Being a college student can be tough enough, but when you factor in the costs of tuition, books, and living expenses, it can be downright impossible to make ends meet. So here we are, some of the best ways to budget as a college student. From tracking your spending to creating a realistic budget, these tips will help you make the most of your money.

The 50/30/20 Rule

The 50/30/20 rule is a great way to budget for college students. This rule states that 50% of your income should go towards necessities like housing, food, and transportation, 30% towards debt repayments and savings, and 20% towards discretionary spending. The rule can help you make ends meet while still allowing you to enjoy your life.

To stick to this budgeting method, start by evaluating your income and expenses. Determine which expenses are necessary and which ones are optional. Once you have a clear understanding of your spending habits, you can start allocating your money accordingly.

If you find yourself struggling to stick to the 50/30/20 rule, there are a few things you can do to make it easier.

- Try automating your savings so that you don't have to think about it.

- Set up reminders or alerts to help you stay on track.

- Be willing to make sacrifices in order to stay within your budget. Cut back on nights out with friends!

By following the 50/30/20 rule, you can ensure that your finances are in order while still being able to enjoy your college experience.

Setting up a Budget

- The first step is to figure out what your income is and where it comes from. This may include money from a part-time job, financial aid, or parental support.

- Next, list your fixed expenses, such as tuition, rent, and utilities.

- Then, list your variable expenses, such as food, transportation, and entertainment.

- Finally, calculate how much money you have left over each month after paying your bills. This can be used for savings or to cover unexpected costs.

If you are not sure where to start, there are many online resources that can help you create a budget. You can also talk to a financial advisor for more personalized assistance. Creating and sticking to a budget can be challenging, but it is worth it in the long run. It will help you make the most of your money and avoid financial problems down the road.

Tracking Your Expenses

Track your expenses by keeping a running tally of what you spend each month, or by using a budgeting app or software. This will help you see where your money is going and make adjustments to ensure that you are staying within your budget. It can also help you identify areas where you may be able to save money.

Get A College-Specific Debit Or Credit Card

A college-specific debit or credit card is often beneficial because of some rewards on spending or discounts on some partnered brands’ products. But still, there are a few things to consider before you apply for one;

- Fees associated with the card. Many cards have no annual fee, but some do. Make sure you know what the fees are before you choose a card.

- The interest rate on the card. Many cards have low-interest rates, but some do not. If you carry a balance on your card, you'll want to choose a card with a low-interest rate so you don't end up paying more in interest than you have to.

- Rewards offered by the card. Many cards offer rewards such as cashback or points that can be redeemed for travel or other purchases. Choose a card that offers rewards that fit your spending habits and needs.

- Customer service offered by the issuer of the card. You'll want to choose a company that is easy to work with and has good customer service in case you have any problems with your card.

Establish A Good Relationship With A Financial Institution

It's important to establish a good relationship with a financial institution. This will help you manage your money and make budgeting for college easier. Here are some tips on how to do this:

- Shop around for the right financial institution. There are many options out there, so take your time to find one that meets your needs.

- Research the fees associated with different accounts. You don't want to be surprised by hidden fees down the road.

- Consider opening a checking and savings account at the same time. This can help you keep track of your finances and reach your savings goals more quicker.

- Make sure you understand the terms and conditions of any account you open. This includes things like minimum balance requirements and interest rates.

- Keep an eye on your credit score. This is important for both getting approved for loans and getting the best interest rates possible.

Open A Checking And Savings Account

Opening a checking and savings account will allow you to have a place to put your money that is separate from your spending money. You can use your savings account to help pay for books, tuition, and other expenses. You can also use it to save up for a car or an apartment. If you have a checking account, you can use it to pay bills and keep track of your finances.

Invest In A Budgeting App

There are many budgeting apps available, so do your research to find one that works for you. Once you have the app, set up a budget and track your spending. This will help you stay on top of your finances and avoid overspending.

A budgeting app can be a valuable tool for college students who are trying to manage their finances. By tracking your spending, you can see where your money is going and make adjustments to ensure that you are staying within your budget. This can help you avoid debt and financial difficulties down the road.

Use Cashback Apps To Your Advantage

If you are a college student, then you know how important it is to save money. Every penny counts when you are trying to make ends meet. One way that you can save money is by using cashback apps. There are a few different cashback apps that you can use, but the two most popular ones are Ibotta and Rakuten Rewards.

Ibotta is a great cashback app because it offers cashback on items that you purchase at grocery stores, pharmacies, and even online retailers. All you have to do is upload your receipt after you purchase an item and Ibotta will give you cash back. For example, if you spend $100 at the grocery store, you may get $5 back from Ibotta.

Rakuten Rewards is another great cashback app that offers cash back on online purchases. Founded as Ebates originally in 1998 and since then, it partners with thousands of retailers and offers cash back on your purchases.

Both of these apps are great ways to save money on everyday purchases. If you use them both, you could potentially save a lot of money each month.

Get Creative With Funding Sources

If you find yourself short on cash, look into other options like student loans, crowdfunding, or private scholarships.

Make Extra Money From Home

You probably know by now that there are a lot of ways to make extra money from home. You can start a blog and sell advertising, work as a freelance writer or editor, do some consulting work, or even teach online classes. The great thing about it is that you can set your own hours and work as much or as little as you want. And, if you’re willing to put in the effort, you can make a decent income.

Affiliate Marketing

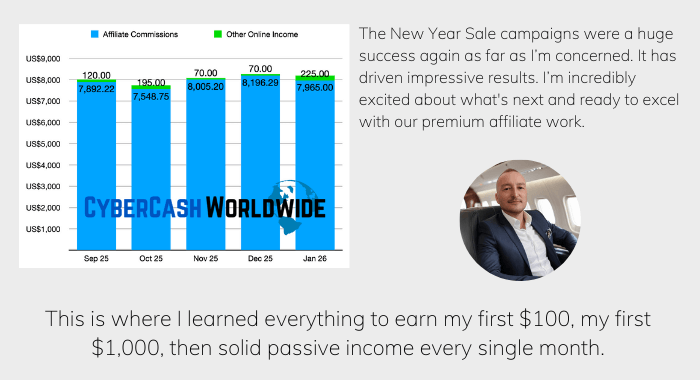

Affiliate marketing is a pretty decent way to make extra money online. You can find affiliate programs for just about any product you can think of, and there are many ways to promote them.

For example, you could start a blog about a particular product and include affiliate links in your posts. Or, you could create a resources page on your website with helpful reviews and links to products or services you recommend. Or promote affiliate products through social media or email marketing. Whatever method you choose, just be sure to put in the time and effort needed to drive traffic and generate sales.

Why Should College Students Get Involved In Affiliate Marketing?

There are a few key reasons why college students should get involved in affiliate marketing.

- Obviously, some extra money.

- It will help you develop valuable skills. Marketing is an essential skill in today’s business world, and affiliate marketing will give you real-world experience.

- Affiliate marketing can be fun. If you choose the right products to promote, you can enjoy yourself while making some money.

How To Get Started

Here's a quick overview on how to get started:

- Find a niche: The first step is to find a niche that you're interested in. This can be anything from fashion to technology to travel.

- Research affiliate programs: Once you've found a niche, research affiliate programs that operate in that space. Look for programs that offer good commissions and have products or services that are relevant to your niche.

- Sign up for an affiliate program: Once you've found a couple of good affiliate programs, sign up for them and create your account.

- Promote your affiliate links: The next step is to start promoting your affiliate links. You can do this by writing blog posts, creating social media content, or even running ads.

- Build a list of subscribers: and promote products to them on a regular basis.

- Track your results: Be sure to track your results so you can see what's working and what's not. This will help you fine-tune your strategies and make more money in the long run.

A couple of things to keep in mind when embarking on an affiliate marketing campaign will be;

- Choose your affiliate products carefully. Make sure you are promoting products that you believe in and that would be of interest to your peers.

- Build up a strong social media presence before you start promoting any products. This will give you a good platform to share your affiliate links and product information with potential customers.

How to Budget for College Students: Conclusion

Making a budget for college can be a daunting task, but it's one that's well worth the effort. By taking the time to plan and research your options, you can find ways to save money on tuition, books, and other expenses. And, by sticking to your budget, you can avoid going into debt and putting yourself in a difficult financial situation. If you're a college student who wants to get ahead financially, start by making a budget and following these simple tips.