Are you ready to retire in style and make the most of your golden years? From financial planning to lifestyle choices, there is a multitude of online resources available to help you navigate this exciting transition.

As someone who took early retirement, I can say that I am very happy with my decision. Of course, early retirement requires careful financial planning. I made sure to save enough money to support myself and to invest my savings in a way that would provide a reliable source of income.

But despite the financial considerations, I am able to live life on my own terms, without the stress and pressure that comes with a full-time job. I have the freedom to explore new interests and to spend time with the people who matter most to me. More fulfilling, satisfying life; I’m grateful for the opportunity to enjoy my retirement years to the fullest. After all, life is too short not to enjoy it in style!

Did You Know?

- Retirement Savings: Approximately 64% of Americans are expected to retire with less than $10,000 saved, highlighting the need for better planning resources.

- Online Banking: Over 76% of Americans prefer using online banking, indicating a comfort level with managing finances digitally.

- Digital Literacy Among Seniors: As of recent years, around 73% of individuals aged 65+ are internet users, showing increased digital engagement among retirees.

- Use of Financial Advisors: About 33% of U.S. adults have used a financial advisor, with many turning to online platforms for advice.

- Retirement Planning Tools: 59% of future retirees use online calculators and tools to estimate their retirement savings needs.

What Are The Best Online Resources For Retirement Planning?

There are a plethora of online resources available to help you plan for your golden years. Here’s a list of some of the best online resources for retirement planning.

Social Security Quick Calculator

This site allows you to input your personal information and calculate an estimate of your future Social Security benefits. The Retirement Estimator is a great resource for getting a ballpark estimate of your future benefits and can help you determine how much you need to save for retirement.

Savings Fitness Worksheets

Another great online resource for retirement planning is the Department of Labor’s Savings Fitness Worksheets. The site provides you with a variety of tools and resources to help them plan for their retirement. You can create personalized savings goals, and track their progress towards those goals. Such as goals and priorities, financial documents checklist, calculating net worth, retirement saving, cash flow spending plan, and debt reduction. These are tips on how to save more money. It’s a good resource for anyone who wants to take a more proactive approach to retirement planning.

Other retirement/Investment Calculators

Numerous sites such as Vanguard and Fidelity Investments offer a variety of retirement calculators and investment tools. They have a wide range of services designed to help people save for retirement.

No matter what type of retirement planning resources you’re looking for, there is likely an online resource that can help. Before making any decisions about your retirement plan, I think it’s always best to speak with a qualified financial advisor. I know it may cost you a little, but it’s affordable, and they will help you ensure that you’re making the right decisions for your unique situation.

Did You Know?

- Social Security Benefits: Over 70% of retirees claim Social Security benefits online, reflecting trust in online government resources.

- Investment Apps: Around 45% of millennials use apps for investing, a trend likely to continue as they approach retirement age.

- Healthcare Resources: 65% of retirees consider online resources crucial for understanding Medicare and healthcare options.

- Retirement Community Searches: 82% of retirees looking for retirement communities start their search online.

- Online Financial Education: 78% of individuals believe online resources are valuable for improving their financial knowledge.

Will Online Retirement Calculators Really Help?

I think so. At least they’ll give you rough ideas of what it’s like to take early retirement. Here's how to get the most out of online retirement calculators:

Use multiple calculators

Retirement is a complex financial planning process. There is no one right way to calculate how much money you'll need in retirement. Using multiple calculators can give you a better idea of what to expect. Be sure to try different scenarios (such as retiring earlier or later than planned) to see how it affects your results.

Compare apples to apples

It means using the same input values (age, salary, investment portfolio balance, etc.) for each calculation. This will help ensure that you're getting accurate results that you can compare effectively.

Know what the inputs mean

Online retirement calculators use a variety of different input values. Make sure you understand what each value represents so that you can enter accurate information.

Consider other factors

Retirement calculators can give you a good estimate of what you'll need for retirement, but they don't consider all factors. Be sure to also consider things like inflation and market volatility when planning your retirement strategy.

Use the results just as a guide

Remember that online retirement calculators are just tools to help you plan for the future. The results are just a guide, not gospel truth. The actual amount you'll need in retirement may be different than what the calculator predicts.

Using online retirement calculators can be a helpful tool when it comes to planning for your future. Just remember that they are just estimates and should be used along with other tools as part of your financial planning process.

What Are The Top Retirement Destinations In The Us?

San Francisco

I’ve traveled and lived in many countries but America is without a doubt, the best country for me. If you are American, you know everything you need is there. If you want to stay active, there are plenty of options for golfing, hiking, and other outdoor activities. If you’re looking for a laid-back lifestyle, there are many beach towns and small cities that offer a slower pace of life.

And if you want to be surrounded by culture and history, there are several great choices in cities like Boston, New York, and San Francisco. No matter what your retirement goals are, there’s sure to be a perfect place in the USA.

Did You Know?

- Mobile Banking: 54% of consumers use mobile banking, with older generations increasingly adopting this technology for convenience.

- Retirement Webinars: 40% of pre-retirees have attended an online webinar or seminar on retirement planning.

- Digital Estate Planning: An increasing trend, 25% of adults have started using online services for estate planning and wills.

- Online Budgeting Tools: 67% of individuals use online tools and apps for budgeting and financial tracking.

- Financial Forums and Blogs: 58% of future retirees read financial blogs and forums as a part of their retirement planning strategy.

It's difficult to determine the single cheapest and safest place in the USA, as the cost of living and safety can vary widely depending on factors such as location, population density, and local economy.

That being said, some areas that are generally considered to be relatively affordable and safe include:

- Midwest cities: Places like Indianapolis, Columbus, and Kansas City offer a low cost of living and relatively low crime rates compared to other urban areas.

- Southern cities: Cities in the southern states, such as Nashville, Tennessee, and Raleigh, North Carolina, also tend to be relatively affordable and safe.

- Small towns: Many small towns throughout the country offer low housing costs and a slower pace of life, along with a strong sense of community.

Ultimately, it all depends on what kind of lifestyle you’re looking for, considering factors such as job opportunities, climate, and cultural amenities.

What Are The Top Retirement Destinations In Europe?

If not America, definitely Europe, I would say. The whole continent offers many great retirement destinations, each with its unique charms, attractions, and lifestyles. Here are some of the top retirement destinations in Europe:

- Spain: Spain is a popular destination for retirees, thanks to its sunny climate, beautiful beaches, and affordable cost of living. The country also boasts a vibrant culture and rich history, making it an attractive place to retire.

- Portugal: Portugal also offers a warm climate, friendly locals, and a laid-back lifestyle. The cost of living is relatively low, and there are many ex-pat communities in the country, making it easy to make new friends.

- France: Exquisite cuisine, rich cultural heritage, and beautiful countryside… While the cost of living in some areas can be high, there are many charming towns and villages throughout the country that are more affordable.

- Italy: Italy is a dream retirement destination for many people, with its stunning architecture, beautiful countryside, and delicious food. While the cost of living can be high in some areas, there are many affordable places to retire, especially in the south of the country.

- Greece: Greece is a budget-friendly retirement destination, with a warm/hot climate, stunning beaches, and delicious Mediterranean cuisine. The country also boasts a rich history and vibrant culture, making it an ideal place to retire.

The factors to consider are obviously the language to start with, then healthcare, and whether you can adapt to different customs.

Did You Know?

- Digital Retirement Advice: 30% of Americans are comfortable receiving retirement advice from robo-advisors or automated online platforms.

- Elderly Online Learning: 35% of people over 60 have taken an online course to learn more about retirement planning.

- Social Media for Financial Tips: 47% of Gen Xers use social media to get financial tips and advice, a habit they're likely to continue into retirement.

- Video Content: 65% of people prefer learning through video, including YouTube channels dedicated to retirement planning.

- Online Savings Accounts: High-yield online savings accounts have been adopted by 52% of savers, showing preference for online financial management tools.

- Retirement Blogs Readership: 60% of individuals planning for retirement follow at least one retirement-focused blog or influencer online for insights and tips.

How To Pick The Right Retirement Community For You

I’m not suggesting that you should move from where you are living now. As long as you have a good retirement community that supports you all the way, you shouldn’t be any happier than that!

When you’re ready to retire, the internet can be a great resource for finding the right retirement community for you. Here are a few tips for using online resources to find the perfect place to spend your golden years:

- Start by doing a general search for “retirement communities” in your desired location. This will give you a good starting point for exploring your options.

- Once you have a list of potential communities, visit their websites and take some time to learn about each one. Pay attention to things like amenities, activities, and overall atmosphere to get a feel for whether or not the community would be a good fit for you.

- Use online reviews to get an idea of what current and former residents think of the community.

- Reach out to the community directly and schedule a tour so that you can see firsthand what it’s like. This is the best way to get a true sense of whether or not a particular community is right for you.

Happy and Healthy Retirement

Not everyone who’s taken early retirement seems to enjoy their life fully. They may be happy and if they’re happy, it’s none of my business. But I have met some fairly young retired people (in their late 40s - 50s) who say they’re bored because of the financial strain or the health problem.

So to retire happy and healthy (mentally as well as physically), here’s my advice.

Start saving as early as possible

This is a no-brainer, you know the earlier, the better. If you wait until you're closer to retirement age, you'll need to save a lot more money each year to catch up.

Invest your money wisely

Retirement accounts like 401(k)s and IRAs offer tax breaks that can help you save more money for retirement. Investing in stocks, gold, and cryptocurrencies can also give you peace of mind.

Find what you really want to do

Retirement can actually be a challenging transition if you don't have a hobby or side hustle that you really enjoy. You can;

- Reflect on your passions and interests: Consider the things that you enjoy doing, whether it's a hobby, volunteer work, or a career. Think about how you can incorporate these interests into your retirement.

- Identify your values: Consider what is most important to you in life, such as spending time with family, helping others, or traveling. Your retirement goals should align with your values.

- Create a vision for your retirement: Visualize what you want your retirement to look like. Consider where you want to live, how you want to spend your time, and what kind of impact you want to make in the world.

- Explore your options: Research different retirement activities and lifestyle options, such as starting a new business, traveling, or volunteering. Attend seminars and events that showcase different retirement opportunities.

Stay healthy and active

Keeping your body and mind healthy will help you enjoy your retirement years more and reduce your healthcare costs down the road. Eating right, exercising, and getting regular checkups can go a long way toward keeping you healthy in retirement.

Stay connected and engaged

Social interaction is important for maintaining mental sharpness and emotional well-being in retirement. Join a club or volunteer group, take classes, or visit with friends and family often to stay engaged with the world around you.

Budget and plan for the future

Know how much money you can afford to spend each month so you don't outlive your savings. Anticipate major expenses like healthcare costs and plan for them accordingly.

Work Online a Few Hours a Day

Working online for a few hours when retired can be a good idea for several reasons. Because;

- It can provide a sense of purpose and fulfillment that retirees may miss after leaving their previous jobs. It can also provide a source of income or supplemental income to support their retirement lifestyle.

- You’ll have flexibility in terms of schedule and workload. Retirees can work from home and choose their own hours, which can allow them to balance work with other activities and interests.

- You’ll get opportunities for continued learning and skill development, which can help retirees stay mentally engaged and active.

The last thing you want is for your online work to become too stressful or interfere with your other happy activities. So don’t anticipate that you’ll be earning a substantial income regularly. Just consider it as an extra money source if lucky. Working online is a good way to enhance your retirement experience as long as it doesn't detract from it.

The Best Countries To Work In When Retired?

Deciding which country to move to when you retire is exciting. But it’s going to be a once-in-a-lifetime decision. You can’t afford to regret and move back at a later stage in life, though it’s not impossible, as you can imagine. So here are some factors to consider when making your decision:

- Cost of living: The cost of living can vary significantly from country to country. Consider your budget and compare the cost of living in different countries to determine which one is the most affordable.

- Quality of life: Quality of life is an important consideration when deciding where to retire. Look for countries that offer a high standard of living, good healthcare, and a safe environment.

- Climate: It’s another major factor in your decision because of global warming. Consider whether you can handle extreme temperatures, hurricanes, wildfire threats, etc.

- Language: Consider the language spoken in the country you are considering. If you do not speak the language, you may have difficulty adjusting to the culture and communicating with the locals.

- Culture: Consider the cultural differences between your home country and the country you are considering. Make sure you are comfortable with the cultural norms and customs of the country.

- Proximity to family and friends: Consider how far away you will be from family and friends. If you want to be close to them, consider moving to a country that is easily accessible.

- Visa requirements: Look into the visa requirements for the countries you are considering. Make sure you understand the process for obtaining a visa and the requirements for maintaining your residency.

- Accessibility to services: Consider the availability of services such as healthcare, transportation, and shopping. Make sure the country you choose can provide the services you need.

Here are some countries that may be worth considering:

- Mexico: Mexico is a popular destination for retirees, thanks to its warm climate and welcoming culture. But affordable cost of living means if you work online (and get paid in USD) it's a great place to live. The country also offers a wide range of job opportunities, particularly in the tourism and hospitality industries.

- Portugal: Portugal is another popular destination for retirees, offering a high quality of life, a mild climate, and a low cost of living, which again, makes it good if you work online. The country is also known for its relaxed pace of life and welcoming culture, making it a great place to work in retirement.

- Australia: A warm and sunny climate, high standard of living with a good healthcare system. Relatively safe, and plenty of outdoor activities you can enjoy. The cultural diversity is fantastic. The cost of living can be high, especially in cities which means your earnings can be high. For that reason, if you want to work locally, Australia can be a great candidate for you.

- Costa Rica: Costa Rica is known for its stunning natural beauty, warm climate, and friendly locals. The country offers a range of job opportunities, particularly in the eco-tourism and hospitality industries, and the cost of living is relatively low.

- Panama: Panama as as you know, beautiful beaches, and low cost of living. The country also offers a range of job opportunities, particularly in the finance and logistics industries.

- Spain: Spain offers a high quality of life, a warm climate, and a rich cultural heritage. The country also offers a range of job opportunities, particularly in the hospitality and tourism industries, making it a great place to work in retirement.

Keep researching so that you can live the life of your dreams during those final years!

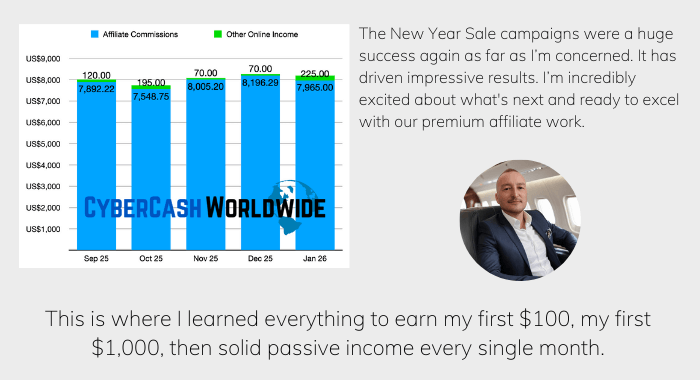

Affiliate Marketing For Retirement

Affiliate marketing can be a good option for retirees who are looking to earn some extra income online. Affiliate marketing involves promoting products or services offered by other companies and earning a commission on any sales that are made through your unique affiliate link.

One of the benefits of affiliate marketing is that it can be done from home and on a flexible schedule, which is ideal for retirees who may have other commitments or interests. It also doesn't require any upfront investment, as you don't need to create your own products or services.

To get started with affiliate marketing, you can search for affiliate programs in your niche or industry of interest. Many companies offer affiliate programs, and some popular platforms for finding affiliate programs include Amazon Associates, Clickbank, and ShareASale.

Once you've found a program that you're interested in, you can promote the products or services through your website, blog, social media accounts, or other channels. It's important to disclose that you are promoting affiliate products and to be transparent with your audience about your affiliate relationships.

While affiliate marketing can be a good way to earn extra income in retirement, it's important to approach it as a business and to put in the time and effort required to be successful. It's also important to be patient and to expect that it may take some time to see results.

I’m tired of these posts that make digital marketing seem so simple. They never mention the insane amount of competition, the constant algorithm changes, or the endless hustle it requires.

We do mention them, never simple like you say. Thanks for your comment.

Good article but I don't agree all of it. It becomes difficult as you get older to decide which destination to spend the rest of your life.

It's best to decide while you are still working then it's better when you know how much you have and how much pension you are going to get. Thanks for your post.

Thanks for your comment, appreciate it!

It’s best if you can retire though? Most people nowadays are having to work full time after 60-65 years old. Both my grandparents work and they are well over 60.