To me, financial planning for semi-retirement is a blend of logic, fun, and a pinch of adventure. It's about making choices that not only ensure a comfortable life but also sprinkle it with joy and surprises.

After all, semi-retirement is a special chapter, and you know what? With a bit of planning, it could be a splendid one for you.

Mapping Out the Budget

When I first thought about sliding into semi-retirement, I grabbed my favorite notebook and pen and started scribbling down numbers. How much did I spend on groceries, fun activities, and those surprise expenses?

Knowing what I spend made me understand how much I'd need. And doing this from home? It's peaceful! No outside distractions, just me, my thoughts, and my trusty calculator.

Why it's great for working from home: Convenient Access to Financial Documents

At home, you can easily pull out your utility bills, bank statements, or credit card bills.

Example:

Say, in March, you spent $500 on groceries, $100 on utilities, $150 on entertainment, and $250 on miscellaneous expenses. By April, you realized you were spending too much on entertainment, so you cut it down to $50. That’s a savings of $100, just by reviewing and adjusting from the comfort of home!

Investing Smartly

I've always been a bit wary of the stock market and all that jazz. But I realized that having my money just sitting in a bank account might not be the best move. I spent some cozy evenings at home, wrapped in a blanket, learning about simple investment options. With a cup of tea in hand, I made a few choices that now make my money work for me.

Why it's great for working from home: Research At Your Own Pace

With online platforms, you can study investments at a pace that suits you, without the pressure of external factors.

Example:

Suppose you had $10,000 sitting in a savings account with an interest rate of 0.5%, earning you $50 a year. After some home research, you invest in a diversified fund with an average annual return of 5%, now giving you a potential return of $500 annually.

Cutting Unnecessary Costs

One day, while sorting through old boxes (thanks, home cleaning spree!), I found receipts for things I barely used. It hit me that maybe I could cut back on some expenses. Do I need that magazine subscription or the premium cable package? It felt good to trim the fat and watch my savings grow.

Why it's great for working from home: Tangible Overlook on Possessions

Being constantly in your living space allows you to see what items or services you use and which ones you don't.

Example:

Imagine you have a gym membership costing $40/month, but you’ve started enjoying home workouts. Canceling that unused membership saves you $480 annually.

Earning On The Side

Semi-retirement doesn't mean no work at all. I found joy in doing little gigs from home. Whether it's tutoring, selling crafts online, or freelance writing, these small earnings add a nice cushion to my savings. And the best part? I get to choose when and how much I work.

Why it's great for working from home: Flexible Work Hours

You decide when you work, which can lead to better productivity and job satisfaction.

Example:

Let's say you pick up a freelance project that pays $20/hour. If you dedicate just 5 hours a week, you could earn an extra $100 weekly, totaling $5,200 a year!

Preparing for Healthcare

I didn’t want a surprise medical bill shaking my budget. So, from the comfort of my living room, I researched and picked a health plan that suits my needs and won't break the bank. A win-win in my books!

Why it's great for working from home: Decision Making

At home, you can spend uninterrupted time comparing health plans, ensuring you get the best deal for your needs.

Example:

By spending time researching, you find a plan that covers your needs for $300/month, while another similar plan costs $350/month. That’s a potential savings of $600 annually.

Building a Safety Net

After chatting with some pals who are also on the semi-retirement train, I realized setting aside some money for unexpected events is smart. So, every month, a bit goes into my “rainy day” fund. It’s comforting knowing I've got a backup.

Why it's great for working from home: Focused Financial Reflection

You have the peace and space to contemplate your financial trajectory and make adjustments accordingly.

Example:

After reviewing your budget, you decide to set aside $200 each month for unexpected expenses. By the end of the year, you’ve saved $2,400. So, when an unexpected $1,500 expense comes up, you're ready!

Planning finances for semi-retirement is like piecing together a jigsaw puzzle. Each piece, each decision, brings the bigger picture into focus. And doing it from my home? It’s been a blend of comfort, convenience, and a whole lot of cozy. Cheers to making choices from the coziest spot in town – our homes!

How Much Do You Need To Semi-Retire?

Ever had one of those moments where everything just clicks? That's what happened to me when thinking about semi-retirement. I always wondered, "How much money do I need coming in before I take the plunge?" Let me share my journey to that magic number.

To comfortably semi-retire, I'd need about $3,000 a month. Here's how I broke it down.

The Coffee Cup Budgeting Method

I started with my trusty notebook and favorite coffee cup. Every morning, I'd jot down my monthly bills, occasional expenses, and those special treats (like that trip I always dreamed of). Over time, a pattern emerged. The numbers weren't just digits anymore; they painted a picture of the lifestyle I hoped to maintain.

With my steaming coffee in hand, I listed:

- Monthly utilities: $150

- Groceries: $400

- Rent: $1,200

- Transportation (gas, occasional repairs): $200

- Internet & Phone: $100

- Health insurance & meds: $300

- Entertainment & eating out: $250

- Miscellaneous expenses: $200

Total: $2,600

Regular and Substantial - What's That?

"Regular" for me meant money I could count on. Think pension, rent from a property, or even part-time work. "Substantial" was trickier. How much was enough? To figure it out, I compared my dream lifestyle expenses with the regular income I expected. The closer they matched, the more confident I felt.

I had some income streams in mind:

- Pension: $1,500

- Rent from a property: $1,000

- Part-time work: $750

Total monthly income: $3,250

This left me with a surplus of $650 every month.

Unexpected Surprises and Rainy Days

Life loves to toss in a curveball or two. So, on top of my regular expenses, I added a little extra. Think of it as my "just in case" fund. Car repairs, unexpected medical bills, or a surprise gift for my granddaughter - this fund made sure little bumps didn’t turn into big hiccups.

With my surplus, I decided that $350 would go into my "just in case" fund. This would help me handle any unexpected surprises.

Fun and Dreams Matter Too!

Semi-retirement isn't just about making ends meet; it’s about enjoying life too! I set aside a portion for fun stuff – maybe a pottery class, a weekend getaway, or those fancy gourmet chocolates. After all, this chapter of life is also about rewarding oneself.

The remaining $300 from the surplus? That's for the fun stuff! This could be a spa day, a short trip, or a fancy dinner out.

Seeking a Little Guidance

I'll admit, numbers aren't my only strength. So, I had a chat with a friendly financial advisor. They didn’t give me a one-size-fits-all answer but guided me in fine-tuning my calculations. Their perspective helped me feel more secure about my decision.

My financial advisor took a look and suggested I consider annual expenses too, like property taxes or big trips. Let’s say these add up to $3,600 a year, or $300 a month. With that in mind, I'd use the surplus to cover these costs, leaving me breaking even each month.

The Magic Number... Is Personal

Here’s the thing: there isn't a universal magic number that suits everyone. Yours might be different from mine. And that’s okay! For me, the magic number was when my regular, substantial income matched my desired lifestyle (with a bit extra for surprises). When these two danced in harmony, I knew I was ready.

In my case, the magic number was $3,250, covering all expenses with a small buffer for unexpected costs. But everyone’s magic number will look a bit different. Some might be higher, some lower.

Finding your balance makes the journey into semi-retirement smoother and sweeter. And while it takes a bit of math, once you've got your number, the peace of mind is priceless.

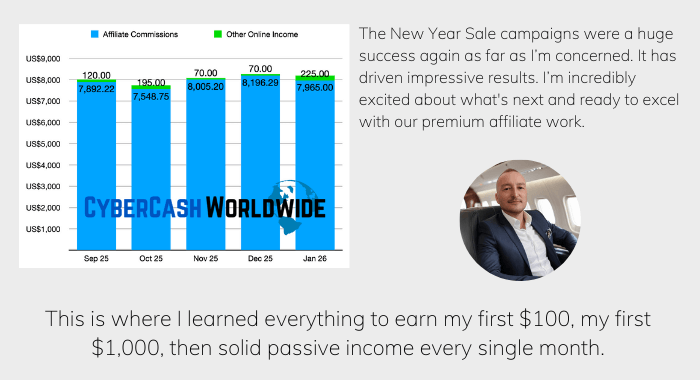

Affiliate Marketing - How Much Should You Earn?

So when you semi-retire and start working as an affiliate marketer, how should you plan your target income? You may ask.

Like many, I had hopes of decent income, but I quickly learned that the earnings can be as diverse as the world of affiliate marketing itself. Setting a target wasn't straightforward, but here's my take based on my experience.

1. Cover Your Monthly Subscriptions

When I began, my initial goal was modest: Cover my Monthly Subscriptions. I have streaming services, online magazines, and some software tools that total about $100 a month.

So I set that as my first milestone. When I achieved this, the satisfaction of having these comforts paid for through passive income was a significant morale boost.

2. Cover Extra Costs, Then Cover Bills

Then, I aimed higher: A Nice Dinner Out Each Week. Now, I love trying out new places in town, and a good meal can set me back about $50. So, I set my next monthly target at an additional $200.

As my confidence grew, I decided to push myself a little more. I wondered if affiliate marketing could cover a portion of my Monthly Rent. With my rent being $1,200, I aimed to cover half. This was a big leap, and it took a lot more effort in terms of content creation and marketing strategies, but the thought of shaving $600 off my monthly expenses was too tempting.

Over time, as I refined my approach, stayed consistent, and expanded my niches, my monthly earnings began to fluctuate between $900 to $1,500. There were months where it soared due to a viral post or an exclusive partnership, and months where it was on the lower end.

3. Scale Up

Today, when someone asks me how much they should target to earn from affiliate marketing, I share my journey and say this: "Start small. Set incremental goals. Celebrate each milestone, no matter how minor. And always keep refining your approach."

Your target should reflect your needs, your efforts, and your aspirations. Remember, affiliate marketing isn't a get-rich-quick scheme, but with patience and persistence, it can provide a tidy sum to complement your primary income.