Money laundering is a serious global issue that affects not only the financial industry but also society as a whole. In recent years, governments and regulatory bodies have implemented several measures to combat this crime and protect their citizens from its adverse effects.

Anti-Money Laundering (AML) regulations are set out to prevent criminals from disguising illegally obtained funds as legitimate income. Understanding AML regulations is crucial for individuals and businesses operating in high-risk industries or dealing with large amounts of money.

So, if you want to safeguard yourself against potential legal troubles or reputational damage, keep reading this blog post on the basics of AML regulations.

What Is Money Laundering?

Money laundering is a process of making “dirty” money appear clean. It certainly is a crime that occurs when criminals attempt to hide or disguise the proceeds of their criminal activities. The goal is to make it look like the money came from a legitimate source so that it can be used without raising suspicion.

Here are some of the common money laundering methods;

Smurfing

"Smurfing" refers to the practice of breaking up large sums of money into smaller, less conspicuous amounts and then depositing them into various bank accounts to avoid detection by authorities. This technique is also known as "structuring" or "splitting."

The term "smurfing" comes from the popular 1980s cartoon characters "The Smurfs" in which small blue creatures would work together in large groups to achieve their goals. Similarly, in money laundering, multiple individuals (the "smurfs") work together to launder the money in small amounts to avoid detection.

For example, instead of depositing $50,000 in cash into a bank account, the criminal chooses to make several smaller deposits of $5,000 - $10,000 each over the course of a few days, rather than depositing the entire $50,000 in one transaction. This is done in an attempt to avoid triggering the bank's requirement to file a Currency Transaction Report (CTR), which is required for all cash transactions over $10,000.

The purpose of smurfing/structuring is to conceal the true source or purpose of the funds being laundered. It is often used by criminals to launder money obtained through illegal activities such as drug trafficking, human trafficking, and fraud.

In addition to being a criminal offense, it’s also a violation of bank policy and can result in the closure of bank accounts and other financial services.

Offshore Accounts

Not all offshore accounts are used for money laundering or other criminal activities. Many legitimate businesses and individuals use offshore accounts for tax planning and other legitimate purposes. It's only when offshore accounts are used to conceal the proceeds of illegal activity that they become a tool for money laundering.

Offshore accounts are typically located in countries with low tax rates and strong bank secrecy laws, which make it difficult for authorities to access information about the accounts. Criminals may use a variety of techniques to move money into and out of these accounts, including wire transfers, shell companies, and third-party intermediaries.

For example, a criminal might use a legitimate offshore company to transfer funds into and out of an offshore account, making it more difficult for authorities to trace the money back to its original source.

Casino Gambling

Some criminals also use casinos to convert large amounts of cash into smaller, less suspicious amounts that can be deposited into bank accounts or used for other illicit activities. For example, a criminal might buy in for a large amount of cash, play a few games, and then cash out smaller amounts over time, making it appear as if the money came from gambling winnings.

Another technique is called "chip washing." In this method, they buy chips with illicit funds and cash them in at a later time, receiving a check or wire transfer for the winnings. The chips effectively serve as a medium of exchange for illicit funds, making them difficult to trace.

Casinos are required to report certain transactions to authorities, such as large cash transactions or suspicious activity, and they are also subject to anti-money laundering regulations. However, criminals can still exploit vulnerabilities in the system to launder money through casinos. As a result, casinos have implemented strict policies and procedures to prevent money laundering and comply with regulatory requirements.

Trade-Based Money Laundering

Trade-based laundering is a method of using legitimate trade transactions to move money across borders, often over- or under-invoicing goods to move money around without raising suspicion.

Criminals use a variety of techniques to manipulate the price, quantity, or quality of goods being traded in order to generate large amounts of cash or other financial instruments. They may use shell companies, false invoices, and other fraudulent documentation to conceal the true nature of the transactions and the source of the funds.

In over-invoicing, the value of goods being exported is inflated, allowing the criminal to transfer more money than the actual value of the goods. Whereas in under-invoicing, the value of goods being imported is understated, allowing the criminal to pay less in duties or taxes and pocket the difference.

Other techniques include phantom shipments, where no actual goods are shipped but invoices are created to transfer funds, and double invoicing, where the same goods are invoiced twice to generate two sets of payments.

The method is often used by criminal organizations involved in drug trafficking, human trafficking, arms dealing, and other illicit activities. It is a complex and sophisticated form of money laundering that can be difficult for authorities to detect and investigate.

The Three Stages Of Money Laundering

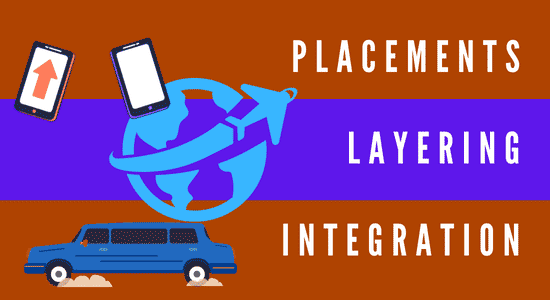

The “three stages” of money laundering are:

- Placement: This is the stage where the "dirty" money is introduced into the financial system. Criminals may use a variety of methods to do this, such as depositing cash into a bank account, purchasing assets such as real estate or vehicles, or using money transfer services to move funds to offshore accounts.

- Layering: This is the stage where the money is moved through a series of transactions and accounts in order to obscure its origin and make it difficult to trace. Criminals may use multiple accounts, shell companies, or other financial instruments to create a complex web of transactions that make it difficult for authorities to follow the money trail.

- Integration: This is the stage where the "clean" money is reintroduced into the legitimate economy, typically through the purchase of assets or investments. Criminals may use the laundered funds to purchase real estate, luxury goods, or other assets that can be easily resold or converted back into cash.

The goal of money laundering is to make the proceeds of illegal activity appear to be legitimate so that the criminal can enjoy the benefits of their criminal activity without attracting the attention of authorities. The three stages work together to accomplish this goal by making it difficult for authorities to trace the source and destination of the funds.

How Do AML Regulations Combat Money Laundering?

Anti-money laundering (AML) regulations are designed to combat money laundering by creating a legal and regulatory framework that requires financial institutions to implement measures to prevent, detect, and report suspicious activity.

Here are some ways in which AML regulations combat money laundering:

Customer due diligence (CDD):

Financial institutions are required to perform CDD to verify the identity of their customers and assess their risk for money laundering. This includes obtaining identifying information such as name, address, and date of birth, and monitoring the customer's transaction history for unusual or suspicious activity.

Transaction monitoring:

Financial institutions are required to monitor transactions for suspicious activity, such as large cash deposits, multiple transactions just below the reporting threshold, or transactions that deviate from a customer's normal pattern of activity.

Suspicious activity reporting (SAR):

Financial institutions are required to file SARs with authorities when they detect suspicious activity that may be indicative of money laundering or other criminal activity. SARs provide a mechanism for authorities to investigate and prosecute money laundering and other financial crimes.

Record-keeping:

Financial institutions are required to maintain detailed records of customer transactions and other activities to facilitate investigations and audits.

Training and education:

Financial institutions are required to provide training and education to their employees to help them identify and prevent money laundering and other financial crimes.

AML regulations are enforced by government agencies, such as the Financial Crimes Enforcement Network (FinCEN) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom. Failure to comply with AML regulations can result in significant financial penalties and reputational damage for financial institutions.

Who Must Comply With AML Regulations?

The Bank Secrecy Act (BSA) requires banks and all other financial institutions to assist U.S. government agencies in the detection and prevention of international money laundering and terrorist financing. Financial institutions subject to the BSA include banks, credit unions, securities brokers and dealers, money services businesses, casinos, and card clubs.

In order to comply with AML regulations, financial institutions must develop and implement a written Customer Identification Program (CIP). The CIP must include procedures for verifying the customer’s identity and maintaining the record of information used to verify the customer’s identity. In addition, financial institutions must develop policies, procedures, and controls to prevent money laundering. These policies, procedures, and controls must be designed to detect and report suspicious activity.

Financial institutions are required to file Suspicious Activity Reports (SARs) with FinCEN when they suspect or have reason to believe that a transaction involves money laundering or terrorist activity. In addition, financial institutions must maintain records of all transactions that involve more than $10,000 in cash. These records must be made available to FinCEN upon request.

The Penalties For Non-Compliance With AML Regulations

The penalties for non-compliance with AML regulations can be severe. Depending on the country, financial institutions can be fined and/or have their licenses revoked for not adhering to AML rules. In some cases, individuals can be criminally charged. The following are examples of recent penalties imposed for AML violations:

There have been several recent examples of significant penalties imposed on financial institutions for non-compliance with AML regulations. Here are a few notable examples:

- Deutsche Bank: In 2020, Deutsche Bank agreed to pay $150 million to settle charges that it failed to properly monitor and report suspicious transactions involving Jeffrey Epstein, a convicted sex offender. The bank also failed to adequately monitor transactions with two correspondent banks in Cyprus and Latvia that were known to have high money laundering risks.

- JPMorgan Chase: In 2019, JPMorgan Chase agreed to pay $5.26 billion to settle charges that it violated AML regulations by failing to report suspicious activity related to Bernie Madoff's Ponzi scheme. The bank also failed to adequately monitor transactions with certain foreign customers that posed a high money laundering risk.

- Commonwealth Bank of Australia (CBA): In 2018, the CBA agreed to pay a record $700 million penalty to settle charges that it violated AML regulations by failing to adequately monitor transactions that were suspected of being linked to drug trafficking and other criminal activity. The bank also failed to report suspicious transactions in a timely manner.

- Danske Bank: In 2018, Danske Bank was hit with a series of penalties and fines for its involvement in a large-scale money laundering scandal involving its Estonian branch. The bank ultimately paid more than $800 million in fines and legal fees and saw its CEO and several top executives resign.

These penalties demonstrate the seriousness with which governments and regulatory authorities view non-compliance with AML regulations. Financial institutions that fail to implement adequate AML controls and procedures can face significant financial penalties, reputational damage, and other sanctions.

How Can We Avoid Being Mistaken For a Money Launderer?

By now, you know how criminals disguise the proceeds of illegal activities as legitimate funds. So it's essential to take steps to ensure that your business operations do not appear suspicious or raise any red flags. Here are the steps you must ensure to take;

Know Your Customers:

Have clear policies and procedures for verifying the identity of your customers, including performing background checks and monitoring transactions. It's essential to know who you're doing business with and to be wary of any transactions that appear unusual or out of the ordinary.

Keep Accurate Records:

Keep detailed records of all financial transactions, including receipts, invoices, and bank statements. This will enable you to track your income and expenses, identify any suspicious activity, and demonstrate the legitimacy of your business operations if needed.

Use a Trusted Financial Institution:

Work with a reputable and well-established financial institution to process your business transactions. Avoid using non-traditional or unregulated financial services such as money transfer services or cryptocurrencies.

Be Transparent:

Be open and transparent about your business operations, including your sources of income and your business structure. This can help to alleviate any concerns or suspicions that might arise.

Report Suspicious Activity:

If you suspect any suspicious activity or transactions, report it to the relevant authorities immediately. This will help to protect your business and demonstrate your commitment to preventing money laundering.

Anti-Money Laundering (AML) Regulations: Basics For a New Business Owner: Wrapping Up

AML regulations are essential for protecting both financial institutions and the public from being exposed to criminal activities such as money laundering.

Large companies indeed need to understand the basics of these regulations, so they know how to comply with them and protect themselves from liability or prosecution, but it's also important for small business owners and sole traders too.

Follow these guidelines and you can ensure that your customers’ funds are safe, helping you maintain a reputation of trustworthiness in an increasingly competitive market.