66% of Americans are concerned about their ability to maintain their current lifestyle in retirement, according to a recent study. There are a number of factors that can impact your retirement living standards, including inflation, investment returns, and healthcare costs. But there are also steps you can take to help ensure a comfortable retirement. I am going to share some of the things that can impact your retirement living standards and offer some tips on how you can help increase them.

What Are The Retirement Living Standards?

When you think about your retirement living standards, what comes to mind? Many of us, envision a life of leisure, travel, and spending time with family and friends. However, the reality is that most retirees have a limited income and must carefully budget their spending in order to make ends meet.

There are a number of ways to increase your retirement living standards, even if your income is limited, such as:

- Downsize your home. This can free up extra cash each month that can be used for other expenses.

- Live in a community designed for seniors. These communities often offer amenities such as fitness centers, swimming pools, and social activities that can make life more enjoyable.

- Consider working part-time during retirement. This can provide additional income to help cover costs and allow you to enjoy the things you love most.

How Does the Standard of Living Change in Retirement?

The standard of living for retirees tends to change, for example;

- Their expenses go down after they retire. This is because they are no longer working and have less need for things like work-related clothing and transportation.

- Their health costs go down after retirement. This is because they are no longer working and are no longer exposed to the stress of the workplace.

- Their social activities change after retirement. They may no longer be able to participate in the same activities as they did when they were working.

How to Increase Your Retirement Living Standards

There are several things you can do to increase your retirement living standards. Let’s take a look at four areas.

1. Review Your Expenses And Make Changes Where Necessary

If you want to get a handle on your finances, it is important to review your expenses regularly. This will help you to see where your money is going and identify any areas where you may be able to cut back.

It can be helpful to break your expenses down into categories, such as housing, food, transportation, and entertainment. Once you have a good understanding of how much you are spending in each area, you can start to make changes.

For example, if you find that you are spending a lot on restaurants and take-out food, you may want to cook more meals at home. Or, if you notice that you are spending a lot on clothes and shoes, you may want to consider shopping at second-hand stores or online consignment shops.

Making even small changes in your spending habits can add up to big savings over time. So, if you want to get your finances under control, be sure to review your expenses on a regular basis.

How Often to Review Your Expenses

Your expenses are always changing, so it's important to review them regularly and make changes as needed. Here's a quick guide on how often to review your expenses:

- Monthly: Review your bank statements and credit card bills to see where you're spending your money. Make sure all of your charges are accurate and that you're not being overcharged for any recurring payments.

- Quarterly: Take a look at your overall financial picture and see if there are any areas where you can cut back on spending. This is also a good time to reevaluate any subscriptions or memberships you have to make sure you're still getting value from them.

- Annually: Doing an annual review of your expenses is a great way to stay on top of your finances and make sure you're not letting any unnecessary costs creep into your budget. This is also a good time to update your insurance coverage and make sure you're getting the best rates possible.

What To Look For When Reviewing Your Expenses

When you're reviewing your expenses, there are a few things you should keep in mind.

#1 Consider your overall financial picture

Overall Financial Picture

Are you saving money each month? Are you paying off debt? These factors will influence how much you can afford to spend on discretionary items.

#2 Find out what you can cut back

Take a look at your regular expenses and see if there are any areas where you can cut back. For example, if you're spending a lot on dining out, consider cooking more meals at home. If you have a gym membership that you don't use often, consider cancelling it. Any little bit of savings can add up over time!

#3 Review your irregular expenses

Irregular expenses include things like travel, gifts, and entertainment. While these expenses are not necessarily bad, they can add up quickly if you're not careful. Try to set a budget for these items so that they don't get out of control.

By taking the time to review your expenses regularly, you can make sure that your spending aligns with your financial goals. By making small changes in your spending habits, you can save money each month and reach your financial goals even faster.

Ways To Trim Your Expenses

- Evaluate your current spending.

- Determine what expenses are necessary and which ones can be cut back on.

- Make a budget and stick to it.

- Automate your savings so that you always have money going into a savings account or investment account.

- Review your expenses regularly and make changes as necessary.

2. Take Advantage Of All Available Tax Breaks

There are a number of tax breaks available to taxpayers, and it can be difficult to keep track of all of them. However, taking advantage of all available tax breaks can save you a significant amount of money each year. Here are some of the most common tax breaks:

If you're looking to save on your taxes, there are a few tax breaks that you can take advantage of. Here are a few of the most common:

- The standard deduction. The standard deduction is a set amount that you can deduct from your taxable income.

- Itemized deductions. If your total deductions exceed the standard deduction, you may be able to itemize them on your tax return. This includes expenses such as medical bills, charitable donations, and home mortgage interest.

- Tax credits. Tax credits can reduce your tax bill dollar-for-dollar. Some common examples include the Earned Income Tax Credit, the Child Tax Credit, and the American Opportunity Tax Credit.

- Retirement account contributions. Contributing to a retirement account such as a 401(k) or IRA can help reduce your taxable income and potentially lower your tax bill.

- Self-employment taxes. If you're self-employed, you may be eligible for certain deductions such as business expenses and health insurance premiums.

Take advantage of tax breaks to lower your tax bill and keep more money in your pocket.

How to find out about new tax breaks

There are a few different ways that you can learn about new tax breaks.

- Simply stay up-to-date on tax law changes. This can be done by reading news articles, speaking with a tax professional, or taking a tax law course.

- Actively search for them. You can do this by using online search engines, visiting the IRS website, or contacting your state’s tax department.

- You can also sign up for email or RSS updates from the IRS or your state’s tax department. This way, you’ll be sure to receive timely information about any new tax breaks that may be available.

Also Read: What Are Your Retirement Goals?

3. Invest In Yourself By Taking Courses And Learning New Skills

Investing in yourself is one of the best things you can do for your future. There is always something new to learn, whether it’s a new skill for your job or interesting information for personal development. Even if you’re not working anymore, that doesn’t mean you should stop learning. In fact, taking courses and learning new skills can help you make the most of your retirement years.

The benefits of taking courses

According to the National Institute on Aging, mental stimulation can help reduce the risk of Alzheimer’s disease and other forms of dementia. Research has shown that people who engage in mentally stimulating activities have a reduced risk of cognitive decline.

Physical activity is important for maintaining physical health as we age. Taking courses and learning new skills can help you stay physically active. Older adults who are physically active have a lower risk of falls, arthritis, heart disease, stroke, type 2 diabetes, some types of cancer, and depression.

In addition to the physical and mental benefits, taking courses and learning new skills can also help you socialize with other people. Social interaction is important for maintaining good mental health. According to the National Institute on Aging, social isolation can lead to feelings of loneliness, anxiety, depression, and poor sleep. Staying socially connected can help reduce stress levels and promote overall well-being.

How to choose the right courses and learn new skills

With so many courses and learning opportunities out there, how do you choose the right ones?

i. Decide what you want to learn

There are endless possibilities when it comes to courses and learning new skills, so it's important to narrow down your focus. What are you interested in? What do you hope to achieve by taking courses and learning new skills? Make sure the courses you choose to align with your goals.

ii. Set a budget

Courses and learning materials can vary widely in price, so it's important to set a budget before you start shopping around. Once you know how much you're willing to spend, you can narrow down your options and find courses that fit within your budget.

iii. Research your options

You can find courses at community colleges, online providers, or even through private companies or organizations.

- Do some research online. There are a wealth of resources available at your fingertips when it comes to taking courses and learning new skills. Udemy is a great place to find courses at affordable prices. A simple Google search will reveal many different options, so take some time to explore what’s available.

- Check with your local community center or library. Many times these types of facilities offer classes and learning opportunities for people of all ages. It’s definitely worth checking out what they have to offer.

- If you know someone who has taken a course or learned a new skill that you’re interested in, ask them for their recommendations. They may have some great insights that you didn’t consider before.

iv. Consider your schedule

When choosing courses, make sure you can realistically fit them into your schedule. If you have other commitments like work or family responsibilities, make sure the coursework can be completed around those obligations.

Many courses are offered on a part-time basis, so you can still enjoy your retirement lifestyle while taking classes. And, many courses are offered at a discounted rate for seniors.

v. Don't be afraid to try something new

With so many different types of courses available, it's easy to find one that piques your interest. Trying something new can be a great way to expand your horizons and learn something completely different from what you're used to. It's never too late to invest in yourself and your future.

Taking courses and learning new skills is a great way to invest in yourself. By following these tips, you can choose the right courses and learning opportunities to help you achieve your goals.

4. Consider Working Part-Time During Retirement

Retirement is the perfect opportunity to start a new business or work part-time. Because;

- Again, you can help keep yourself mentally and physically active. You can also help you stay sharp and prevent cognitive decline.

- It can give you a sense of purpose and provide extra income. These activities can help stave off boredom and depression, which are common in retirement.

- It can provide valuable social interaction. This is especially important if you’re retired from a job that provided regular contact with others. Social interaction can help reduce stress, improve mental well-being, and promote longevity.

How to find the right part-time job or business venture

If you are not sure what skills and experience you can offer, there are plenty of online quizzes and skill assessments that can help you narrow down your strengths.

Once you know what you have to offer, start thinking about what kind of work or business would be a good fit. Do some research on industries and companies that interest you. If you're not sure where to start, look for job postings or businesses for sale in your local area. Not necessarily to find a job, but to get a good idea.

Another important consideration is how much time and energy you're willing to invest. Be realistic about how much you can commit. It's also important to think about how much income you want to generate. Consider your lifestyle and retirement goals to help determine an appropriate target earnings amount.

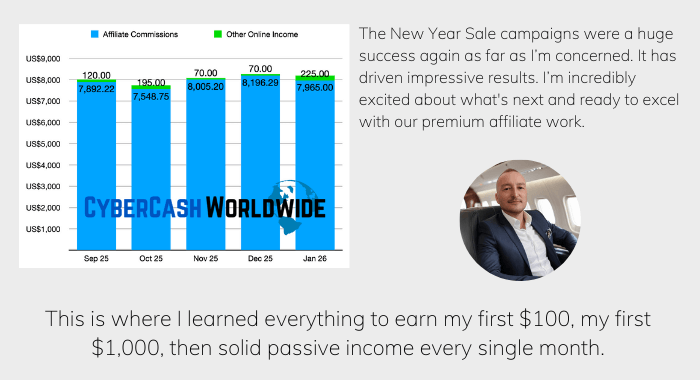

Start Affiliate Marketing Through Blogging

You may know affiliate marketing is one of the most popular ways to make money online. But affiliate marketing through blogging is actually the perfect way for retirees for a good reason.

Because the business model requires a low initial investment, many beginners try out using their spare time. However, soon they realize that there are only two ways to make it a success;

- Content marketing (blogging or YouTubing) which takes time, or

- By paying a lot of money to drive traffic to receive quick results.

Either way, you need to learn the techniques. Many beginners drop out within the first few months because they cannot afford to pay for the traffic, and they don’t have enough spare time to update blog posts.

So this is good news for retirees. Blogging can drive organic traffic, which means free. It requires you to keep writing blog posts while learning how to optimize for the search engines to pick up your blog site. But potentially, you’ll be able to start earning passive income without spending much money. Essentially, affiliate marketing gives you the opportunity to make money while you enjoy your retirement.

Other reasons you should start affiliate marketing are;

- You can choose to promote products that you are excited about and earn a commission on each sale that you make.

- You can blog about anything you want. As an affiliate marketer, you have the freedom to choose any topic or niche to write about. This allows you to blog about your passions and interests, which can make retirement living more enjoyable.

- You can work from home, or anywhere else that you have an internet connection, which means that you can travel and still earn an income.

- There are no set hours, so you can work as little or as much as you want.

- You can help others while making money. By sharing your affiliate links and reviews on your blog, you can help your readers find products and services they need while earning a commission on each sale. This is a great way to give back while still providing for yourself financially.

How To Get Started with Affiliate Marketing Blogging

i. Find a niche:

When it comes to blogging, niche matters. Pick a topic that you're passionate about and that you know there's an audience for. This will make it easier for you to produce content and market to potential customers or readers.

ii. Use WordPress:

There are many different blogging platforms out there, but WordPress is the most popular one in the world, and it will allow you to start your blog site for free. It’s easy to use and has plenty of resources available.

iii. Set up your blog:

Once you've opened your WordPress, it's time to set up your blog. This includes choosing a domain name, designing your blog's theme or template, and adding content. Start with something simple and build from there as you become more comfortable with the process.

iv. Promote your blog:

The final step is promoting your blog so people actually see it. The methods include; social media, paid to advertise, guest posting on other blogs, and submitting your site to directories.

With these tips in mind, you're ready to get started with affiliate marketing blogging. Remember to take things slowly at first and don't be afraid to ask for help if you need it. With time and effort, you can build a successful blog that brings in supplemental income.

How To Increase Your Retirement Living Standards: Conclusion

There are many ways to increase your living standards in retirement, and it ultimately comes down to finding what works best for you. Some retirees opt to downsize their homes, while others choose to take on part-time work or start a business. Others find that they can make do with a smaller nest egg by being strategic about their spending and investments. No matter what approach you take, be sure to keep your long-term goals in mind so that you can make the most of your retirement years.

THIS IS EYE OPENING. I APPRECIATE THE EXTENSIVE INFORMATION.

I AM RETIRED ALREADY BUT LOOKING TO MAKE EXTRA CASH SO I CAN HELP MY FAMILY LIVE MORE COMFORTABLY.

I CAN MAKE USE OF THE INFORMATION AS A REFERENCE.

THANK YOU.

JAMES PINNOCK.