physical gold reserves as part of their central bank's investment portfolio diversification strategy or even as a way to hedge against potential losses from other investments.

Ultimately this means that there is significant activity taking place in the global gold market today - making it an exciting space for investors who want to capitalize on the current trend in precious metals investing!

To summarize, here are some key things investors know about the global gold market:

- The BRICS countries are increasingly becoming major players in the gold market.

- The demand for gold from these countries is expected to continue to grow in the coming years.

- Investors need to be aware of the different ways that they can access the gold market (e.g., through ETFs, mining stocks, etc.).

- The price of gold is reasonably volatile and can fluctuate significantly depending on global economic conditions.

Average Gold Price Per Year Since 2000

The Impact of BRICS on the Gold Market

The rise of the BRICS economies has had a significant impact on the global gold market. The increased demand for gold from these countries has led to higher prices and more volatility in the market. In addition, the BRICS nations have been working together to establish a new global financial system that could challenge the dominance of the U.S. dollar.

The impact of BRICS on the gold market has been both positive and negative for investors. On one hand, the higher prices and increased demand for gold are good news for those who own the precious metal. On the other hand, the increased volatility can make it difficult to trade gold effectively.

Longer-term, the establishment of a new global financial system could have major implications for the gold market. If successful, this could lead to a decrease in demand for gold as a safe haven asset and potentially lower prices.

What Does This Mean to Investors?

For years, the BRICS nations have been growing in both economic and political power. This has led to increased scrutiny of the gold market by these countries, as they look for ways to diversify their holdings and protect themselves from global economic uncertainty.

With the war raging on, it is impossible to predict what will happen. We (in the West) may be forced to bear much of the brunt of the conflict and its consequences if things don't turn out in our favor. We could face economic hardship or even a major shift in how we live our daily lives.

What does this mean to investors?

In the short term, it means that there is increased demand for gold from the BRICS nations. This could lead to higher prices for gold, as these countries look to build up their reserves. In the long term, it means that the BRICS nations could play a larger role in setting the price of gold, as they become more influential in the global economy.

Preparation For The US Recessions

Gold is a popular investment choice for those looking to protect their assets in case of an economic downturn. Investing in gold can provide stability and protection against inflation as the price usually rises during times of financial difficulty.

When preparing for a potential US economic crash, investors should consider buying physical gold such as coins or bars, or investing in gold stocks, ETFs (exchange-traded funds), or options. It's important to do research on the different types of investments available and understand how they work before making any decisions.

Additionally, it's wise to diversify your portfolio by investing in other asset classes like bonds, cash deposits, and real estate so that you have multiple sources of income if one area collapses.

How BRICS Is Shaping The Global Gold Market And What It Means For Investors

In conclusion, it is clear that BRICS countries have a profound influence on the global gold market. This has led to increased investment opportunities for investors who are willing to take advantage of this growing trend. Due to their large population and access to resources, these countries are well-positioned to become larger players in the gold industry. As such, investors should keep an eye on trends in emerging markets and look for potential investments within them.