Investing money can be daunting when you're trying to decide between two different types of investments. Gold and stocks are both popular investment options with their unique advantages and disadvantages. I invest in both, so I will share my experience of how I manage between the two.

Some strategies have helped me maximize the potential return from each type of investment while minimizing risk, although there is no magical solution.

But I can at least share my insights into how I evaluate market conditions to determine which asset class is more suitable for any given time period. Hopefully, you can use these same principles to manage your own investments responsibly. So read on.

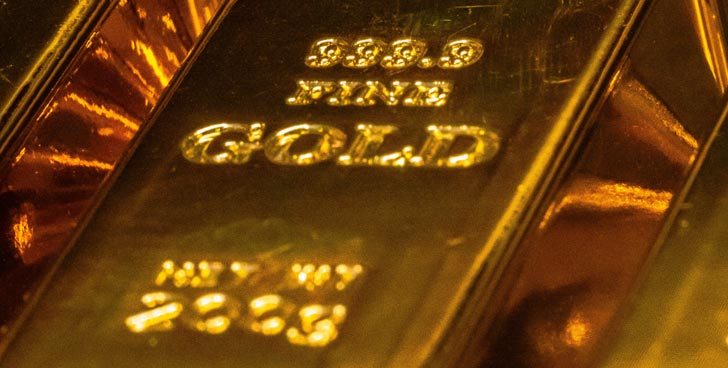

Gold as an Investment

Gold has always been considered a safe haven investment due to its ability to retain value over time. Unlike stocks, gold is not affected by inflation or economic downturns.

One of the main advantages of investing in gold is that it provides protection against currency devaluation. When paper money loses its value, as it often does during times of economic uncertainty or political instability, the price of gold tends to rise. This makes gold an effective hedge against inflation and other macroeconomic risks.

Another advantage of investing in gold is that it offers diversification benefits for investors who want to reduce their exposure to traditional asset classes such as stocks and bonds. Gold has a low correlation with these assets, which means that adding some exposure to this precious metal can help reduce overall portfolio risk.

However, there are also some drawbacks associated with investing in gold. One major disadvantage is that, unlike stocks or bonds, gold does not generate any income on its own. It's purely a speculative investment whose value depends entirely on market demand and supply dynamics.

Despite these limitations, many investors still consider gold an important component of their investment portfolios due to its unique properties and diversification benefits. Whether you choose to invest directly in physical bullion or through exchange-traded funds (ETFs), make sure you understand the risks and opportunities associated with this asset class before making any decisions about your investments.

Stocks as an Investment

Stocks are a popular investment option for those who want to grow their wealth over time. When you buy stocks, you’re essentially buying ownership in a company. As the value of the company increases, so does the value of your share.

One benefit of investing in stocks is that they have historically provided higher returns than other types of investments such as bonds or savings accounts. However, it’s important to note that past performance doesn’t guarantee future results.

Another advantage of investing in stocks is that there are many different companies and industries to choose from. This allows investors to diversify their portfolios, meaning spread out their risks. When one share is losing, you have other winning shares to cover that loss.

When selecting individual stocks, it’s important to do your research and consider factors such as the company's financial health, management team, industry trends, and competitive landscape. Alternatively, investors can also invest in mutual funds or ETFs which offer exposure to a diversified selection of stocks.

One potential downside of investing in stocks is that they can be volatile and subject to market fluctuations. It's not uncommon for stock prices to rise or fall based on news events or changes in the broader economy.

While investing in stocks carries some risks, it can also provide significant long-term growth opportunities for those willing to do their due diligence and stay committed through market ups and downs.

Pros and Cons of Gold vs. Stocks

As you know by now, investing in gold and investing in stocks are two different approaches and they both come with their own set of pros and cons. Here's a summary of the key factors to consider when comparing the two:

Pros of Investing in Gold:

- Safe-Haven Investment: Gold is often seen as a safe-haven investment during times of economic uncertainty or inflation, providing a store of value that can protect against currency devaluation.

- Tangible Asset: Gold is a physical asset that can be held and stored, which can provide a sense of security in times of market volatility.

- Diversification: Gold has a low correlation with other asset classes like stocks and bonds, making it a good option for diversification in a portfolio.

- Global Acceptance: Gold is accepted worldwide as a valuable commodity, providing a level of liquidity that makes it easy to sell and convert into cash.

Cons of Investing in Gold:

- No Cash Flow: Gold doesn't generate income or dividends, so investors rely solely on price appreciation.

- Limited Industrial Use: Gold's industrial uses are limited compared to other metals, which means that demand is primarily driven by investment demand rather than by supply and demand factors in the industrial sector.

- Volatility: Gold prices can be highly volatile and subject to rapid price fluctuations, making it a risky investment.

Pros of Investing in Stocks:

- Long-Term Growth Potential: Historically, stocks have provided higher returns than gold over the long term, providing the potential for capital appreciation and dividend income.

- Diversification: Investing in stocks provides exposure to a wide range of industries and companies, which can help to reduce portfolio risk.

- Liquidity: Stocks are easily bought and sold on public markets, providing high levels of liquidity.

- Innovation: Investing in stocks provides the opportunity to participate in innovative companies and industries, which can provide high growth potential.

Cons of Investing in Stocks:

- Market Volatility: Stock prices can be highly volatile, subject to changes in company performance, economic conditions, and other factors.

- No Guarantee of Returns: There is no guarantee that stocks will provide positive returns, and investors can lose money.

- Complexity: Investing in stocks requires research and analysis to identify quality companies with strong growth potential, which can be time-consuming and challenging.

- High Risk: Investing in individual stocks carries high risk, as the performance of a single company can have a significant impact on overall portfolio returns.

Your Investment Goals

Investment goals can be different between gold and stocks, as each asset class has its own unique characteristics and investment purposes.

Gold is often used as a hedge against inflation and a store of value during times of economic uncertainty. Investors who are looking for a safe-haven asset to protect against market volatility and currency devaluation may choose to invest in gold. Gold is also used as a portfolio diversifier because it tends to have a low correlation with other assets such as stocks and bonds.

Stocks, on the other hand, are generally used for long-term growth and income generation. Investors who are willing to take on more risk in exchange for higher potential returns may choose to invest in stocks. Stocks offer the potential for capital appreciation, dividend income, and the ability to participate in the growth of companies and industries.

Additionally, the investment goals for gold and stocks may differ depending on the economic environment. In times of economic expansion and growth, stocks may be more attractive to investors seeking high returns. In times of economic recession or instability, gold may be more attractive to investors seeking a safe-haven asset.

Risk Tolerance

Gold is often considered a less risky asset compared to stocks, as it tends to be less volatile and less susceptible to market fluctuations. Gold is often seen as a safe-haven asset that can provide a hedge against inflation and economic uncertainty.

Stocks, on the other hand, are generally considered to be higher-risk investments, as they are more susceptible to market fluctuations and company-specific risks. Stocks offer the potential for higher returns than gold over the long term, but they also carry a higher degree of risk.

Therefore, an investor's risk tolerance can play a significant role in determining their allocation between gold and stocks. Investors with a lower risk tolerance may choose to hold a higher percentage of gold in their portfolio to provide stability and diversification. Investors with a higher risk tolerance may choose to hold a higher percentage of stocks in their portfolio to potentially benefit from higher returns over the long term.

Time Horizon

The time horizon refers to the length of time an investor plans to hold an investment before selling it.

Gold is often viewed as a long-term investment, as it is typically held as a store of value and a hedge against inflation and economic uncertainty. Investors who hold gold often do so for years or even decades, as it can provide a reliable and stable source of value over the long term.

Stocks, on the other hand, are often considered to be long-term investments, but they can also be suitable for short-term trading. Investors who plan to hold stocks for the long term may benefit from the potential for capital appreciation and dividend income over time. However, investors who plan to trade stocks in the short term may be more focused on capitalizing on short-term price movements.

How to Manage Both Investments

So is it best to buy both gold and company stocks? In very short, generally, yes. By holding a combination of gold and stocks, investors can potentially benefit from the diversification benefits of both asset classes. Gold can provide stability and a hedge against economic uncertainty, while stocks can provide long-term growth potential and exposure to innovative companies and industries.

- Diversify your portfolio by investing in different types of assets. This will help you reduce the risk of losing all your money at once. Allocate a percentage of your funds into gold and another percentage into stocks depending on your financial goals.

- Keep track of market trends and economic indicators that affect stock prices and gold values. It's vital to stay informed about global events such as political instability or natural disasters that could impact the markets significantly.

- Consider using exchange-traded funds for both gold and stock investments instead of purchasing individual stocks or physical gold bars. ETFs provide better liquidity than holding physical commodities while also providing exposure to fluctuations in commodity prices.

- Regularly review and rebalance your portfolio according to market trends and changes in personal circumstances. A balanced portfolio helps mitigate losses during periods when one asset class is underperforming while others are flourishing.

The Price Indicators

The indicators of gold prices and share prices can be quite different since gold is a physical commodity and stocks represent ownership in a company. Here are some of the key indicators for both:

Indicators for Gold Prices:

- Supply and demand: The amount of gold being produced and the demand for it will affect its price.

- Interest rates: When interest rates are low, the demand for gold increases as it becomes more attractive relative to other investments. Conversely, when interest rates rise, gold may become less attractive as an investment and demand may decrease.

- Inflation: If inflation is expected to rise, investors may turn to gold as a hedge against inflation.

- Currency fluctuations: The price of gold is often affected by currency fluctuations, particularly the strength of the US dollar. If the dollar weakens, gold may become more attractive to international investors and demand may increase.

- Geopolitical events: Political instability and global events such as trade disputes or conflicts can also have an impact on the price of gold. Investors may turn to gold as a safe haven during times of uncertainty.

Indicators for Share Prices:

- Earnings: The earnings of a company will affect its share price. If a company is performing well and generating profits, investors will typically be willing to pay more for its shares.

- Valuation metrics: Valuation metrics such as the price-to-earnings ratio can provide insight into whether a stock is overvalued or undervalued relative to its earnings.

- Economic indicators: Economic indicators such as GDP growth, inflation, and interest rates can impact the stock market as a whole and the performance of individual companies.

- Market sentiment: Market sentiment, or the overall mood of investors, can also impact share prices. If investors are optimistic about the future, they may be more willing to invest in stocks, potentially driving up share prices.

- Industry-specific factors: Industry-specific factors such as regulation, competition, and technological developments can also have an impact on the performance of individual stocks.

These indicators are not a guarantee of future performance, and predicting the future price of gold or the performance of individual stocks can be challenging. It's generally recommended that investors take a long-term view and focus on building a diversified portfolio that aligns with their investment goals and risk tolerance.

Gold vs. Stocks: Which is the Better Investment

If you haven’t started investing any money in either of gold or stocks, which is a better option to buy?

It’s definitely gold right now. In fact, the price of gold is steeply rising, you should buy some as soon as you can. This is because many experts say that it’s the end of petrodollars. The term 'petrodollars' refers to the money that oil-producing countries earn from selling their crude oil.

The world is entering a new era where more countries agree to trade oil without relying on petrodollars to remain competitive. US Dollars are losing value, which is pushing up our inflation rates steeply. When inflation rates climb too high, many companies will be unable to keep up with the rising cost and eventually collapse.

As the global economy continues to be volatile and uncertain, investors are shifting their interest away from regular currencies and towards more tangible assets such as precious metals. Investors now see these metals as a much safer alternative than traditional fiat currencies which cannot always be trusted in an increasingly unstable market environment.

For that reason, buying gold is better to protect your wealth for now.

How to Manage Gold and Stock Investment: Wrapping Up

After analyzing the pros and cons of investing in gold versus stocks, it is clear that both have their advantages and disadvantages. Gold is a safe haven investment that can protect your portfolio against inflation and economic uncertainty, while stocks offer higher potential returns over the long term.

The key to managing both investments successfully is diversification. By spreading your money across different asset classes, you can reduce risk and increase your chances of achieving your financial goals.

You must already know that whether you choose to invest in gold or stocks (or both), it's important to approach investing with a long-term mindset. The market will inevitably fluctuate over time, but if you stay committed to your strategy and make informed decisions based on solid research and analysis, you can build wealth over time.

Remember: Investing comes with risks. Always consult with a financial advisor before making any investment decisions.

How I "Finally" Make Over $7,000 Monthly Income

"The most valuable thing I've ever done!"