It seems like we’re always going on about how to make more money, but what about changing our spending habits to save money? After all, that’s the real key to financial success. What motivates people to spend money - some people may be more inclined to spend money when they're in a good mood, while others may do it out of habit. Regardless of why someone spends money, there are some ways that you can change your spending habits in order to better control your finances.

If you don’t think you are managing your personal finance well, you are in the right place. I will show you have to change your spending habits so that you can start saving money and improving your financial situation. Read on to learn everything you need to start saving money today.

1. Determine Your Financial Milestone

Before you can change your spending habits, why don’t you determine your first financial goal? Think about what you want to achieve over the next few months or years. For example;

- Clear all my outstanding credit card debts by the end of September.

- Save $5,000 by the end of this year and put it towards my mortgage deposit.

Setting a milestone on a specific date will help you set specific targets for how much money you want to save or spend each month.

Don’t forget to be realistic - don't set goals that are too hard to achieve or that you don't have the ability to meet. Saving $1,000 in your bank account while you have your credit card balance at $1,000 will defeat the purpose. (Because your credit card interest you pay will be greater than your bank interest income.) You'll be more likely to achieve your goal if it's something that you can realistically accomplish over time.

2. Understand What Drives Your Spending Habits

Firstly, start by tracking every penny that you spend for at least three weeks and figure out where the majority of your money goes. This will help you identify areas where you may be overspending or wasting money.

Once you have a plan of action and have determined where your money is going, you can start controlling your spending habits. One way to do this is to establish rules for yourself regarding when and where you can spend money. Also be sure to set limits on how much debt you want to take on in the future. You can start to shift the balance of your household finances in a positive direction.

3. Make A Budget That Works For You

If you want to find ways to cut back on your spending, it's important to create a budget that works for you. There are a number of different methods that can help you save money, and the one that's right for you will depend on your individual finances and lifestyle.

It's important to be honest with yourself when creating your budget. If there are areas in which you're struggling to cut back, it might be tempting to deceive yourself about how much money you're actually spending. It's important to face the facts and make adjustments as needed so that you can stick to your budget.

4. Track Your Spending for Better Insights

One popular way to create a budget is to use a spending tracker. This type of tool takes all of your expenses and breaks them down by category so that you can see where your money is going most often. This information can help you identify areas where you might be overspending or wasting money. There are a number of different apps and online tools that you can use to keep track of your spending.

For example, Mint is an app that lets you track your budget and transactions. You can also use this app to see where you can save money, identify areas where you overspend, and see how your income changes over time.

Another option is Personal Capital, which is a website that helps you manage your finances and make smart investment decisions. You can use this website to track all of your expenses, including food, home bills, travel costs, and more.

By tracking your expenses, you can get a better idea of where you can cut back on spending and where you are overspending. This information can help you build a more sustainable financial plan for yourself.

5. Pay Bills By Direct Debit

All the house bills and insurance payments - you have to pay what you have to pay. Automate it all and pay by direct debit, because the last thing you want is you run out of money by the due date and get charged with interest or a penalty.

Even if you have enough money to pay, setting it aside and making sure to pay by due dates is just an additional stress. Also, some companies give you a small discount if you pay by direct debit.

6. Get a Handle on Your Debts

"Over-indebtedness" can lead to major financial problems down the road if not dealt with immediately. Make a budget and track all of your debts monthly so that you can see where improvements can be made. Try to get rid of high-interest loans and credit card balances first before tackling other debt levels.

7. Use Credit Cards Wisely

Pay off your cards each month. Not only will this help you avoid interest charges and debt accumulation, but it will also give you a sense of responsibility and financial independence.

If you have to carry the balance forward, remember that using credit cards can always lead to higher bills and longer payment periods – so use them sparingly if at all possible! Try using plastic only for emergencies if you know you won’t be able to pay it off within a month.

8. Calculate Loan Interest

If you really, really have to borrow extra money, the first thing you have to do is to ask your bank. Because the interest on bank loans tend to be the lowest of all (not always.)

Many people overlook the many savings and loan programs that are available to them. These programs allow you to borrow money for a fixed period of time with the option to pay back the principal plus interest over time.

Get all the loan options, including your credit card loan, and write them down. See which one will offer a loan with the lowest interest.

Be prepared to go through the credit checks. Some private financing companies offer to lend money without checking your credit score. This may sound tempting to you, but you know the consequences; their interest rates are usually a lot higher than others, so you’ll end up paying a lot more, or worse still, not being able to pay, which may lead to legal trouble.

9. Prioritize Your Needs

Be realistic about what needs to be purchased and don't overspend on needless items. One common way that people wind up spending too much is by thinking they need something when they really don't. Try to stick to purchases that will actually improve your life - this means items like food, shelter, and clothing rather than things like cars and vacations.

For example, try not to buy items that you can easily find alternatives for or that don't need to be replaced soon.

10. Cut Back On Entertainment Expenses

When it comes to spending money, one of the easiest ways to blow through your bank account is by raiding the entertainment section of your budget every month. Instead, try curbing entertainment expenses by thinking about what activities are really worth spending money on (like going out with friends for dinner instead of buying tickets to a movie).

11. Reduce Wastefulness in Everyday Life Decisions

One of the easiest ways to rack up unnecessary expenses is to make small, everyday decisions with big consequences. For example, if you always buy gas at the maximum amount allowed by your state, that could add up to hundreds of dollars over the course of a year. Try to curb wasteful spending by thinking about how a small change in your habits could have large financial implications down the road.

12. Build an Emergency Fund

An emergency fund is important for two reasons: First, it allows you to cover unexpected costs such as car repairs or medical bills. Second, it provides some cushion should times get tough financially down the road and prevent you from needing to take on more debt (or go without basic needs).

Set a realistic emergency fund rule for yourself. For example, decide that you must save at least $3 every day, which will become $1,095 in the next 365 days.

Keep a record of it every single day, and it will motivate you.

13. Do Your Homework Before You Go To The Store

When you go to the store, it is important to do your homework on what you are looking for before you leave. This will help you save money and get what you need without feeling like you are overpaying.

One way to do your homework is to look online at different retailers’ prices for the same item. This can help you find out which retailer has the best price for the product and whether or not there is a sale going on.

14. Negotiate Better Prices

It's important to be prepared to negotiate better prices when shopping for goods and services and, when negotiating, you should always keep these tips in mind:

Know your budget

Before starting negotiations, know what you're willing to spend and set a limit. This will help you stay within your budget and avoid being taken advantage of by the seller.

Be clear about what you want

When describing your needs, be clear about what you're looking for. State your positions without any emotion or hesitation. This will help you remain impartial during the negotiation process.

Don’t give away too much

While it’s important to be clear about what you want, don’t go overboard by giving away too much information early on in the negotiation process. This could cause the other party to feel like they have little control over the situation and could lead them to walk away from the table with nothing agreed upon.

Be prepared with evidence of price comparisons

This can help prove that your price is fair and reasonable. Also, make sure that you are clear about what services or products are included in the deal. This will help the other party understand what they're getting in return for their investment.

Focus on solutions rather than blame

Once you’ve outlined your position, focus on finding solutions that meet both your needs and those of the other party involved in the negotiation process. Don’t focus on pointing out why their position isn’t valid or why their proposal won’t work. This will only lead to frustration and animosity on both sides.

Stay Calm and Persist

When negotiating prices, it is important to stay calm and persistent. Oftentimes, negotiators will become emotional or frustrated, which can lead to inaccurate negotiations. If you find yourself getting angry or emotional, take a step back and try to remember your goal for the negotiation: Get the best deal possible for you and your business.

Try to be realistic about what you're asking for. Many times, negotiators will ask for too much money or too many concessions. It's important to keep in mind what your business needs in order to operate smoothly. If you're not sure what you need, ask your colleagues or customers.

Be flexible

Even if you initially don’t agree with the other party’s proposal, be willing to be flexible in order to reach a compromise. This will show that you are willing to work towards a solution, even if it means making some concessions. If something isn't working out as planned, be open about how you'd like things to change and see if the seller is open to those changes too.

15. Invest In Savings and Asset-Building Activities

One of the best ways to change your spending habits is to invest in savings and asset-building activities. By building up your financial reserves, you will be less likely to need to rely on credit cards or other forms of debt when emergencies arise.

Additionally, an investment may allow you to achieve long-term financial stability. There are a number of different ways to invest your money, so find one that works best for you. Some popular savings and asset-building activities include;

Stocks and Bonds:

Stocks and bonds are two of the most common types of investment vehicles.

By buying shares in a company or borrowing money against a bond's value, you are able to gain ownership in that company or security. This gives you a stake in its future performance and the potential for increased profits.

Gold:

Gold is a great investment option for anyone looking to protect their money in the long run. While it can be expensive to buy and store gold, it has been proven to be a reliable asset over the years. Those who invest in gold can rest assured that their money will be safe, even in times of economic uncertainty.

Additionally, gold tends to bounce back quickly from downturns, meaning that you may end up making a profit even if the economy takes a dip.

You can purchase gold coins or bars online or at a physical store, or you could open an account with a company that specializes in buying and selling gold. Gold is an established asset with a history of doing well in times of economic turmoil, so it's worth considering as an option for your investment portfolio.

16. Make Extra Money Through Side Hustles

Side hustles include things like tutoring, pet sitting, or freelance work. By supplementing your regular income with additional income sources, you can build up your savings faster than if you were only working full-time.

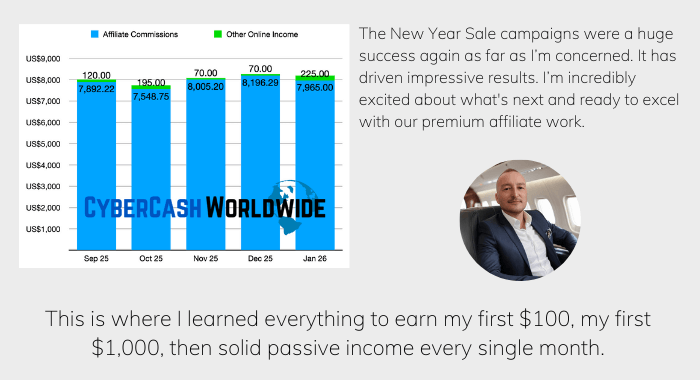

Learn Affiliate Marketing

Starting an affiliate marketing business can be a great way to make some extra money. By sharing your skills through your own website, you can start gaining the trust of the audience. There is a lot of work involved in this type of business, but with a little effort, it can be very successful.

It will take some time to build a strong website, but it's worth the effort. With a well-designed WordPress website and an active following, you can start turning your affiliate marketing efforts into profits.

Spend a few hours in the evening, and you can start building your skills and begin to earn some extra income. It won't happen quickly, but persistence will pay off in the end. A little bit of effort goes a long way when it comes to affiliate marketing.

17. Believe in Yourself and Have Confidence In Your Finances

How do you change your spending habits? One way is to believe in yourself and have confidence in your finances. Believing in yourself means having self-confidence and knowing that you can handle whatever life throws at you. Having confidence in your finances means knowing what you can afford, sticking to your budget, and not being afraid to take risks.

Conclusion

Thank you for reading our tips on how to save money. I hope that they have helped you figure out some ways to cut down on your spending and start saving money, whether it's by taking advantage of sales or by making simple changes to your lifestyle. I would strongly recommend you start spending a few hours learning how to make some extra money by doing a little bit of work from home, too.

If you have any additional tips that have helped you save money in the past, feel free to share them in the comments below!