Candlesticks are optical bars that display on a price chart the price development of a stock over a certain time period. They are composed of price fluctuations that show the beginning, peak, and closing values of an asset. Moreover, they are widely utilized by market players to trade a wide range of assets. Candlestick patterns are regarded as a tactical manner of analysis, regardless of the trading instrument you use—stocks, their options, forex, cryptocurrencies, bonds, futures, etc.

In that context, the bullish 3 white soldiers pattern may be used by investors to spot a possible market reversal. Because candle combinations show patterns or tell tales about the chart, some traders use them as indicators to assist them to choose when to join and exit deals. These technical analysis candlestick patterns may be used to assess the market situation for a particular stock.

Let's figure out the three white soldiers pattern and learn how to make good use of it in trading.

The Three White Soldiers Pattern Explained

The easiest way to define the candlestick pattern of the three white soldiers is as a three-bar bullish reversal pattern. This price adjustment has caused the market's sentiment to significantly change from pessimistic to optimistic.

Trading experts are aware that even when the market is in fall, an upswing might happen at any time. Trend reversals may be detected using price movement, volume, and various candlestick patterns. Information from a candlestick pattern is reliable since its elements may recur. The candlestick pattern with the three white soldiers is one of the chart patterns.

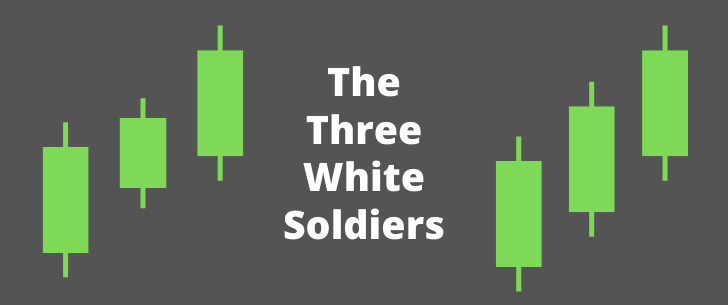

Depending on how you set up your candlestick chart for the asset you are trading, the pattern consists of three successive green or white bullish candlesticks, making it feasible to identify the three white soldiers.

The growing trends and somewhat lengthened bodies of these candles indicate vigorous market activity. Each candle's price movement should reveal a clear bullish rising price trend.

The Three White Soldiers Pattern's Effectiveness

The bullish reversal pattern, which indicates that the downtrend may be coming to a close and an upswing may be starting, may not support a trade. Candlestick patterns are lagging indicators because it is only after they have been fully completed throughout the course of the selected price chart that their importance can be fully understood.

As a result, a lot of traders watch for the formation of the three white soldiers to appear over time on a chart. This bullish pattern, which denotes a true market upturn rather than a correction, is a more trustworthy and potent indication.

In daily subsequent trading sessions, lengthy bullish candlesticks are typically interpreted as the beginning of a prospective fresh upswing. Traders might plan their buy and sell positions by anticipating a potential price increase using market data and/or time.

Professional traders typically utilize other technical indicators in addition to candlestick pattern analysis. They might be incredibly potent confirmations when combined with a sound trading plan. The MACD, RSI, Bollinger Bands, zones, trend lines, moving averages, and trend lines are common technical or fundamental tools.

How Can You Tell It Apart?

A trader should watch for long bullish candlestick bodies with short to no wicks to visually identify the candlestick patterns of the three white soldiers. Shadows, which are commonly referred to as wicks or smaller candlestick bodies, might represent a brief price movement in contrast to a real market reversal.

Strongness may be indicated by bullish candlesticks that regularly form the three white soldiers pattern but with longer wicks or shorter bodies and no price movement. A trader may then be notified of a potential negative retracement.

Since each candlestick pattern accurately predicts a likely future price movement, they are also quite reliable. However, it's important to avoid consolidation and phony breakouts. Utilize the patterns as a tool, but also search for extra validation as part of your risk management plan.

Volume is essential for identifying the bullish reversal candlestick pattern of the three white soldiers. As the slump loses momentum, the selling volume will start to decline. The volume will quickly rise as the buyers show up and the candlestick pattern with the three white soldiers appears.

Final Thoughts

The pattern of the three white soldiers may be used to visually depict a market turning from a decline to an upswing. It can be a helpful candlestick pattern for recognizing a price reversal when combined with other technical indicators. A trader should look for long-bodied bullish candlesticks with minimal to no wicks and an increase in buyer volume to confirm the pattern's correctness.

What Do You Advocate?