It takes a lot of learning before you are able to manually trade in the forex market. But did you know there was a way to automate your trades and make profits while you sleep? These automated programs have become increasingly popular among traders, promising to analyze market data and execute trades on your behalf. But what exactly is a Forex robot? How do they work, and are they really worth the investment?

Trading forex can be intimidating due to its complex nature, with many terms and jargon that seem incomprehensible. Fortunately, you don't have to worry about understanding all the complicated terminology because I'll show you a completely beginner-friendly online resource. It will help demystify the language used in the markets so that you can start trading without the uncertainty of jargon. Through these tools, you will learn how to identify trends, enter trades and manage risk while maximizing your rewards on each trade.

With this knowledge under your belt, you'll be able to approach foreign exchange trading with confidence!

What Is a Forex Robot?

A forex robot, also known as an automated forex trading system or a forex expert advisor (EA), is a software program that is designed to automatically execute trades in the foreign exchange market (forex) based on pre-defined trading algorithms and rules.

Forex robots are designed to remove human emotions from the trading process and make trading decisions based solely on the data and parameters set by the user. They can analyze market data and make trades faster and more efficiently than a human trader, and can operate 24/7 without the need for breaks or sleep.

Forex robots are typically used by traders who are looking for a systematic and automated approach to trading. They can be used for a variety of trading strategies, including trend following, range trading, and breakout trading. While forex robots can potentially increase the profitability of a trader's account, they also come with risks and limitations, and it is important for traders to thoroughly research and test any robot before using it in a live trading account.

A Beginner-Friendly Forex System

The 1000pip Climber System is the perfect system for beginners. It offers an easy-to-understand video training that makes it accessible to people with any level of experience in trading. This system will teach you the basics and provide guidance on how to make consistent profits from forex trading. Start now and gain the skills necessary to become a successful trader! With this system, you can take control of your financial future and start building wealth through smart investments.

How Do Forex Robots Work?

Forex robots are programmed to analyze market data and make trading decisions based on pre-defined trading algorithms and rules. They are designed to remove human emotions from the trading process and make trading decisions based solely on the data and parameters set by the user. They can analyze market data and make trades faster and more efficiently than a human trader.

They use technical indicators, such as moving averages, relative strength index (RSI), and Fibonacci retracements, to identify potential trading opportunities.

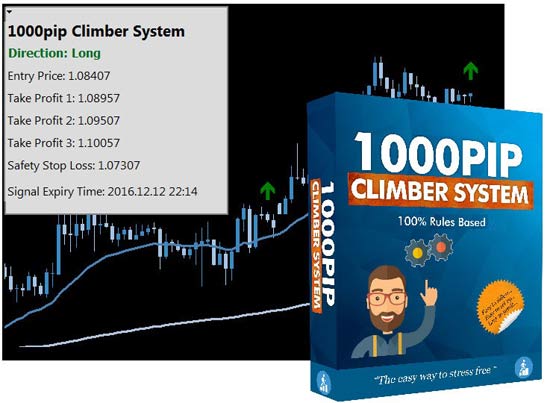

Once a trading opportunity is identified, the forex robot will generate a signal indicating whether to buy or sell a particular currency pair. The signal is typically based on a set of predetermined conditions, such as the price of the currency pair crossing a certain moving average or the RSI indicating overbought or oversold conditions.

Once the signal is generated, the Forex robot will automatically execute the trade in the trader's account, without the need for human intervention. The robot will typically set the stop-loss and take-profit levels based on the trader's pre-defined risk management strategy.

Forex robots can also use more advanced trading strategies, such as hedging and grid trading. Hedging involves opening multiple positions in the same or opposite direction to reduce risk, while grid trading involves opening positions at regular intervals above and below the market price.

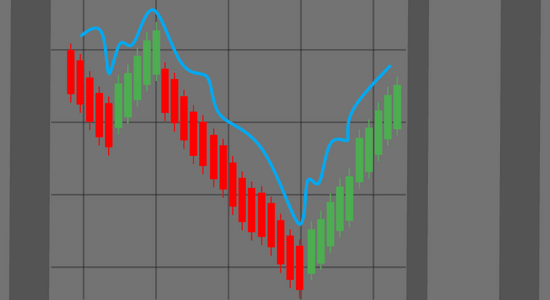

Moving Averages

Moving averages are a commonly used technical indicator in financial markets, including the forex market. They are used to smooth out fluctuations in price data and help identify trends.

A moving average takes the average price of a currency pair over certain days,, such as 10 days, 30 days, and so on. As each new price data point is added to the calculation, the oldest price in the calculation is dropped, creating a "moving" average.

For example, a 10-day moving average means the average price of the past 10 days. As each new day's closing price is added, the oldest closing price (i.e. 10 days ago) is dropped from the calculation.

Moving averages are often used to identify trends in the market. If the current price is above the moving average, it’s referred to as an “uptrend”, whereas if the current price is below the moving average, it’s “downtrend”. Traders may use moving averages in combination with other technical indicators to generate trading signals and make trading decisions.

Relative Strength Index

Relative Strength Index (RSI) is a technical analysis indicator used to measure the strength of a currency pair's price action over a given period of time. The RSI compares the magnitude of recent gains to recent losses in order to determine whether a currency pair is overbought or oversold.

The RSI is calculated using the formula:

RSI = 100 - (100 / (1 + RS))

Where RS (Relative Strength) is equal to the average gain of up periods divided by the average loss of down periods over a specified time period.

The RSI is plotted on a scale of 0 to 100, with readings above 70 typically considered to indicate overbought conditions and readings below 30 indicating oversold conditions. However, traders may use different thresholds depending on their trading strategy and risk tolerance.

The RSI can be used in a variety of ways, including as a standalone indicator or in combination with other technical indicators. Traders may look for divergences between the RSI and price action, or use the RSI to generate trading signals based on overbought or oversold conditions. As with any technical indicator, it is important to use the RSI in combination with other analysis tools and to consider other factors, such as fundamental analysis and market sentiment, when making trading decisions.

Fibonacci Retracements

Fibonacci retracements are a technical analysis tool used to identify potential levels of support and resistance in a currency pair's price action. The tool is based on the Fibonacci sequence, a mathematical pattern that occurs frequently in nature and in financial markets.

To use Fibonacci retracements, a trader identifies a significant price movement in the currency pair, such as a sharp increase or decrease in price. The trader then draws a horizontal line at the high point of the price movement (known as the swing high) and another line at the low point (swing low).

The tool then automatically plots several horizontal lines at key levels between the swing high and swing low, based on the Fibonacci sequence. The most commonly used levels are 38.2%, 50%, and 61.8%, although other levels may also be used.

These levels are potential areas where the currency pair's price may encounter support or resistance. Traders may use these levels to identify potential entry or exit points for a trade or to set stop-loss and take-profit levels.

Fibonacci retracements are based on the idea that financial markets often exhibit natural and repeating patterns of behavior, and that price retracements after significant moves tend to occur at predictable levels. However, as with any technical analysis tool, it is important to use Fibonacci retracements in combination with other analysis tools and to consider other factors, such as fundamental analysis and market sentiment, when making trading decisions.

The pros and cons of using a Forex robot

Here are some of the advantages and disadvantages of using a Forex robot:

Pros of using a Forex robot:

Cons of using a Forex robot

How to Choose the Best Forex Robot

Choosing the best forex robot can be a challenging task, as there are many different options available in the market. Here are some factors to consider when selecting a Forex robot:

- Performance history: Look for a Forex robot that has a proven track record of generating consistent profits over a significant period of time. This can be verified by checking the robot's performance history or backtesting results.

- Customization: Choose a Forex robot that allows for the customization of trading strategies and settings. This can help traders adjust the robot to their specific trading style and risk tolerance.

- Support and updates: Look for a Forex robot that comes with good support and regular updates. This can help ensure that the robot is working properly and that any issues or bugs are addressed promptly.

- Compatibility: Ensure that the Forex robot is compatible with your trading platform and operating system.

- User reviews: Check online reviews and testimonials from other traders who have used the Forex robot. This can provide valuable insights into the robot's performance and ease of use.

- Price: Consider the price of the Forex robot, and whether it represents good value for money compared to other options on the market.

- Transparency: Look for a forex robot that is transparent about its trading strategies and performance. Avoid robots that make unrealistic claims or use proprietary algorithms that are not open to scrutiny.

It is also important to remember that no forex robot can guarantee profits and that it is important to use a forex robot in combination with other analysis tools and trading strategies. Ultimately, the best forex robot will depend on each trader's individual needs and preferences, and it is important to research and compare different options carefully before making a decision.

The 1000pip Climber Forex System

The 1000pip Climber Forex System is a comprehensive trading system developed to help novice and experienced traders make consistent profits from the currency markets.

The system utilizes a combination of technical indicators, price action analysis, risk management tools, and advanced money management techniques in order to provide users with signals on when to enter or exit positions. The system also includes an educational component that teaches users how to analyze charts and market conditions in order to improve their trading performance.

With its easy-to-follow rules and detailed instructions, the 1000pip Climber Forex System can be used by virtually anyone - regardless of their level of knowledge or experience - in order to maximize profits while minimizing losses.

The 1000pip Climber Forex system is 100% rules-based; it uses a set of predetermined rules to make trading decisions. This can be beneficial for traders who are looking for a systematic and consistent approach to trading, as it removes the need for subjective interpretation or emotions in trading decisions.

1000pip Climber System