Are you prepared for unexpected expenses that may arise? You do need a separate account that you set aside money in to cover in case of emergency; a job loss, car repair, home appliances breakdown, medical bill, etc. Most experts recommend that you have 3-6 months of living expenses saved in your emergency fund, but does it sound realistic to you?

I think it's very unhelpful advice. Because it does seem like hell of a lot, but it will give you peace of mind knowing that you can cover any unexpected costs that come up. Try to save $50 per month, it will add up over time.

Why Does an Emergency Fund Mean To You?

Just google it. They say 60% of Americans have less than $1,000 in savings. Some say 70%, some say 59%, whatever. But when things happen, they happen. You don't want to lose everything and be homeless out of the blue.

Financial security really depends on an emergency fund. It can help you avoid going into debt when an unexpected event occurs. You want peace of mind knowing that you have money set aside for unexpected expenses.

So what does an emergency fund mean to you?

Years ago when I was once out of work for more than 3 months, I had savings that would cover just under 12 months. As soon as I lost my job, I worked out how I had to live frugally until I found the next one. But still, you can imagine how desperate I was. Now although I have my own business, I never know what happens in the future; my work may suddenly dry up or I may fall ill and be hospitalized (hope not).

Therefore an emergency fund means a lot to me in case I have no income source for months after months.

How Much Money Should You Have In Your Emergency Fund?

So how much cash money should you have in your savings account?

It’s impossible to work out if you see it that way. As much as possible is the answer.

Instead, you should work out how much you can save each month. According to Wikipedia, the average American's discretionary income is only 8% of their gross income. It means that 92% of your “before tax” income goes out to pay for necessities like taxes, housing, food, healthcare, etc.

But the remaining 8% (discretionary income) is for entertainment, clothing, etc. You have to go out socialising, watch movies, buy some fancy goods, and have some fun from time to time.

So it’s best to work out how you can cut down costs. Let’s think about how you can achieve this.

Emergency Fund in Cryptocurrency

Having an emergency fund in cryptocurrency is not the best idea for two obvious reasons; it has high levels of volatility and can be difficult to access due to its decentralized nature.

When your landlord accepts your rent payment in Bitcoin and your local hospital accepts Ethereum (if ever), then yes, an emergency fund in cryptocurrency may become feasible. But because the price fluctuation is so high, what you have in hand might be dramatically overvalued or undervalued when you actually need it.

Steps To Build Up Your Emergency Fund (Realistically and Unrealistically)

Why realistically and unrealistically? Because the most optimistic option is unlikely to be achievable, but the easiest option won’t get you to save enough. So take the middle road, you should aim to build up your emergency fund at a level you can afford, but try a little harder than you normally do.

Here are the steps you can take.

1. Test Drive: Cut Down All The Costs For One Month

Try cutting down all the costs you can think of and test drive for a month - yes, for 30 days.

Change up some of your spending habits and be mindful when purchasing items. Consider making meals at home instead of eating out, shop around for the best deals on groceries and other necessities, or take advantage of public transportation instead of paying for an expensive ride share.

Look for activities that don't require a large financial commitment such as local parks, free concerts, or movies in the park. If you do decide to go out and spend money, try planning ahead by researching promotions like discounts or coupons so you can save some cash while enjoying yourself.

Implement these simple changes in lifestyle and you may be surprised to see how much you can save in just one month.

2. Think About The Worst Case Scenario

Now, work out your “frugal lifestyle” monthly outgoings including rent/mortgage, utility and food bills, transportation, etc.

Then imagine you lose your job today. How long would you be able to survive, and what would you do? You may need to move to a cheaper place, but your current rental agreement may not allow you to do it so soon. If you own your place, you can consider renting it out.

Think about not having a job for;

- One month

- 3 months

- 6 months

This will give you an idea of the somewhat unrealistic target - because although you’ve managed to cut down unnecessary costs, the target may still be too high.

3. Set Your Monthly Saving Target

From your frugal lifestyle experience (1. above), now you know how much realistically save every month. You still want to go out and spend money from time to time, but now you have the idea of not going over the top.

How much can you save every month? Even as little as $50 will be great - it will be $600 per year.

4. Set Up a Dedicated Savings Account

It only makes sense that you keep your emergency fund in a separate savings account so that you won’t be tempted to spend money on non-essential items.

Choose a bank account that offers the highest interest rate, but also allows withdrawals without prior notice.

5. Automate Your Savings

Set up automatic transfers from your checking account to your emergency fund so that you're automatically saving each month. This will help you reach your goal faster and make it less likely that you'll dip into of the funds for non-emergency expenses.

6. Keep Your Finance Record

Start logging accurate records of your finances each month. This is to properly manage your money and ensure that you are staying on top of all income, expenses, debts, and savings.

Some months, you’ll notice that you are left with some free money, and in other months, you may make a deficit. So you can adjust the amount of transfer to the emergency fund accordingly.

7. Make Extra Money

Start using a couple of hours in the evening for a side hustle and make some extra money. This will give you a buffer if you ever face unexpected expenses. Having some extra cash on hand is always a good thing, anyway.

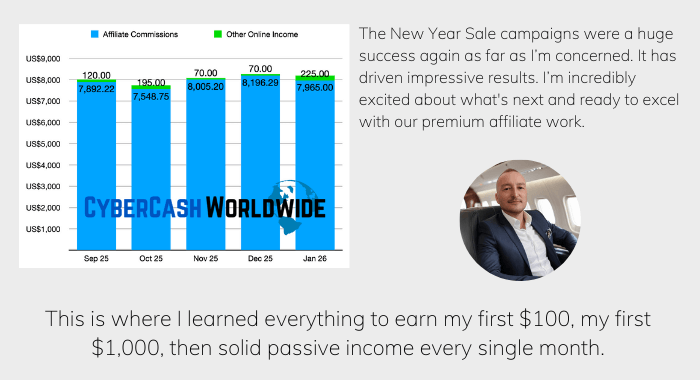

If you don’t know what to start with, then go for affiliate marketing. It’s a legitimate business model that involves promoting other people's products and earning a commission for every sale that you make.

You can build your own website for free, sign up for affiliate programs with companies like Amazon, Clickbank, and ShareASale, and start promoting products on your website.

Join through the link below, and you will gain access to comprehensive information on how best to use affiliate marketing for your online project. You'll also benefit from expert advice on setting up campaigns and tracking their performance, as well as tips on how to maximize your earnings potential with affiliates.

Even if affiliate marketing doesn’t turn out to be the right fit for you, there are still valuable skills that can be applied to other online businesses in the future. These skills include;

- Website building

- Content creation and promotion

- Analytics tracking

- Relationship building with users

With these tools under your belt, you can launch an eCommerce business or create an informational YouTube channel or a blog site that reaches people across the world.

Leverage the lessons learned from affiliate marketing, and anything is possible when it comes to using digital platforms as a means of making money online.