Today I'll show you an easy bookkeeping method for small business, specifically for those who are new to affiliate marketing. I am (was!) an accountant with 25+ years of bookkeeping experience, and have seen countless number of fellow online marketers struggle to keep up with their financial transactions. But really, there's nothing complicated. Particularly if the majority of your income is from affiliate commissions, it couldn't be simpler.

I said it was a 'method' but there's nothing special. Use an online bookkeeping tool. But only use a part of it - the key is not to overcomplicate anything. I use a free tool called "Wave". I actually use it myself and use it for my tax return, since my source of income is solely via online.

Just a little disclaimer first; Accounting standards and tax regulations vary from country to country and I'm just an accountant from the UK. I'm in no way suggesting anything to hide or mislead the authority in your country. Keep your transactions as transparent as possible in case of being questioned.

What You Need

One of the main reasons people put themselves in a "bookkeeping muddle" is because they mix up their business and personal transactions. The solution is - obviously - to keep them separate. You need:

#1 Prepaid debit card

Google it and you'll find some companies who allow you to have a new card for a very low fee. I have one called Pockit Mastercard but that's for UK residents. Check the transaction fees though - some charge you every time you spend, some charge you a fixed monthly fee.

The idea is to transfer a lump sum from your personal account to your new prepaid account periodically. (This will be your "equity".) Then make any business-related payments on your card. As the card balance becomes lower, top it up.

How much to transfer and how often depend on the level of expenditure. If your monthly total spend (online tools, membership fees, advertising costs etc.) is $100, perhaps transfer $300 from your personal account to this card account every quarterly.

#2 Designated bank account

You'll only need a bank account if the only option to receive your affiliate commission is via wire transfer or by check, not by PayPal. Even so, your prepaid card account #1 above should be attached to the card issuer's bank and you might have your own account number. If that's the case you don't need it. Otherwise you want a separate bank account that you're not using for anything else for.

Any type of account as long as it allows you to deposit and withdraw freely throughout the year. If you don't have one, you can ask your bank to open one. They are unlikely to open a business account for you so easily, but many of them will be happily open an extra account.

#3 Business PayPal account

You'll definitely need a separate PayPal account for business transactions. Check this one ("Can I Have Multiple PayPal Accounts?") and open new one if you haven't already.

Use Wave App

Okay, so Wave is simple but proper accounting software for small business owners. It doesn't have budget planning feature, which often makes many users hard to keep up with, so it's great it doesn't have it. Simple is best.

I will only focus on your income and expenditure for the current year. My aim here is to simplify as much as I can, and still make it useful for your year-end tax return.

Just keep in mind that the software will allow you to record so much more in detail if you want it to. Balance Sheet (means how much money you've got) - I'll ignore that too. I'll be happy to answer your questions.

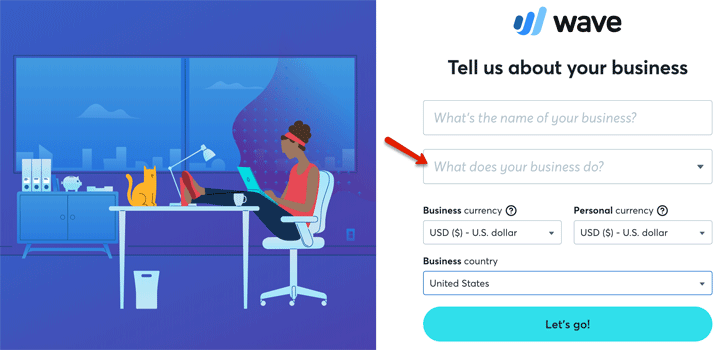

When you first sign up with Wave, it will ask you to choose what kind of business that you do from the dropdown menu. Choose 'Marketing' or 'SEO' or something similar.

It will also ask you the country of your business. You need to set it to your country and your local currency, even if all your receiving income is in US Dollars. This is important in order to be able to use Wave for tax return, and also important because once it's set, you won't be able to change it. You can post any foreign currencies in Wave, but the default currency should be your own.

Setting Up [1] - Your Tax Year End

Now you're in Wave dashboard. In the left-hand menu, you'll see "Sales" and "Purchases" - completely ignore these two. Very useful (to make sure not to miss payments/receipts) but you don't need those for affiliate marketing.

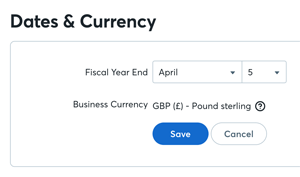

Go straight to "Settings" at the bottom-left corner. Then "Dates & Currency". Your currency should be set to yours and cannot be changed as I just mentioned.

Your Fiscal Year - you can decide your business tax year for any period you like, but I strongly suggest that you stick to your personal tax year. January 1st - December 31st in USA as I understand. So make sure the fiscal year end is set to December 31.

I live in the UK and our tax year runs from 6th April - 5th April over here. (Odd? Yeah!) If you live in the UK, change the date to April 5, and save.

Setting Up [2] - Chart Of Accounts

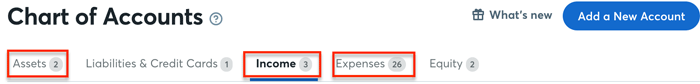

Now from the left-hand menu, go to "Accounting" then click a sub menu "Chart of Accounts". Here, you'll set the categories. Types of accounts you have (bank account, debit card account). Types of income (affiliate income, other ad hoc income if you have any), type of expenditure and so on.

Notice that there are 5 main tabs (sections) at the top. You'll make a small change to 3 of the sections - Assets, Income, and Expenses.

Assets

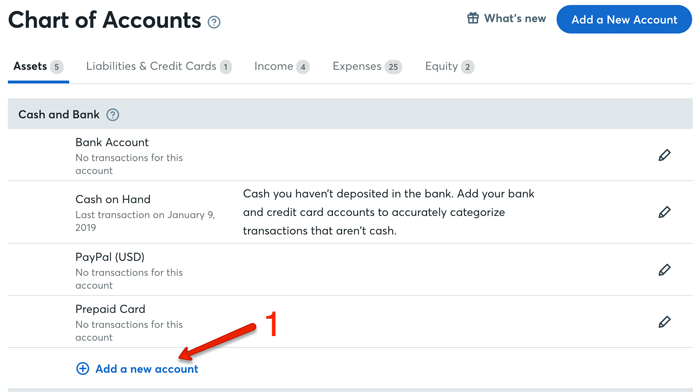

Firstly under Assets. Right at the top under "Cash and Bank", you should only have "Cash on Hand" right now.

- 1Add a new account, and add "Bank Account" "PayPal" and "Prepaid Card".

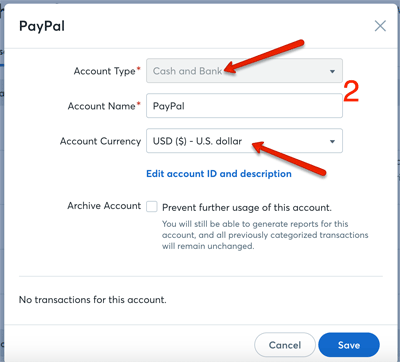

- 2When you click "Add a new account", a box appears. Leave Account Type "Cash and Bank" (on all of them) and enter PayPal. Account Currency should be US Dollar because you'll likely to receive your affiliate commissions in USD. If you receive and pay in your local currency, you also need to create another PayPal account in your currency.

Income

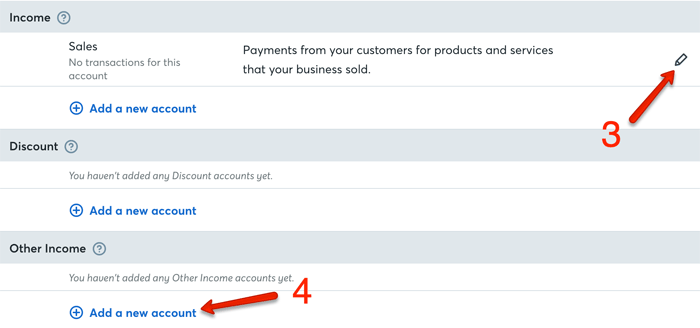

Now move on to Income tab.

- 3Click this pencil icon again, and change the name to "Affiliate Sales".

- 4Under Other Income, add a new account and name it "Other Income" - just in case you have other kinds of income. If you have another source of income regularly such as guest blogging, traffic selling, etc. You can add it specifically. But only if it's your regular income!

Expenses

Lastly click Expenses tab.

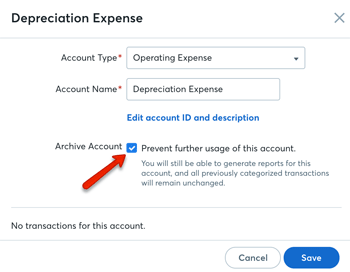

You'll find quite many types of expense accounts listed there. Delete most of them - delete anything that's unrelated to your expenditure.

For example;

- "Insurance - Vehicles"

- "Meals and Entertainment"

- "Rent Expenses"

- "Telephone"...

None of these applies to your expenses, so delete as many as you can and leave only a few (maximum 5) expense categories.

How to delete is to click the pencil icon, then check "Archive Account" box and Save.

Minimize The Number Of Categories!

Seriously, it's so important to minimize the number of categories, because too many categories will make a mess - don't underestimate it! I have seen hundreds (literally) of non-finance managers, colleagues, clients who get trapped in this problem over and over again.

They want to create many categories because they want to be precise in the beginning. Then they get confused by the large number of categories, lose interest and end up hating the whole bookkeeping task.

I'll give you an example. You say,"I want Google Ad Fees and Facebook Ad Fees in separate categories, because I will want to check how much each service has cost me later on in the year."

No, you won't! You will not want to check that. But in 3 months time you couldn't care less. No disrespect but believe me.

If you really, really, really want to check, you can go through the transaction history and recategorize them at a later date. You may find some of them missing, because you've misallocated Google ad costs in "Internet General" category and Facebook ad costs in "Website Tools" category and so on... Now, how many categories have you made!?

My answer to this is just to create one category for "Advertising/Promotion". In total you'll only need a few expense categories for affiliate marketing.

- Advertising/Promotion

- Web tools

- Training/Membership

- Virtual Assistants

- Other (stick any ad hoc expense here!)

Now your Chart of Accounts is all set!

Setting Up [3] - Connect To Your PayPal and Bank Accounts

Now connect your Wave account to your bank account and PayPal account. Wave will download all your income and expense transactions automatically (and securely), and all you have to do is to check each transaction, change the description if needed, and confirm.

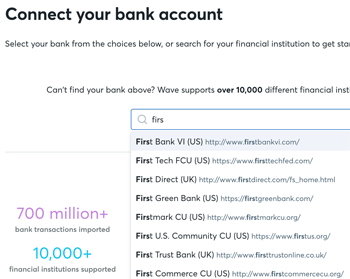

- To connect to your bank account: go to "Banking" in the left-side menu, then "Bank Connections". The dropdown menu will find your bank.

- To connect to your PayPal account: go to "Integrations" in the left-side menu towards the bottom. Choose the earliest date of the transaction history you want it to download. That should be the first day of your fiscal year.

You may notice the "Integration" feature also allows you to connect to other apps, e.g. if you sell on Etsy regularly, it will make it easy to download your sales transactions.

As soon as you connect Wave to your bank and PayPal, it will start downloading all the transactions.

All the setup's done!

Your Bookkeeping Tasks

Finally! This is what you're going to do - weekly if you can, or monthly at least.

- Look up the automatically downloaded transactions (income & expenses) line by line and 'review' them.

- Add other income & expenses (prepaid card use, for example) and review them.

- Add any transfer from one account to another (including a transfer to/from your personal account).

I'll show you one by one.

#1 Confirming Downloaded Transactions

You only need to link your Wave account to your bank / PayPal once in the beginning. Afterwards every time you log on to Wave, you can connect to your bank and PayPal at a click of a button. The latest transactions (from where you left off previously) will be downloaded.

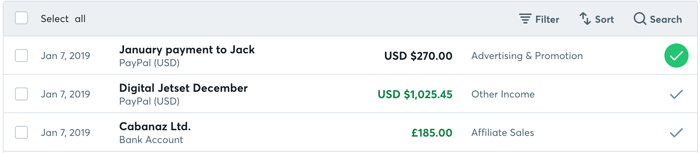

Go to "Accounting" in the left menu > "Transactions". Your latest income and expenses appear there. Like the screenshot below.

Amount of each income (=deposit) is shown in green, and each payment (=withdrawal) is shown in black. You need to click line by line to confirm the description and category.

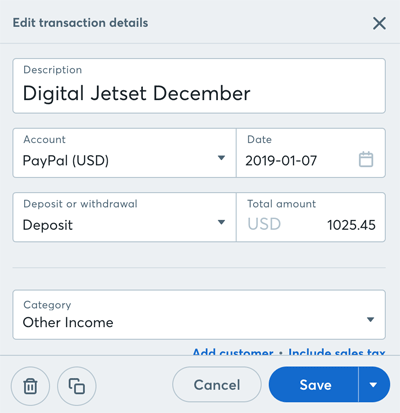

- Description: Shown as how it's described in your bank and PayPal statement, you can retype and change it to something more recognizable for yourself.

- Account: Which account (bank or PayPal) the transaction is related to.

- Category: It's randomly allocated (most likely to be "Uncategorized Income/Expense") so choose the right category from the dropdown menu.

When you've edited the description and category, click Save.

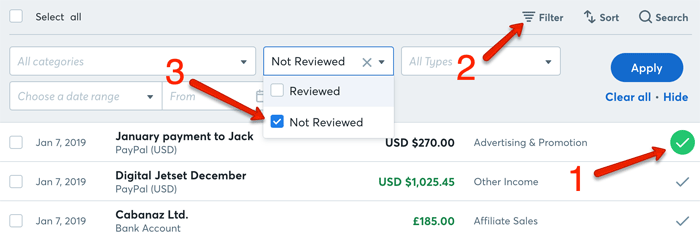

Now going back to the transactions... You need to 'review' each line. What it means is simply to confirm each transaction is correct and correctly allocated in the right category. If you have a question (you can't remember what the payment was for, for example), you can leave it for now and review it later.

- 1If the receipt/payment is correct, click this check, and it will turn green. That means you've confirmed it. That's all it is! The idea behind is......

- 2...Click "Filter" and...

- 3...Filter out reviewed items by checking "Not Reviewed" and "Apply". So you are left with only questionable items, which you need to find out sooner or later. Find a receipt, email communication on that day, etc.

When this section is filtered by "Not Reviewed", there should be nothing left. So next time you log on, all nice & clear, and you can start checking the newly downloaded latest transactions.

#2 Add Other Income and Expenses

Now expenses paid on your prepaid card. If your card account allows you to download transactions, that's great.

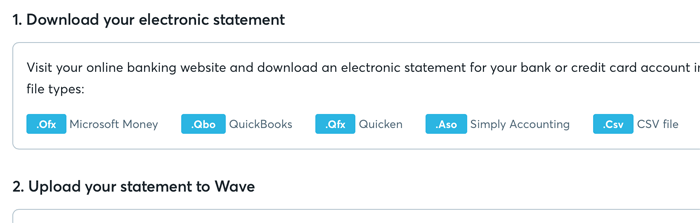

Wave can upload your statement in either Microsoft Money, QuickBooks, Quicken, Simply Accounting, or CSV file format. Top-right corner of your Transaction screen, there's a button that says "Upload a Bank Statement".

My prepaid card account unfortunately only allows me to download statement in PDF format. So I just have to manually type in one by one.

Then check each transaction and 'review' as explained in #1.

#3 Adding "Journal Transfer"

I'll give you 3 x examples where you transfer money from one account to another.

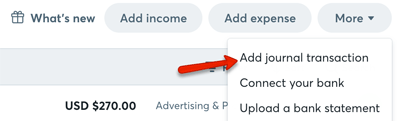

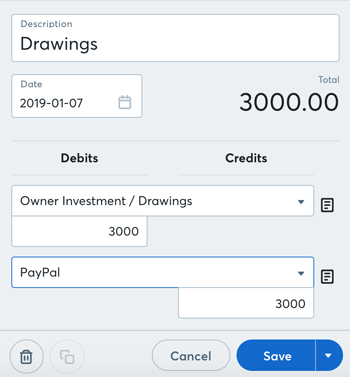

Still in the "Transaction" screen, firstly go to "More" in the top-right corner and click "Add journal transaction".

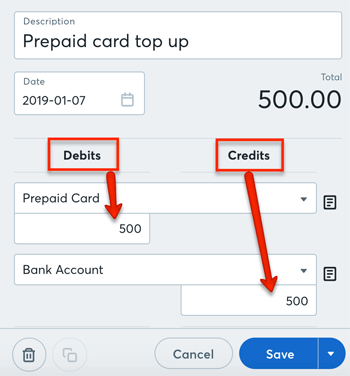

(1) Top up your prepaid card account from your (business) bank account

Prepaid card (debit card) needs to be topped up when the balance is low. And you physically make a wire transfer online, right? Here's how you record it.

For example you transferred $500 from your bank account to prepaid card account.

Remember this. In "balance sheet" - money in your accounts, Debit means Deposit, and Credit means Payment.

Just remember like a mantra. "D-D (Debit-Deposit)". So credit is the opposite of D-D, which is Payment.

Your bank account gave $500 to your prepaid card account. The prepaid card received a deposit of $500.

So the top line Debits should be "Prepaid Card" (choose from the dropdown menu), and enter 500. The bottom line should be "Bank Account", and enter 500.

Click save!

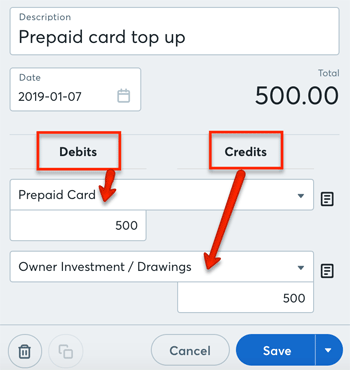

(2) Top up your prepaid card account from your personal bank account

Wave can actually record your whole personal account in a separate screen (you may have noticed), but I'll talk about it in another occasion - or you can work it out at a later date. For now I'll explain it simple.

You sent $500 from your personal bank account to your prepaid card by wire transfer.

The prepaid card account received a deposit (Debit-Deposit). So it goes on the top line. You paid from your pocket, that goes on the bottom line, and the category you're looking for is "Owner Investment/Drawings" - scroll right down the dropdown menu.

And click Save.

(3) Withdraw money from PayPal account and transfer to your personal bank account

Now you have some money in your PayPal account and you want to transfer $3,000 to your personal bank account. It's the money that you've earned, you can do anything you want. But it's being transferred out of your business account.

It's the other way round now - your personal account (Owner Investment / Drawings) receives $3,000 (Debit for Deposit). It goes on the top line.

PayPal pays out $3,000, so it goes on the bottom line.

And Save!

Reporting

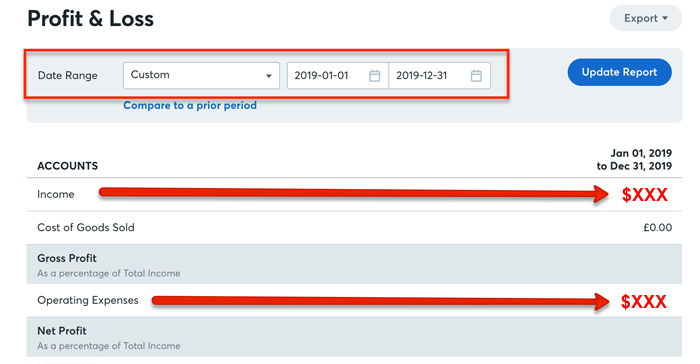

Now all your income and expenses are recorded, how much money you've made so far, how much you've spent and what your net profit is, can be checked at a glance.

Go to "Reports" in the left menu (towards the bottom), and click "Profit and Loss".

The screenshot above is just an example. I've set the date range from January 1 - December 31, 2019. You'll see the total of income, expenditure and the net profit for the year... That's your bookkeeping sorted!

Simply take the figure shown in "Income" line and "Operating Expenses" line and fill in your tax return form.

Accrual Basis or Cash Accounting Basis?

If you're wondering about "accrual basis or cash accounting basis"... I'll go with cash accounting basis here.

Accrual is where related period matters. If you pay for a December membership fee, it should be recorded in your December account regardless to the actual payment date - whether you pay in advance (November) or pay in arrears (January). This is how it should be.

But I'll take the cash accounting method. If you pay on January 5th, it's a January expense.

Bookkeeping For Affiliate Marketing

Like I mentioned in the beginning, this is not the complete accounts of your business - far from it, in fact. But at least it will indicate your profit or loss clearly throughout the year.

If you want to know a little more detail about it, debits/credits, gross/net profit, balance sheet... Any jargon clarifications... Don't hesitate to contact me or leave a comment below any time.

Thank you for this helpful information, Ray. I'll be having a DC the next day with an affiliate marketing agency, this is a huge help of information for my preparation. All the best!

Thank you Argelyn, I appreciate your positive comment! Any questions, don’t hesitate to get back to me at any time!

Hi Ray,

Thanks for the useful information.

Looking at starting affiliate marketing and setting a business account up to separate this from personal money, as advised.

Regarding buying affiliate training / resource such as eg Wealthy Affiliate, can this be offset as a business expense?

Hi Mike, yes of course. Training, resources/tools that you use, a guidebook to affiliate marketing, and anything that’s directly related to your new business can be treated as business expenses, offset against your income (=reduce your net profit, so you’ll pay less tax.) Any more questions don’t hesitate to get back to me. Thanks for your comment. Wishing you all the best in starting your affiliate business!

Great job, thanks. I was using spreadsheet and things were getting out of hand. Good to know about Wave app, I'll see how I get on.

Thanks Josh, appreciate your commment. Any problems or questions don’t hesitate to get back to me. I wish you all the best!

Quickbooks File Doctor is the best accounting software that makes the use of the Quickbooks tool hub to diagnose the files and treat as the doctor for the websites. Whereas The Quickbooks Diagnostics Tool is the software that just only make the use of the quickbooks software to diagnose the files and send the reports to the system to get it fixed.

Hi Nick, thanks for your comment. But the site looks awfully outdated, and it’s a third-party service company, unauthorized by Intuit Inc. who owns QuickBooks. I know QuickBooks is good software, particularly for a small business (I first used it over 20+ years ago!) the support is great, if I had a problem I’d get it fixed by them, not by a third-party company though.

Hello- aside from PayPal does Wave allow you to add other merchants like Stripe? Thanks so much for sharing all of your knowledge Ray.

Hi Lisa, yes it does! Wave integrates with Zapier app so you can add Stripe, Shopify, Square, etc. You can add them by one click, and Zapier is free up to 100 tasks (i.e. moving data) per month, which should be sufficient. Thank you for your comment, I wish you all the best!

Another question…

Why is a prepaid card necessary? PayPal Business accounts come with a card that you can use

Couldn’t you just receive payments to PayPal account and use PayPal card for business transactions? And transfer funds to personal account when needed and transfer person to business when needed?

Hi Hugo, thanks for your questions.

(1) about the home office expenses – it depends on how you claim your allowable expenses in your tax self-assessment form. ONLY if you do list up each item separately every year then by all means, it may be easier to create a dedicated category. But even if you work out your actual costs by calculating the proportion of personal and business use for your home (rather than claiming a flat-rate), if you don’t have to list it up on your tax form then, I would put them all in “ad hoc” category…for less risk of errors.

(2) PayPal debit card – Yes! You’re absolutely right, I use my PayPal debit Mastercard now, no extra charge which is good, plus 0.5% cashback which is even better! Thank you so much for your comments!

why don’t you create a section for home office deductions? Like rent, office supply, landline etc

Great post Ray.

You have not said anything about invoicing though. If you are into affiliate marketing, any income is considered as selling a marketing service. So, you should create and send an invoice to the affiliate network right? Can you elaborate on invoicing if you have some time?

Thanks

Hi Harris, thanks for your comment. Affiliate networks take a self-billing system and never require invoices from affiliates as far as I’m aware. The Wave app however can generate sales invoices very easy. I would suggest that you (affiliates) use the sales invoice feature only for medium-term debtors (people who pay in arrears / who don’t usually pay on time), so that the system will keep reminding you of the outstanding debt. But that would be very rare circumstances for affiliates. Any more questions don’t hesitate to get back to me. Thanks for your input!

Thanks a lot Ray for your reply.

One more question if you don’t mind. I live in Europe and my bank account is in EUR. I receive commissions from Amazon US in USD and the money automatically get transformed by my bank in EUR and get deposited in my account.

Which currency shall I issue the sale Invoice in such a case? In USD or in EUR? For bank reconciliation and accounting purposes I will need to show the exact EUR amount in my sale invoices right?

Any feedback will be greatly appreciated.

Harris

Hi Harris, thanks for getting back to me! I’m in the same position too, I’m from the UK and most of my commissions are in USD.

The Wave app allows multi-currencies, so what you do is to enter the amount in USD and also the exchange rate. The app automatically inputs today’s rate and converts it to EUR for you, but the rate can be different from your bank’s rate, so you need to manually enter the bank’s rate. There are several ways to do this;

————————————–

(a) If you reconcile your bank later…

1. When you receive a commission notification from Amazon ($10), you enter $10 as a receipt (it will convert automatically by today’s rate, 0.88593 = 8,86€)

2. When you reconcile the bank, you find out the actual amount that came in is 8,75€. You can simply change the exchange rate to 0.875.

————————————–

(b) If you really want to use a sales invoice feature…

1. When you receive a commission notification from Amazon ($10), raise an invoice to Amazon for $10 ((it will convert automatically by today’s rate, 0.88593 = 8,86€)

2. When you reconcile the bank, you enter a receipt of $10 against that invoice. Exchange rate as per bank’s (0.875).

3. It means your invoice is still partially outstanding by (8,86 – 8,75) = 0,11€.

4. This balance of 0,11 can be cleared, and it will be treated as a “Foreign exchange loss”.

————————————–

(c) I personally, simply pick it up from the bank statement because Amazon only pays once a month. If I see €8,75 from Amazon on my statement, I would put $10, exchange rate 0.875 in my Wave system.

————————————–

Sorry for the long reply, I hope it makes sense but if not, don’t hesitate to ask me again any time. Thanks Harris!

Wow Ray, I really appreciate you taking the time to answer everything. It makes sense now. You helped a lot !!

Thank so much

Harris

That’s great to hear! Thanks again for your visit & questions Harris, I wish you all the best!

I discovered this today and thought it would be a good solution as I need to send 60 emails with just slightly adjusted text in each. However, I also need to include a pdf attachment to the email. I get the error, “Can not send. Mail with stationery may not include attachments other than photos.

Thanks.

Sounds like a great app for Android user. Shame about not being able to send a PDF as an attachment though, considering many customers do want to keep their invoice in PDF format. Thanks for the info, I appreciate your input!

Very intriguing. I just leave everything to my accountant because I don’t want to make mistakes and be penalized. But I end up spending days & days to show all my records to him, it’ll be worth it if I can do all my book keeping by myself.

Hi Sergio, certainly the safest option is to leave tricky tax return to your accountant but from the cost saving point of view, there are no complicated income & expenditure transactions. It’s possible for you to manage your accounts all by yourself. Perhaps you can start trying now and see if something will work out for the next year’s return? Thanks for your comment.

It’s hard to get my head around this…think I need a training. Is there?

Hi Chappie, I know how you feel, there’s a lot to take in in the beginning. No, Wave doesn’t offer a training but offers help and support as much as they can. If you have any specific question, you can ask them directly (or ask me if you want) any time 🙂

Hi, does it apply to any parts of the world? You mentioned about tax filing but each country has a different system. I would like to know if I can use Wave for both my own tax and business. Thanks.

Hi Bharat, yes as you say, tax law varies from country to country and as for your business tax return, you need to claim it accordingly. If you’re not confident, you should employ an accountant and claim it on your behalf. But still this app will make it easier for both yourself and the accountant to ensure the accuracy.

Yes, if you click your business name (or your name) at the top-left corner, there’s a personal account option as well. That’s where you can switch from account to account. If you own more than one business, you can add from there. Thanks for your comment.